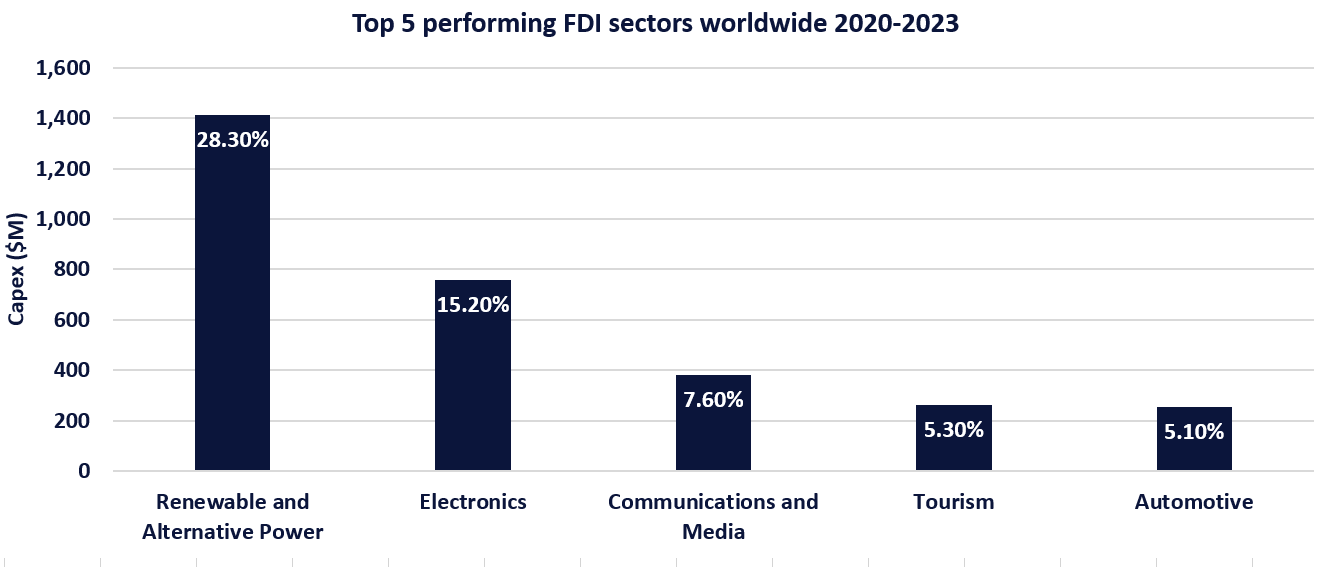

As decarbonising growth becomes a top boardroom priority, investment in renewable energy technologies and assets is surging. Analytics from market intelligence firm GlobalData shows that between 2020 and 2023, renewable energy was the best performing foreign direct investment (FDI) category worldwide, attracting capital expenditure of US $1.5 trillion between 2020 and 2023. The sector, which includes solar, wind, green hydrogen projects, battery storage and other clean energy technologies, accounted for more than one-quarter of global total FDI capital investment between 2020 and 2023, beating electronics, a category also on turbocharge as a result of the rapid development of AI and Generative AI technologies.

Chris Papadopoullos, ESG research lead at GlobalData, says: “The significant growth of FDI in renewable energy is directly correlated with the urgent need for businesses to decarbonise in line with emissions reducing regulations as well as the increasing reputational risks of not listening to investors and customers for whom environmental stewardship has become mission critical.

He adds: “There is also the aspect of wanting to achieve greater energy diversity and with wind and solar project costs coming down over the past few years, in many places there is now either price parity with fossil fuels, or electricity from renewables is cheaper than coal or gas.”

The International Energy Agency (IEA) has reported that in 2023, an estimated 96% of newly installed, utility-scale solar PV and onshore wind capacity had lower generation costs than new coal and natural gas. The energy organisation anticipates that wind and solar photovoltaic systems will become even more cost competitive over the coming years, driven by technology innovation and maturity in the sector.

Renewable energy investment: from strength-to-strength

GlobalData’s FDI Projects Database, which tracks global FDI projects across sectors, reveals how the sector has grown since the pandemic.

