The energy transition is in full swing, with much of this momentum being driven by the automotive industry. To date, most of the ‘buzz’ has been around gigafactories – giant battery plants that produce hundreds of thousands of battery packs to support the automotive industry as it moves toward all-electric. Across the globe, there are currently more than 300 gigafactories under construction, more than 200 of which will be built in China in direct response to enormous local demand.

These gigafactories are capital intensive, but car manufacturers and cell manufacturers are investing significantly. This year, it is expected that we will reach 1TWh globally, meaning that the overall investment so far is US$60bn.

However, the scale and pace of the electromobility revolution is going to be hampered over the next decade by a compounding shortage of key battery and other raw materials, such as lithium, nickel and graphite, as well as electrical steel and rare earths for magnets. As such, the industry is taking steps to prevent this from becoming a sustained threat by reducing its use of scarce materials, developing new materials and battery technologies, and building a scaled-up global battery recycling industry.

Mining and the raw material shortage

Battery packs are either produced by the battery manufacturer or pulled in-house by the car manufacturer. Typically, OEMs aren’t informed on mining or the upstream supply chain and leave it largely to their tier-one suppliers, the cell manufacturers.

According to an International Energy Agency (IEA) report regarding global supply chains of EV batteries, the world will need hundreds of new mines in operation by 2035 to produce the gigatons of energy conversion materials that will be needed if global energy conversion goals are to be met. There are a number of factors preventing this rapid growth, not least because it currently takes decades to develop a new mine, in addition to a lengthy permitting process beforehand.

Part of the problem lies with the world’s miners chronically underinvesting in new mines, which is in part due to the impact of ESG challenges. In regions such as Chile and Bolivia, which are rich in lithium reserves, exploration activities are being delayed due to increasing public unrest over environmental issues. Over the next two years, the world’s top ten mining companies are scheduled to invest $20bn between them in mining projects, compared to $40bn in 2016 alone.

Localisation of the batteries supply chain

According to Dave Oudenijeweme, Batteries Material transformation lead at Worley, the batteries supply chain has historically relied on supply from all over the world, including China: “Chinese companies have successfully ensured raw material supply through long-term offtake agreements and significant strategic investments. One example is Ganfeng Lithium, which through a strategic acquisition programme is now one of the largest lithium miners and refiners in the world. Recently it invested US$3.1bn to expand its ability to produce batteries by lifting capacity across three lithium battery plants, becoming fully vertically integrated.”

The reliance on a concentrated supply chain is in itself not the issue, nor is the level of investment required. However, governments across the world with significant end markets and industries to protect, now want a slice of the value-add opportunity. North America and Europe are also looking to stimulate local industry growth. These actions range from relatively minor R&D and capital grant incentives to the extremely influential Inflation Reduction Act.

On the other end of the value chain, countries such as Indonesia, Australia, Canada, and Chile, which have significant resources such as nickel, lithium, copper and other valuable raw materials, are keen to benefit from the EV revolution. We see a diverse range of strategies from taxation to encouraging more value addition within each country of exploration.

Reducing demand, increasing supply

The automotive industry is typically good at engineering itself out of trouble. To reduce the supply chain’s reliance on scarce materials, car and battery manufacturers are addressing ways that batteries can be redesigned, such as the development of cobalt-free lithium-ion battery technology.

