On Friday, the ruling party of China released a draft of its 14th five-year plan, outlining the country’s upcoming economic priorities.

The draft plan covers a wide range of economic objectives and gives a broad view of how the country will build out its energy infrastructure. Later in the year, the Chinese Communist Party will publish more detailed plans around the power industry.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

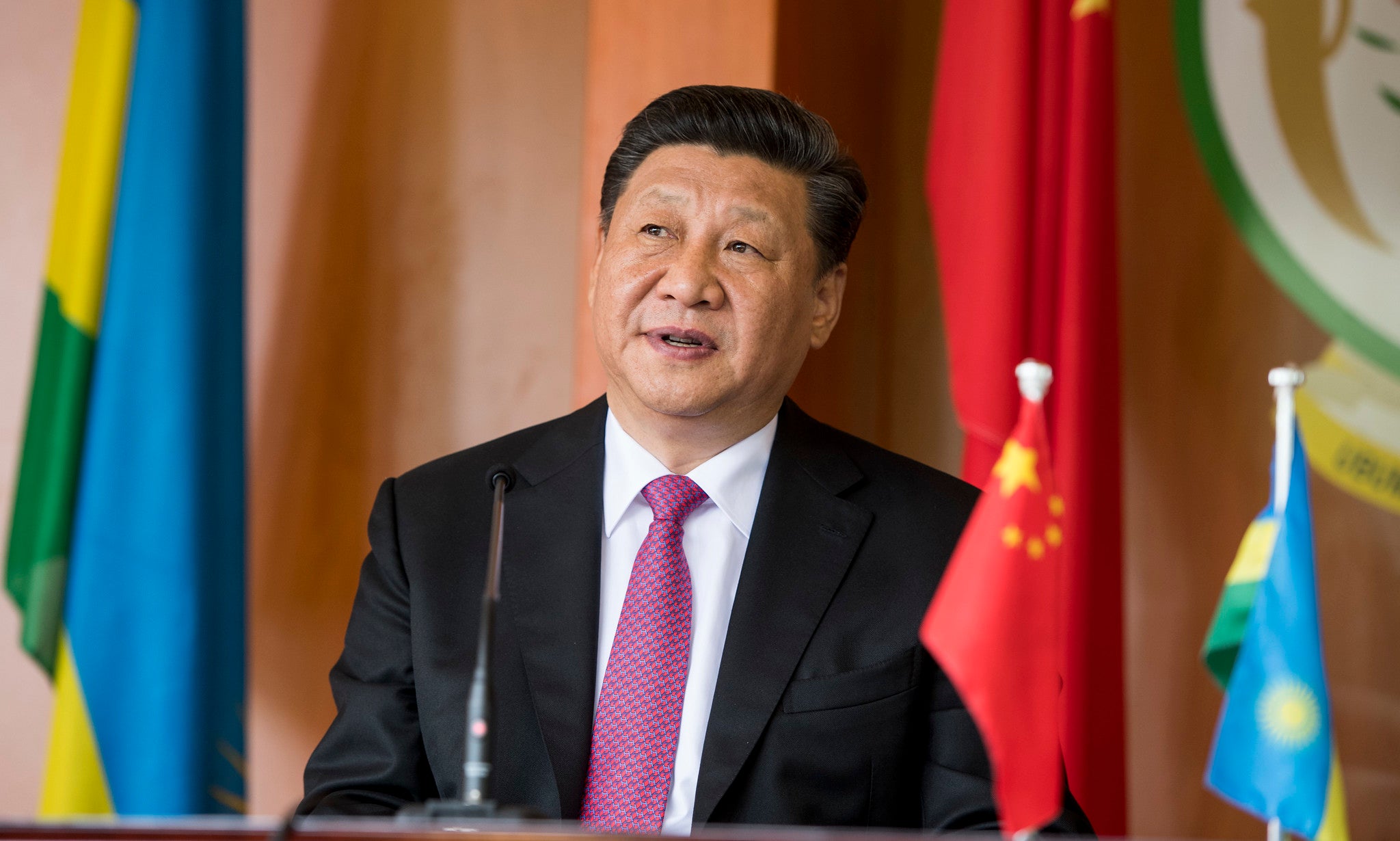

By GlobalDataThe plan is also the first since President Xi Jinping told a UN summit that China would aim to reduce its carbon emissions to net-zero by 2060. This target falls ten years later than the 2050 deadline adopted by most countries, in line with the Paris Climate Agreement. Xi also said that China’s emissions would peak by 2030, though this provoked scepticism as China continues to build and commission coal-fired power plants.

Nuclear generation to reach 70GW by 2025

The upcoming five-year plan states that at the end of 2020, Chinese nuclear capacity reached 51GW. This fell short of the country’s 58GW target, but it has set a new target for 70GW of generation before 2025.

In January, the China National Nuclear Corporation began commercial operations at its first Hualong One reactor. This reactor design is the first developed in China and, according to Reuters, industry officials have suggested construction of at least six new nuclear units per year in order to take advantage of economies of scale.

Luo Qi, a member of China’s Atomic Energy Research Initiative, wrote: “By 2035, nuclear plants in operation should reach around 180GW, amounting to 5% of total capacity.”

Five year plan sees China continue with coal plant construction

At the Two Sessions meeting of China’s rulers, premier Li Keqiang said that the coming five-year plan would “promote the clean and efficient use of coal”. The country’s new coal plants use emissions reduction technology to minimise their sulphur and particulate pollution, both of which significantly contribute to urban smog problems.

In 2020, the country built 38.4GW of coal-fired generation. At the same time, it started the decommissioning of 8.6GW, leaving a net gain of 29.8GW. In the same year, the country’s power demand increased by 3%, despite the Covid-19 pandemic. As such, Chinese authorities view coal as a “cornerstone” of meeting energy demand.

Since his announcement of China’s net-zero target, President Xi has given no indication that China will slow its coal plant construction campaign.

However, state-owned generation company China Huadian Corp has since told Reuters that it will close more than 3GW of coal-fired generation in the next five years. At the same time, the company will increase its renewable generation to half of its total generation.

Moreover, the company aims to have 60% non-coal generation by 2025. This means that the company will generate no more than 10% of its power from gas.

While previous five-year plans have included a cap on total power consumption in China, this plan did not. This seems to relate to the plan targets tying CO₂ emissions to economic growth.

Cutting energy intensity by 13.5% and emissions intensity by 18% before 2025

The country compares the energy use of its economy with the economy’s output by a measure known as energy intensity. As such, planning to reduce this would mean growing the country’s gross domestic product (GDP) faster than its energy consumption.

Emissions intensity is a measure of the amount of carbon dioxide generated per unit of economic wealth. The five-year plan aims to reduce this by the same amount targeted in its previous five-year plan.

While the plan did not set out a target for economic growth over the five years, it allowed for annual targets instead. The first of these mandates an economic growth of 6% in the coming year. The Chinese ruling party said that China’s GDP grew by 2.3% in 2020, though Covid-19 suppressed this.

If this rate continued over all five years, the Chinese economy would grow by 34% before 2025. As such, an 18% reduction in emissions intensity means that the country may continue to increase its emissions but must do so slower than it currently is, compared to its GDP.