With a fleet of state-run power and water plants capable of generating more than 80GW of power and 7 million cubic metres a day of desalinated water, it is no surprise that the long-promised privatisation of Saudi Arabia’s utilities sector is of huge interest to regional and international investors.

But Saudi Arabia’s ambitious plans to privatise large swathes of its electricity and water sectors appear to have stalled, despite the fresh impetus they gained in 2016 with the launch of the kingdom’s Vision 2030 economic reform programme.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPlans to sell off state-owned power and water plants, as the initial part of broader privatisation of the utilities sector, were first announced more than a decade ago, with preparations to break up and sell off the giant Saudi Electricity Company’s (SEC’s) assets beginning in 2007.

This was followed by a 2008 decree to privatise assets of state desalinated water producer Saline Water Conversion Corporation (SWCC).

After little initial progress in selling off government assets, moves to reduce the government’s role in delivering electricity, water and wastewater services were stepped up in 2016 with the launch of the kingdom’s Vision 2030 economic reform agenda, and the 2020 National Transformation Plan.

Plans to aggressively cut state energy and water subsidies, along with the privatisation of state-owned utilities are central pillars of the kingdom’s reform blueprint.

Partial Progress

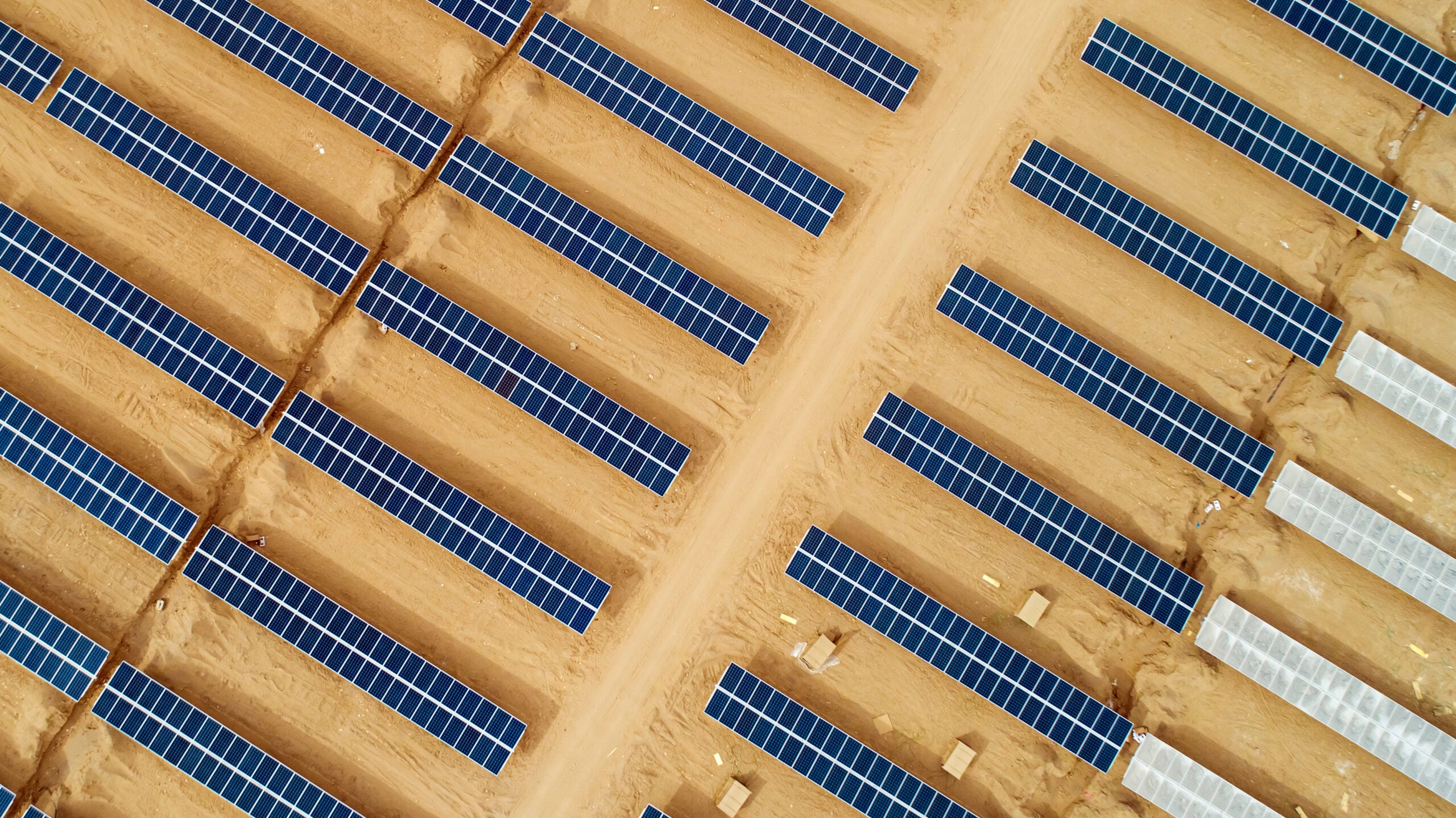

While new greenfield projects in the sector have gone ahead under various public-private partnership (PPP) models, potential investors still are waiting for the programme to privatise existing brownfield assets to materialise.

The final structure for Saudi Arabia’s privatised power sector was approved in 2010, culminating in the Electricity Industry Restructuring Plan.

Under the plan, SEC’s assets are to be split into four generation companies, a distribution firm and a National Grid company.

The grid company, National Grid SA, was the first entity to be unbundled in 2012.

Since then however, the programme has fallen behind schedule.

SEC had set a target of creating the generation and distribution firms by the start of 2014, and planned to complete the process of selling assets to the private sector by the end of 2016.

Power buyers

Following the launch of Vision 2030, the milestone of establishing a principal buyer for electricity was achieved in June 2017 with the creation of the Saudi Company for Energy Purchase.

Its primary role is to purchase and sell electricity, to purchase fuel to supply to generation firms that have signed agreements with the buyer, and to import and export power.