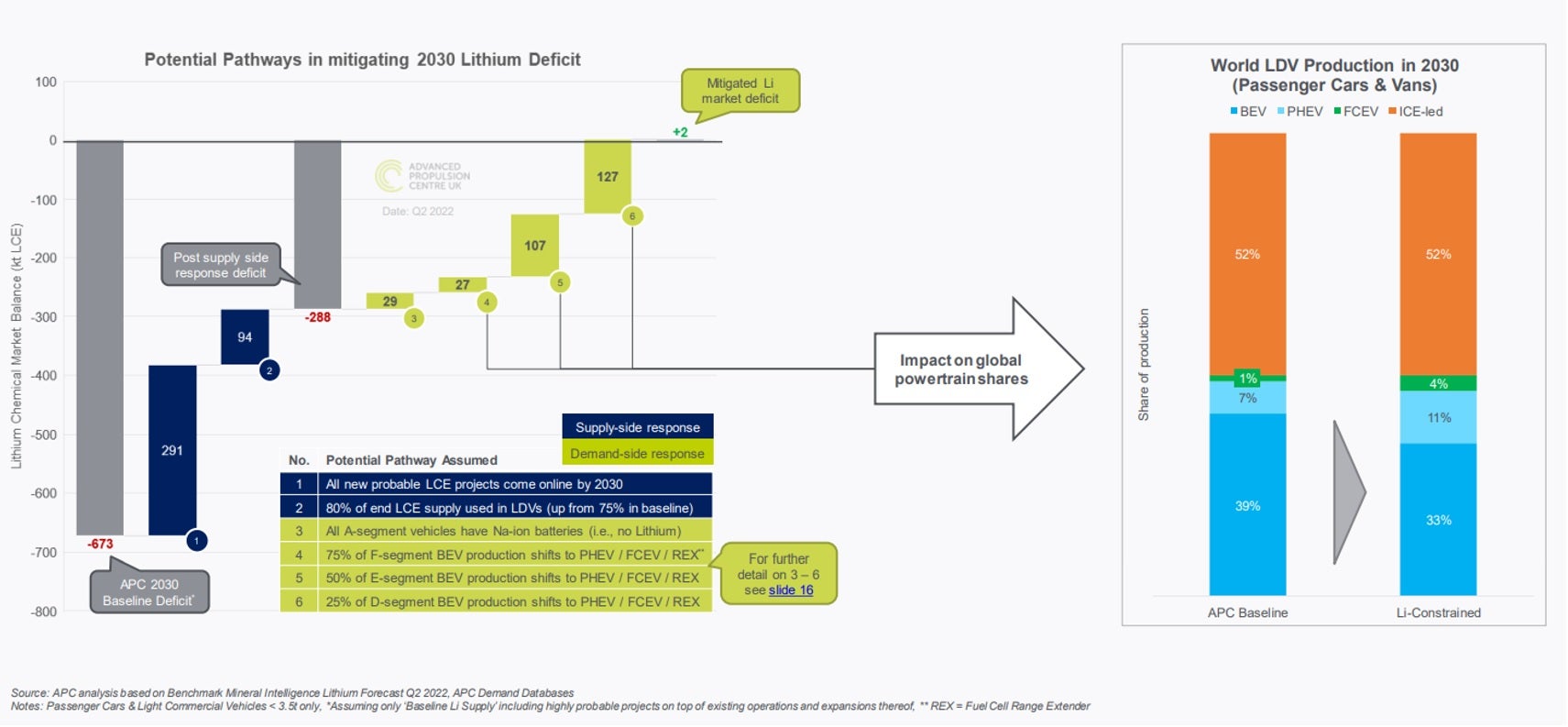

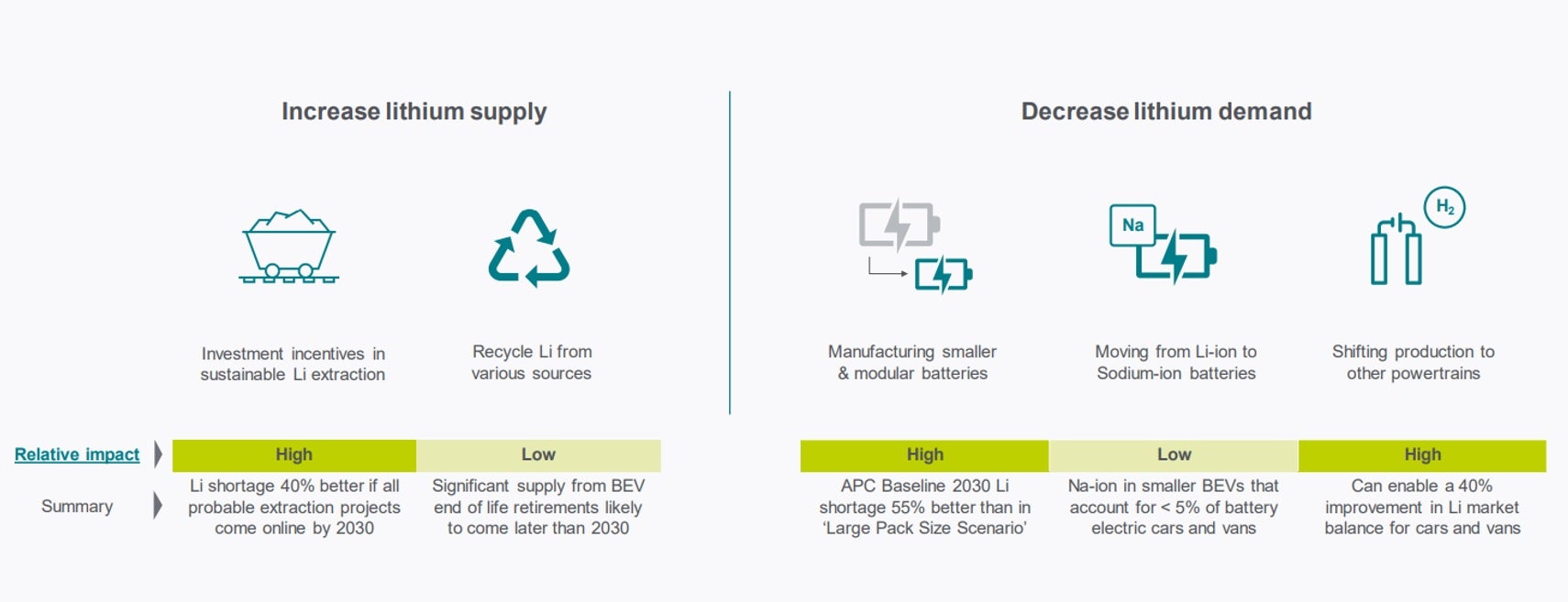

In its automotive industry demand forecast, the Advanced Propulsion Centre in the UK concluded that an approach of increasing supply and reducing demand seems to be the only way to bridge the gap. This means that all probable plausible lithium mines will need to come online as expected, in tandem with decreasing lithium usage in manufacturing.

Reduction in lithium demand can be achieved through the reduction in battery size and greater use of Plug-in Hybrid with ICE or fuel cell in the larger car segments. Reducing battery size is going against the trend of bigger, heavier cars with longer ranges and is only palatable to customers if the charging infrastructure gets much better very quickly. In other words, if you don’t have a particular component for the car, you don’t build the car as witnessed by the chip shortage. Furthermore, if you don’t have enough of a particular component, you might lose out to the competition. Winners in this space will have an integrated supply chain and R&D strategy.

Strategies for success for cell manufacturers

In the evolving world of critical minerals, many things remain uncertain. But the overall endpoint is clear: most cars will be powered by electric motors and store energy in a sizeable battery.

Cell manufacturing companies have fast realised securing materials is vital. For participants in the battery market, the success of this transition depends on having a vision, strategy, and plan. It’s key to have clear advice at the front end, underpinned by solid information and market insights to make the right investment decisions at the right time.

Finding the right delivery partner to help access raw materials such as lithium, nickel and copper will determine the growth rate of any battery materials company. Successful companies will also have vertical integration strategies to better secure their supply chains. This can range from taking minor stakes in mining companies, to JVs or to full vertical integration such as owning a natural graphite extraction operation in Africa that’s directly linked to an active anode plant in the USA.

Further details:

For more information, download the whitepaper from Worley