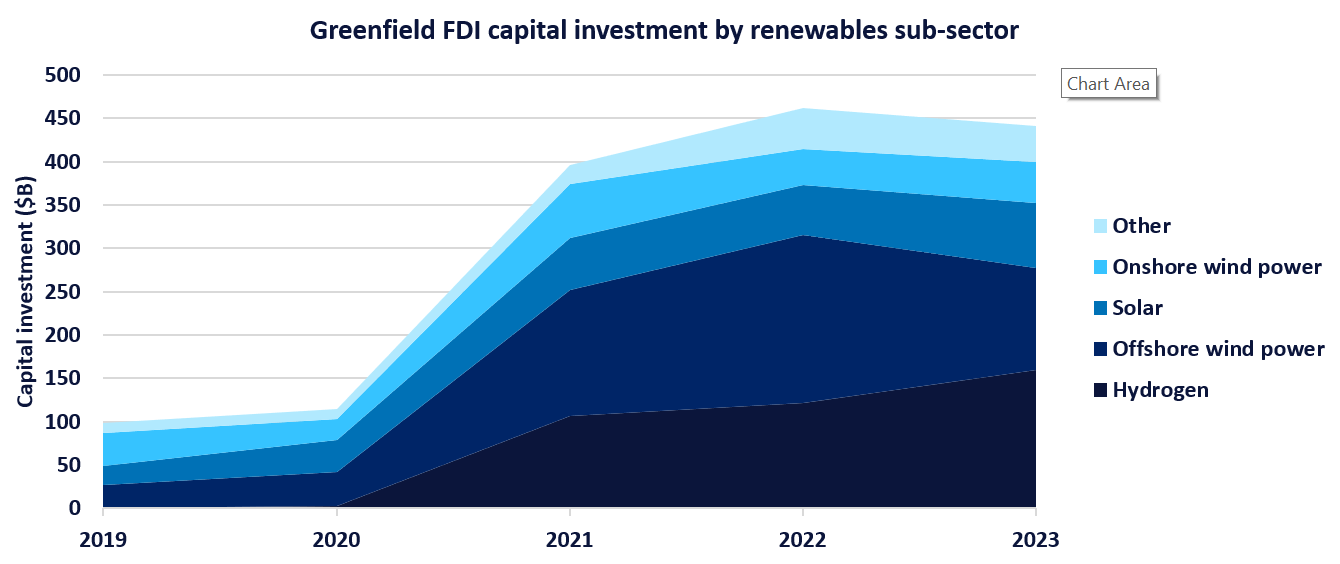

Between 2019 and 2021, FDI into clean energy grew almost 100%. In 2019, 444 new projects were announced worldwide and just two years later, that number had grown to 859 new projects.

In 2023, 1,110 new greenfield projects were announced, with a capex of $440 billion. Almost half of those funds were funnelled into offshore wind and photovoltaic solar power which also dominated power M&A last year. Hydrogen was also a big winner, with $160 billion flowing into infrastructure and technologies to create electrolysis from cleaner resources than fossil fuels.

GlobalData projects further growth in the category to reflect the COP28 pledge to triple renewable energy capacity by 2030. A report by the International Energy Agency (IEA) said in 2023 renewable energy capacity additions increased by almost 50% to nearly 510 gigawatts (GW), the fastest growth rate in the past two decades, with capacity reaching all-time highs in Europe, Brazil and the US, locations which are also benefiting the most from clean energy FDI flows.

The IIE Renewables 2023 report projects that the world is on course to add more renewable capacity in the next five years than has been installed since the first commercial renewable energy power plant was built more than 100 years ago.

Florida emerging as a hot spot for affordable clean energy

GlobalData analytics show that, between 2019 and 2023, the US ranked number one for clean energy FDI investment, followed by Spain and then the UK and Brazil. Within the US, one state that has been a major beneficiary of clean energy investment recently is Florida. Of the top 10 FDI projects by capex over the past 18 months in the Sunshine State, two have been from major climate technology companies investing in research hubs focusing on solar and clean hydrogen.

Last year, France-based CMG Clean Tech announced its first US R&D facility, Green Garden Village, in Osceola County in a $431 million deal that could create 1,200 high-wage jobs. Meanwhile, also in 2023, South Korean LowCarbon, a carbon capture specialist, committed to support the development of a clean hydrogen hub in central Florida in a strategic position near natural gas pipelines. LowCarbon’s carbon capture technology will be critical for Florida’s significant but energy-intensive aerospace and space industry to switch fuel sources as regulatory net zero targets drives the energy transition further.