The optimism that the first of the generation companies would reach the market by the end of 2017 was short lived.

“We are still waiting for a timeline of when the first [SEC] generation assets will be let to the market,” says one senior figure at one major energy company interested investing in the region’s biggest utilities market.

“The process is made a bit more complicated as SEC is a listed company, with the public holding about 20 per cent of the shares, but we expected there to have been more progress with finalising the process by now.”

Water reforms

Despite preparations for privatising the government’s desalination assets having lagged behind the SEC unbundling process, the inclusion of the Ras al-Khair power and desalination plant in the National Centre for Privatisation (NCP) 2020 Delivery Plan launched earlier this year increased the likelihood that SWCC would offer the first opportunity for investors seeking to buy into the kingdom’s utilities market.

Launched in April, the Delivery Plan 2020 sets out the first round of targets and metrics for the kingdom’s privatisation programme.

The Ras al-Khair plant, which contains the world’s biggest desalination plant, forms the centrepiece of the plan, and is expected to raise up to $7bn of the $10bn Riyadh is aiming to generate from privatising five entities by 2020.

While some progress has been made with the privatisation of four sate-owned flour milling firms under the delivery plan, investors are still waiting for news on the Ras al-Khair project.

Complex challenges

While some have suggested the delay could be due to the government waiting for the finalisation of the country’s Private Sector Participation Law, others say the complexity of the deal may be the cause.

“It is more complicated than developing a new greenfield utilities project with the private sector,” says a lawyer close to the kingdom’s utilities sector.

“When selling off an existing asset, you need to have new industry structures in place so investors can understand how revenues will work and how it will all fit together before they are willing to buy into it.”

There is considerable appetite to invest in the Middle East biggest economy, but investors are not famed for their patience.

Riyadh needs make progress on delivering its asset-sale programme to ensure investors do not look elsewhere.

This article is sourced from Power Technology sister publication www.meed.com, a leading source of high-value business intelligence and economic analysis about the Middle East and North Africa. To access more MEED content register for the 30-day Free Guest User Programme. https://www.meed.com/registration/

Related Company Profiles

SEC Co., Ltd.

National Grid Plc

Power Technology Inc

Saline Water Conversion Corp

NCP Co., Ltd.