Shell subsidiary Shell Energy Operations, along with Infrastructure Capital Group (ICG), has agreed to acquire online energy retailer Powershop Australia in a deal valued at $526m (A$729m).

The deal will be executed with the acquisition of Powershop parent company Meridian Energy Australia (MEA) Group.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAccording to the deal, Shell will acquire Powershop, which serves more than 185,000 customers while ICG will take over MEA’s Mount Mercer and Mount Millar wind farms, Hume, Burrinjuck, Keepit hydropower stations and development assets.

Meridian chief executive Neal Barclay said: “The transaction represents an exciting opportunity for the future of the Meridian Energy Australia business, given Shell’s and ICG’s intentions to grow their respective renewable energy and retail presences in Australia.”

Powershop acquisition is in line with the Powering Progress strategy of Shell and its ambition for an integrated power business creation.

Upon the completion of the deal, Powershop will be part of Shell’s residential power platform in Australia.

The deal will also boost Shell’s position in the Australian market as the largest electricity retailer in the country for commercial and industrial (C&I) customers.

Under the agreement between Shell Energy and ICG, the former will acquire wind power purchase agreements (PPAs).

Additionally, Shell Energy agreed on offtake arrangements with ICG for the hydro and wind assets of MEA.

Shell Australia chairman Tony Nunan said: “This acquisition is another example of how we are continuing to grow our footprint in Australia to meet customers’ evolving needs through the energy transition.

“Powershop today offers innovative energy packages and customers will benefit in the future from access to Shell’s broader suite of energy solutions linked to e-mobility and battery storage.”

Subject to regulatory approvals, the deal is slated for completion in the first half of next year.

Last week, Shell signed an agreement with Simply Blue Group to acquire a 51% stake in the Western Star venture.

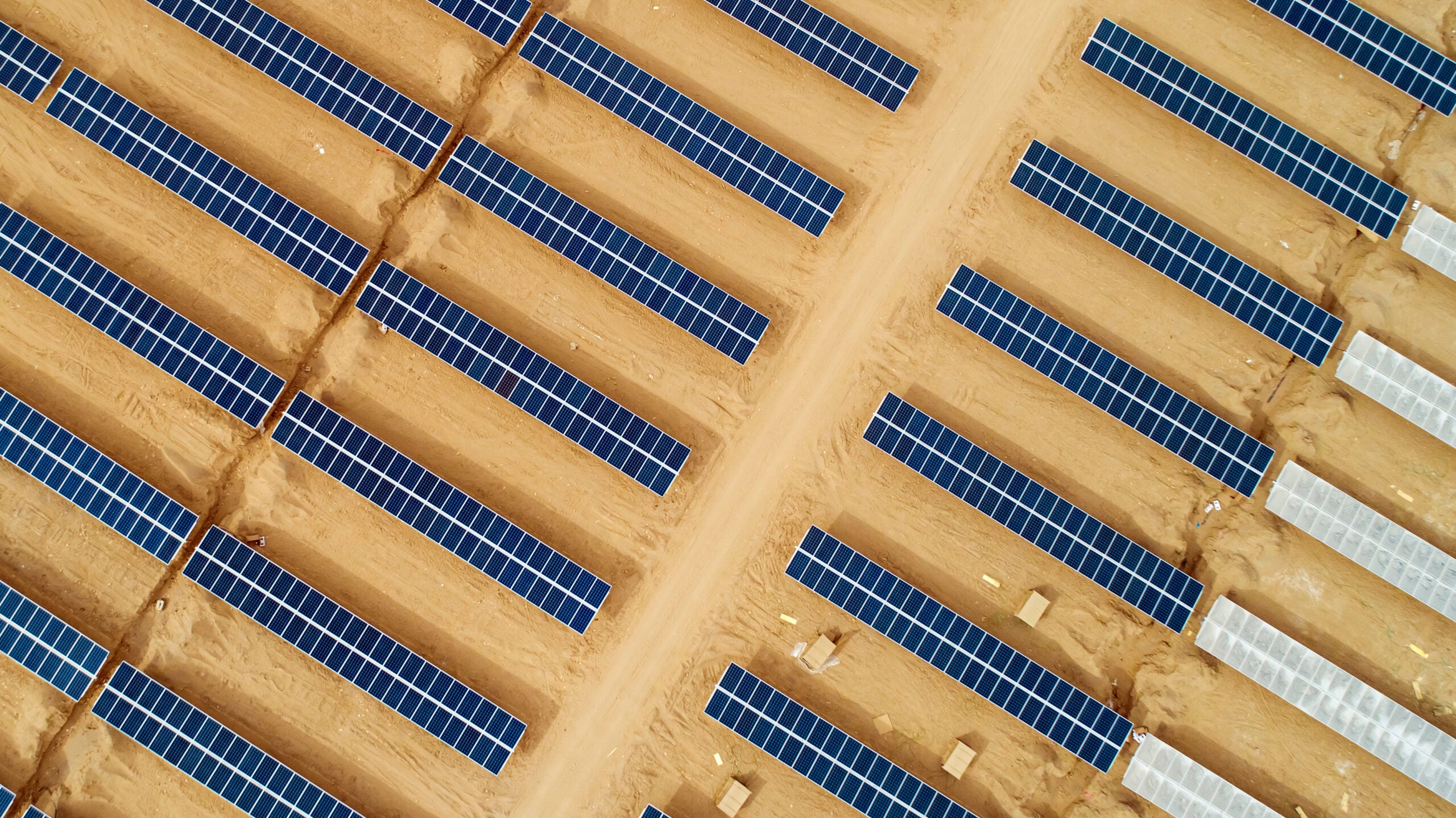

Image:

https://pixabay.com/photos/electric-power-pylon-high-voltage-273648/

PR:

Addl:

Reuters Content:

Shell expands into Australian retail power market with $528 mln deal

MELBOURNE, Nov 22 (Reuters) – Royal Dutch Shell (RDSa.L) has made its first foray into selling power to households in Australia, teaming up with an infrastructure fund to buy Meridian Energy’s (MEL.NZ) local electricity business for A$729 million ($528 million).

The deal, which follows Shell’s acquisition of the country’s biggest power supplier to commercial businesses in 2019, is in line with its plans to double the amount of power it sells globally to retail and business customers by 2030 to around 560 terawatt hours a year.

“Our aim is to become a leading provider of clean power-as-a-service and this acquisition broadens our customer portfolio in Australia to include households,” Elisabeth Brinton, Shell’s executive vice president of renewables and energy Solutions, said in a statement.

Meridian’s local electricity and gas retail business has more than 185,000 customers. It is Australia’s 10th largest electricity retailer with roughly a 1% residential market share, according to consumer comparison firm Canstar Blue.

Infrastructure Capital Group will acquire Meridian’s 300 megawatts of Australian power assets – which include wind farms and hydropower – as well as a wind farm development project and an energy storage project. Shell has agreed to buy all of the output from the producing assets.

Shell and ICG did not disclose how much each was putting towards the acquisition.

The deal expands ICG’s renewable generation capacity under management by more than 50% to 875 MW.

“Not only does this significantly scale our renewables portfolio but the addition of hydro comes at an important stage as we look to diversify with well-established, well-located assets,” ICG Managing Director Tom Laidlaw said in a statement.

Meridian put the business up for sale this year and attracted bids from Spain’s Iberdrola SA (IBE.MC) and Italy’s Enel SpA (ENEI.MI) among others, according to Australian media.

The deal is expected to close in early 2022 pending foreign investment approval from the Australian government.