With Donald Trump’s victory in the 2024 presidential election, the US and global renewable energy markets anticipate a potential storm ahead.

The election result has already sent tremors through the renewables industry. US solar stocks tumbled on Wednesday, with companies like First Solar dropping 10%, while Sunrun and Sunnova plunged more than 29% and 51%, respectively.

Despite Trump not having made clear his stance on solar, investors reacted to his broader promise to eliminate green subsidies. The former president has pledged to dismantle the IRA, a cornerstone of Joe Biden’s $369bn clean energy initiative and a legislation that has played a key role in the expansion of renewables deployment in the country.

On the other hand, Trump’s disdain for wind power is no secret. He famously declared “I hate wind” and promised to halt offshore wind projects immediately upon returning to office. His Agenda47 policy platform reiterates his vow to “end all Joe Biden policies that disrupt energy markets… including the outrageous subsidies for wind energy”.

Trump’s victory reverberates far beyond US borders, sending shockwaves through global markets and testing international alliances. As his administration prepares to reverse climate policies and reshape the renewables landscape, both domestic and international markets brace for the wider implications for clean energy initiatives and geopolitical stability.

A global ripple effect

In addition to US renewables companies taking the hit, Trump’s victory has shaken global markets. European clean energy stocks fell sharply following the election, with wind turbine manufacturers Vestas and Nordex trading down around 11% and 7.6%, respectively, while Orsted, the world’s largest offshore wind developer, saw a decline of up to 14%.

The US renewable energy market has long represented a significant growth opportunity for utility companies across the globe. Trump’s shift in policy could dampen this upward trajectory, alongside the global momentum on emission reductions.

“The likely shift in US policy impacts global climate governance as US climate leadership pushes other major economies toward emission reduction commitments and supports developing countries in their green transitions,” says Paul Hasselbrinck, senior energy analyst at Power Technology’s parent company GlobalData.

Beyond the stock market, Trump’s stance on renewables could strain alliances with key climate-focused partners such as the EU, Canada and Japan. Hasselbrinck points to US-Europe relations as being particularly vulnerable to “suffering from turbulence on the diplomatic side”, paired with “dwindling support for NATO and the unlikely easing of protectionist policies”.

He adds, however, that these geopolitical tensions may be counter-balanced by the US’ willingness to sell liquified natural gas (LNG) to Europe and Europe’s demand for it, which could support the need for good relations.

“However, as a result, European countries may find themselves under increased pressure to reduce overall gas demand, turning to renewables at a quicker pace to avoid being subject to the leverage of an administration that will be – at least partially – at odds with the Union’s stance on Russia-Ukraine conflict resolution, and increasingly, on Israel-Palestine.”

US renewable supply chains on the precipice

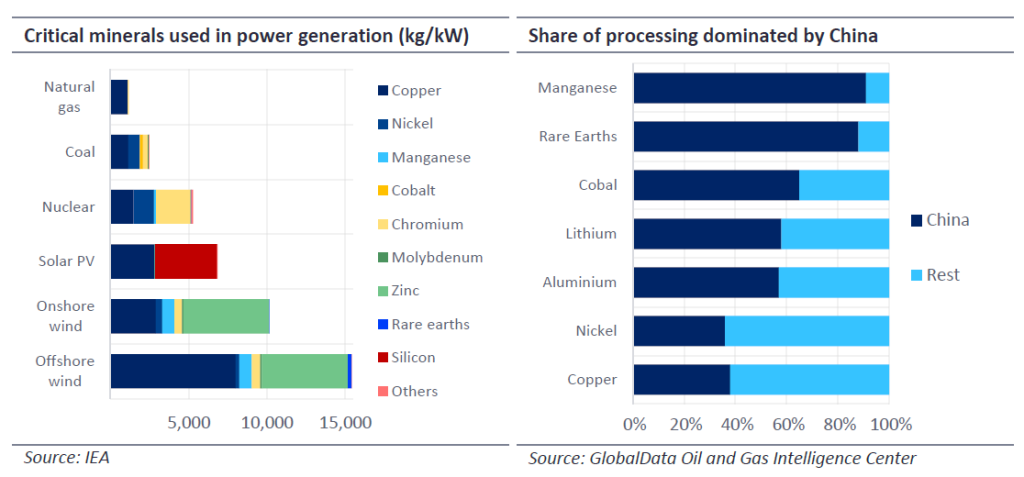

China’s control over critical minerals as well as the manufacture of energy-related equipment and infrastructure pose a significant challenge for the US renewables industry.

“The supply chain vulnerabilities have been spotted: solar and wind-powered electricity generation requires the kind of critical materials that China overwhelmingly dominates,” Hasselbrinck says.

For instance, China is responsible for nearly 40% of the global share of processing for copper, which is essential for not only renewables but also nuclear, coal and natural gas. The Asian nation also dominates around 90% of global processing for manganese, used for onshore and offshore wind.

Hasselbrinck claims that Trump’s solution to this conundrum will “look radically different from his opposing candidate and predecessor” as the options of safeguarding a good relationship with China to avoid supply chain disruptions and price-controls, in addition to establishing strong strategic partnerships with other key suppliers, “will seem less enticing to him”.

Rather than fostering international partnerships or diversifying supply chains, Trump is likely to focus on reducing US reliance on imports by boosting domestic production of traditional energy sources, further sidelining renewables. This could exacerbate supply chain vulnerabilities, as clean energy industries remain dependent on critical minerals for which the US lacks immediate alternatives.

“Trump’s practical – if not simplistic – approach means that renewables investments may decrease even more in response to uncertainty and lack of government support,” Hasselbrinck adds.

Not all doom and gloom

Despite the concerns, all hope is not lost when it comes to the growth of renewables in the US.

Data from the Global Infrastructure Investor Association shows that the IRA has spurred around $115bn in investments and generated roughly 90,000 jobs, the majority of which benefitted Republican-led states.

While this surge in investment and job creation is now in jeopardy considering Trump’s stance of renewables and the IRA, states that the bill has paid off for – many of which politically align with Trump – are likely to push back against his plans to gut the bill. With bipartisan recognition of its economic benefits, there is a strong possibility that at least parts of the IRA will survive his term.

Furthermore, Trump’s opposition to the IRA conflicts with his fixation on curbing China’s influence.

The solar industry has been a significant beneficiary of the IRA. According to the US Solar Market Insight Q3 2024 report, US solar module manufacturing capacity has surged nearly fourfold since the enactment of the IRA, rising from around 8GW in 2021 to more than 30GW. While this growth hasn’t extended up the supply chain to include cells or wafers, it has helped reduce the US’s dependence on China – an achievement that should satisfy the former president.

The nation has also almost doubled total installed solar capacity through the IRA’s support. GlobalData projects US cumulative solar capacity will reach 220.95GW by the end of the year, compared with 120.47GW in 2021.

Meanwhile, China is expected to surpass 850GW of solar capacity by the end of 2024. If Trump’s administration fully enacts its agenda, the nation risks falling even further behind its Asian competitor in the clean energy race.

It is possible that this is simply a battle that Trump is willing to lose. Whether the US stalls its renewables growth and widens the gap between itself and global competitors will depend on the degree of resistance his policies face and how far they are implemented.