GlobalData’s latest report, “Spain Power Market Outlook to 2030, Update 2021 – Market Trends, Regulations, and Competitive Landscape,” discusses the power market structure of Spain and provides historical and forecast numbers for capacity, generation, and consumption up to 2030. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario and future potential. An analysis of the deals in the country’s power sector is also included in the report.

Spain is on track to complete the nuclear power phase-out by 2035. The nuclear power capacity in the country is expected to decline sharply from 7.1GW in 2020 to 3GW in 2030. As of August 2021, the country had seven operational nuclear power reactors, the majority of which are owned and managed by Iberdrola and Endesa. Under its National Energy and Climate Plan 2021-2030, the Spanish Government is planning to decommission nuclear power capacity during the 2027 to 2035 period. By 2030, nuclear power capacity is expected to decline to 3GW before being phased out altogether by 2035.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

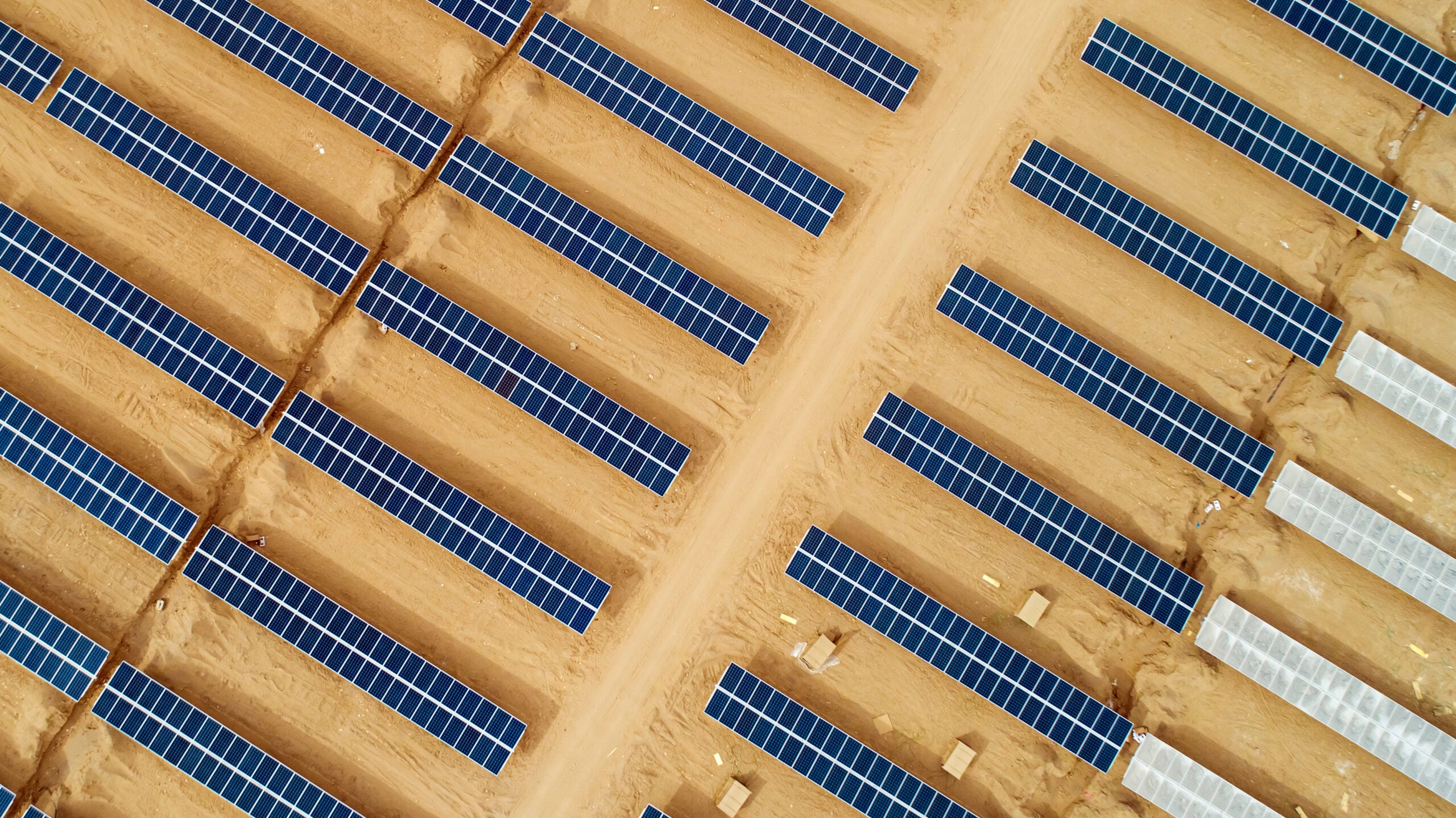

As of 2020, nuclear power held a share of 22.5% in Spain’s power generation mix. This share is expected to drop to 7.8% in 2030. The country is also phasing out coal power plants by 2025 and gradually decommissioning oil-fired plants by 2030 to meet its carbon emission reduction targets. In 2020, the country has already started the process of phasing out coal power by decommissioning around seven coal power plants with a cumulative capacity of 3.95 GW. Gas capacity is expected to remain almost constant from 2021 to 2030. The phase-out of coal and nuclear power plants and the gradual decommissioning of oil-fired plants will be offset with a simultaneous and gradual increase in renewable power capacity.

Spain will start the nuclear power phase-out in 2027. Out of the seven nuclear reactors that the country has, four are scheduled to be closed by 2030 while the other three nuclear reactors will stop operations by 2035.

Although Spain is rapidly moving towards a green energy future, the phase-out of coal and nuclear power plants in a short time frame may endanger the supply security of the country. The country is already a net importer of power since 2016 and its power imports will further increase if the generation void caused due to coal and nuclear power phase-out is not filled by renewable power sources. Due to the intermittent nature of renewables, the country will have to significantly invest in energy storage technologies once coal and nuclear power leave the generation mix.

Spain was one of the worst-hit countries in the world due to the Covid-19 pandemic. To curb the spread of Covid-19, the Spanish Government imposed strict national lockdowns in the country. Majority of the sectors in the country were affected due to these lockdowns; however, tourism and hospitality sector was the most badly affected.

With respect to the power sector, electricity consumption in the country declined by 5.5% in 2020 as compared to 2019. Electricity demand from industrial and commercial sectors declined significantly due to national lockdowns. The manufacturing of renewable power equipment also took a hit in the country due to the lockdowns. In March 2020, Vestas, a major wind turbine manufacturer, stopped almost all manufacturing at its two factories in Spain. Siemens Gamesa, another major wind equipment manufacturer, closed its blade manufacturing plant and another facility in Spain along with temporarily halting all its activities at production plants and wind farms in March 2020. In April 2020, Nordex, a Germany-based wind turbine manufacturer, suspended production activities in Spain due to the rapid spread of the Covid-19 pandemic and the resulting lockdowns. The Spanish Government passed the Royal Decree-law 23/2020 of 23rd June 2020 as a measure towards revitalising the economy and approving energy-related measures. The regulation came into effect on 25th June 2020 and provides measures to ramp up the power sector post the impact of Covid-19 on the economy, especially investments in renewables, energy efficiency and new generation processes.

Related Company Profiles

Nordex SE

Vestas (Inactive)

Iberdrola SA

Siemens Gamesa

Endesa SA