Carbon capture, utilisation, and storage (CCUS) is entering a period of acceleration. While only a handful of large-scale projects have reached final investment decision (FID) to date, the many CCUS pre-FEED and FEED projects over the last five years created a collective experience and repository which lays the groundwork for success.

The application of carbon capture started 40 years ago as a means of enhancing oil recovery but has since grown more broadly. Recent introductions of specific carbon capture and storage (CCS) targets, carbon trading, direct government funding, tax credits, and compulsory requirements for year-on-year carbon reductions have all created new incentives for growth.

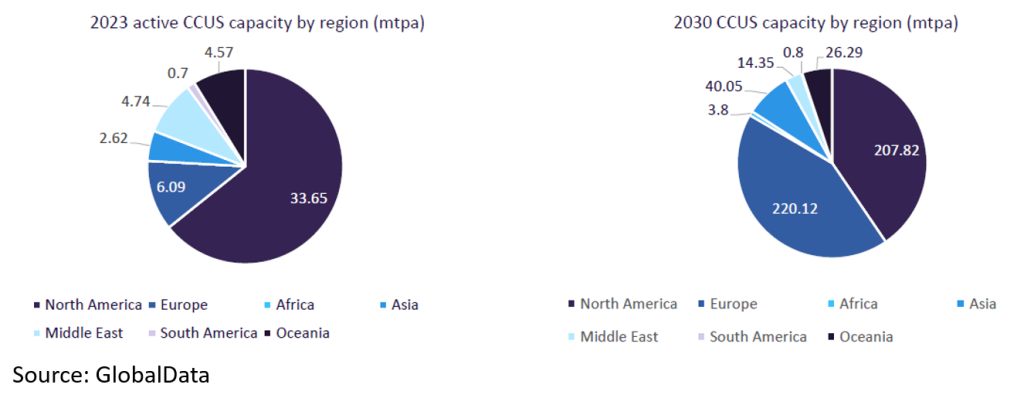

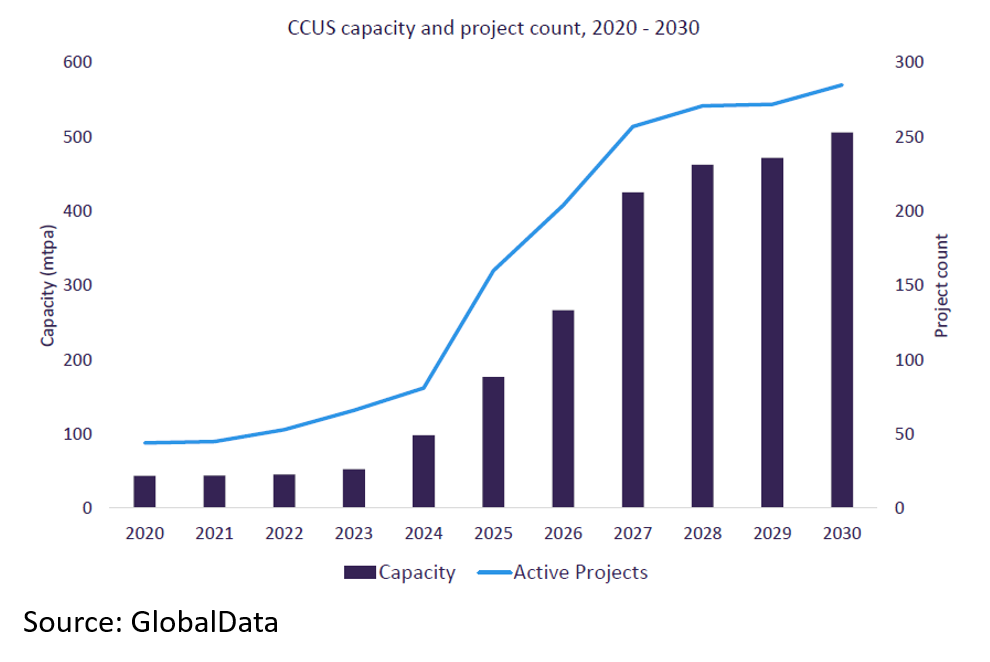

Consequently, Bloomberg found that between 2022 and 2023 carbon capture investments more than doubled, hitting a record high of $6.4bn. According to GlobalData, the number of active CCUS projects is forecast to increase four-fold by the end of this decade. North America currently holds a 64% share of active CCUS capacity. But Europe is forecast to experience the biggest increase in active CCUS capacity, experiencing a compound annual growth rate (CAGR) of 66% between 2023 and 2030. With Asia’s share of active capacity also set to significantly increase over the coming decade, the sector is prime for further investment and deployment.