“Attracting these kind of investments will be essential for the advancing of clean energy ecosystems,” says Francesca Gregory, a senior analyst at GlobalData. “In turn, these will become increasingly core for energy intensive industries as the need to diversify energy supplies grows in terms of energy security and affordability.

“The enormous potential of AI is creating a boom in power-hungry data centre infrastructure. The space economy too is a dynamic and potentially lucrative sector, which again is hugely energy intensive. A location interested in attracting this kind of investment has to think strategically about the fuel sources it can offer these growth industries.”

It’s fortunate then that Florida’s leading power company NextEra Energy and its electric utility subsidiary Florida Power & Light (FPL) Company recognise this well. One of the largest power providers in North America, NextEra Energy has more than 59,500 megawatts (MW) of net generating capacity in the US and Canada and most of that is clean energy. This dates back to a commitment 20 years ago to run FPL’s fleet off domestic natural gas and solar power, a decision that has since saved customers more than $15 billion in fuel bills.

In 2023, NextEra Energy owned the second-highest solar power capacity of all power companies worldwide generating 7.84GW, according to GlobalData. It also had the highest capacity of wind power with 21.22GW of onshore wind, nearly 2GW above its closest competitor. In 2021, FPL unveiled the world’s largest solar battery system. The Manatee Energy Storage Center, about the size of 30 American football pitches, has a 409MW capacity with the ability to power about 329,000 homes for two hours.

Looking ahead, FPL plans to significantly expand solar capacity in Florida, which currently makes up about 5% of its generation mix, harnessing the state’s most powerful natural asset. FPL is now five years into a historic – and the largest in the US – solar development programme called 30-by-30. Taking advantage of Florida’s average 240 sun-soaked days a year, FPL aims to build 30 million solar panels by 2030, making the state a world leader in solar energy, which has already saved its customers almost $700 million in fuel costs since 2009.

NextEra Energy has said it expects to bring online an additional 33GW to 42GW of new wind, solar and battery storage projects between 2023 and 2026. FPL is also investing in green hydrogen, which can use solar energy to power electrolysis. Its Cavendish NextGen Hydrogen Hub, the first of its kind in Florida, will help the utility test whether it can use clean hydrogen to offset the use of natural gas to run a traditional power plant.

These measures are supported by NextEra Energy’s ‘Real Zero’ initiative, a commitment to be fossil-fuel free by 2045. By 2045, FPL will significantly expand its solar capacity, increasing the amount of solar generation on its system to more than 90,000 MW from hundreds of millions of solar panels.

Real Zero will add more than 50,000 MW of battery storage to FPL’s grid, up from 500 MW today. This energy storage will be critical to harness and store surplus energy when it’s sunny, which can be tapped into during periods of cloudy weather.

“Our Real Zero goal to eliminate carbon emissions from our operations is a real goal that would make a significant difference for our customers,” says John Ketchum, president and chief executive officer, NextEra Energy.

“We are building on our decades of innovation and investments in low-cost renewable energy to decarbonise our company while keeping bills affordable for our customers. Attaining Real Zero will be one of those achievements that provides lasting value to our customers and the communities where we do business. We’ve been working on this for a long time and will take our extensive experience, industry-leading development platform and scale to help accelerate the decarbonization of the US economy.”

Florida has been on a steady growth trajectory for a number of years thanks to a combination of its expansive infrastructure allowing easy access to global markets, a business-friendly regulatory environment, low taxes and an unmatched quality of life. It is estimated that about 1,000 people a day are moving to Florida, as the post-pandemic appeal of more space, better weather and low taxes shows no sign of abating.

It’s no coincidence then that in 2021, majority foreign-owned firms accounted for 358,200 Florida jobs, employing 16,100 more Floridians than the year prior and yielding 4.7% annual growth. As a result, Florida ranks 1st in the Southeast US and 5th in the country for employees attributed to majority foreign-owned firms.

Over the past 10 years, employment at Florida affiliates of majority foreign-owned firms has increased by more than 115,000 jobs (47.7%), signalling long-term growth and development in the state.

Florida’s top three European investora, the UK, Germany, and France, and Canada account for a majority (55.9%) of FDI employment at majority-owned affiliates, or 200,300 Florida jobs.

This combination of renewable energy resources, a growing workforce and fast connections to the world’s economy make Florida a compelling case for international companies searching for their first or next US location.

Empower your business with clean energy and benefit from expert guidance, top incentives and a thriving clean energy community. Contact FPL today to discover the perfect location for your clean energy operations in Florida.