The tightening of carbon markets, the introduction of carbon border adjustment mechanisms, the EU Industrial Carbon Management Strategy and innovative approaches to joint infrastructure are set to accelerate the industry further. The development of the Middle Arm Sustainable Development Precinct near Darwin in Australia, for example, will be one to watch, offering a new approach to industrial decarbonisation through high-scale common infrastructure.

Meanwhile, new markets are also emerging. With a lack of suitable storage sites, countries such as Japan and South Korea are looking to liquify carbon dioxide (CO2) from steel, cement, and power plants for shipping and sequestering elsewhere, creating business opportunities not even considered five years ago.

For example, in 2023 Santos and SK E&S publicly announced that they are collaborating on securing additional CO2 storage including the Bayu-Undan field and developing a transboundary business model to aggregate and transport CO2 from Korea to Australia. Altogether, in 2023, around ten capture facilities entered operation and almost 20 projects reached a final investment decision, with hundreds more projects still in the pipeline according to the IEA.

A dedicated CCUS workforce

With the spotlight on CCUS shining more brightly than ever before, the world is relying on industry to accelerate the technology maturation curve. Reflecting on the past decade of technology development, many lessons have been learnt from the world’s first CCUS projects. These lessons have created a rich and invaluable library of insights, many publicly available. This in turn has created a niche but highly skilled workforce of subject matter experts (SMEs). Worley, for example – which is developing about a third of CCUS capacity under development – has over 100 CCUS specialists. Each with their own niche in everything from post-combustion capture, dehydration, and compression to transport and storage by pipelines and liquid CO2 carriers.

In practice, this breadth and depth of experience means that learnings and insights are shared from all areas of the world and those SMEs can be brought together to solve any given challenge. It is not uncommon for CCUS projects in the APAC region to benefit from projects being designed in the UK and Europe – and vice-versa in other regions of the world.

In fact, Worley has nearly 40 mostly large-scale projects in advanced development and over the last 30 years has executed more than 375 CCUS studies and projects. This has led to a huge repository of CCUS-related files, which also houses vendor data, and the latest technical and market data from agencies, organizations, and companies such as the IEA, GCCSI, and Rystad. And the learnings continue through every project.

Standards and best practice continue to evolve

In the same decade, the industry has witnessed a huge amount of standardisation and adaptation. Existing pipeline standards, for example, have been adapted to established internationally recognised frameworks for the design, construction, and operation of CO2 pipelines. Those standards continue to evolve, with the involvement of Worley SMEs, as we optimise the process and make technological and design breakthroughs.

Pipeline design and flow assurance are critical areas, with fracture propagation being a specialty area requiring early attention, especially when re-rating existing gas pipelines for re-purposing to CO2 service. Materials selection is important as CO2 is a highly corrosive solvent. Compressor selection is critical and needs to be made early in the project life, as it impacts on utilities, layout, piping design, power consumption, and is typically long lead equipment.

Dehydration technologies have also become a critical project enabler. Many of the earliest projects could afford a slightly higher risk based on the remoteness of their locations and thus low consequences. But as projects are increasingly located in industrial hubs or adjacent to population centres, there is a need for a better understanding of dehydration and robust designs.

Venting has also posed challenges unique to CO2, such as formation of dry ice plugs in vent systems. This has required a complete reimagining of not only the venting system, but also platform design and even evacuation strategies in comparison to the approaches found in oil and gas. Finally, the industry is still developing technologies and processes for managing contaminants. There is a fine balance between being conservative to avoid chemical reactions among contaminants and the cost of their removal and disposal.

Resourcing projects upfront

Many of these challenges can be addressed by ensuring the right resources are allocated early in the concept and pre-FEED stages of project development. This approach requires a shift from traditional oil and gas project development. For example, lower system availability is often acceptable, non-API design standards can be applied, and CO2-specific issues must be addressed through the engagement of SMEs. Engineers can solve these challenges effectively with the necessary expertise and support during the study, pre-FEED and FEED phases. Without this, projects may follow a traditional path, leading to gaps that must be resolved later through redesign. Therefore, properly resourcing projects in terms of schedule, funding and SME involvement from the outset is critical.

This mindset shift will become increasingly important as the pressure to reach net zero increases, the pipeline of CCUS projects increases in step, and the world moves from tentatively implementing CCUS to accepting it as a part of a sustainable future for hard-to-abate industries and even removing CO2 from the atmosphere. While the earliest CCUS projects faced significant hurdles, they also laid the groundwork for what has become an incredibly valuable collection of subject matter expertise.