Solar PV (photovoltaic) and wind will account for half of all generation capacity by 2035 but the biggest shortcoming of renewables is their intermittency. So, when dark clouds cover the sun or the wind doesn’t blow, these energy sources can’t produce as much. That is why energy storage is crucial: so that when there is a surge in renewable energy generation, for example, on windy days or during peak sunshine hours, this extra capacity can be stored and then released when demand exceeds production.

It makes sense that the energy storage industry is growing in tandem with the increase in renewable capacity around the world. Energy storage systems (ESS) play a pivotal role in enhancing the reliability and stability of clean energy sources and will be key to a successful energy transition. By storing excess energy generated during peak production periods and releasing it during low production or high demand periods, ESS ensures a consistent and reliable power supply and ambitious sustainability goals are driving a boom in this market.

Market intelligence firm GlobalData values the ESS market at $73.5 billion in 2023. GlobalData power analysts say favourable market conditions and government policies, like the EU Green Deal, the Fit for 55 proposals and in the US, the Inflation Reduction Act (IRA), will be the tailwind for further growth. GlobalData projects a compound annual growth rate (CAGR) of more than 15% for the ESS industry between 2023 and 2026 as the amount of renewable energy deployed globally by the end of the decade is set to double.

Currently, pumped-storage hydroelectricity (PSH), which stores energy in the form of gravitational potential energy in reservoir water, is the most established large-scale energy storage technology, and accounts for about 90% of the world’s installed storage capacity. But, battery energy storage systems (BESS), which have much more flexible deployment capability and better scalability, are gaining traction.

“The global battery energy storage market is on a rapid growth trajectory,” says Buket Mansuroglu, director, vertical markets at nVent Schroff, a global leader in electrical connection and protection solutions.

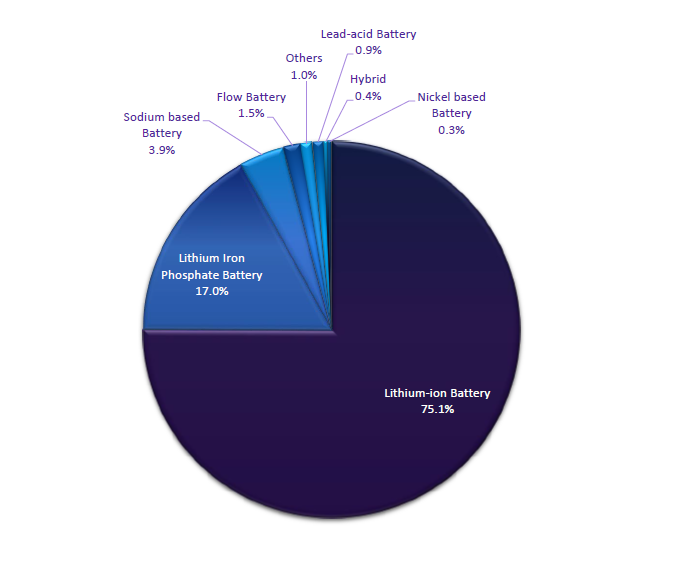

“APAC has currently the largest share of installed capacity, but Europe has seen an exponential increase in battery energy storage systems over the past few years. In terms of technology, lithium-ion (li-ion) based batteries have been favoured for their high energy density, efficiency, and declining costs but R&D investment is now flowing into other technologies with favourable characteristics.”

The development of battery technologies continues. Lithium-ion batteries are undergoing continuous improvements in energy density, charging speed, and lifespan. Sodium-ion batteries are emerging as a promising alternative with their cost efficiency, environmental friendliness, and safety features. On the other hand, solid-state batteries are promising advances in battery chemistry which offers the potential for increased energy density, safety, and improved cycle life.

In addition to them, flow batteries, which use energy stored in electrolytes by increasing the potential difference between two electrochemical liquids, promise a longer lifespan then li-ion and an improved safety profile too. Developments in these technologies should be closely watched. Buket notes: “The main drivers for researching and investing in alternative battery technologies are achieving greater stability, higher energy density, longer cycle life, and overall cost reduction. Sustainability and environmental factors are also crucial.

But Kirim Serhan, business development manager at nVent says the market is still very much dominated by li-ion and will continue to be for a while yet.

nVent is one business playing a crucial role in the energy transition, supporting OEMs and integrators navigate regulatory and safety hurdles and shape energy storage systems so they are fully optimised while also flexible enough to accommodate for technological upgrades. Its unique enclosures include advanced thermal management systems, comprehensive electrical protection solutions, and modular power distribution systems which can be integrated into larger infrastructure projects, all critical components for effective energy storage.

BESS manufacturers can stand out if they deliver high performance and longer lifecycles. “But there are hurdles,” says Serhan. “Battery degradation is inevitable. Batteries need to survive in increasingly challenging and harsh environments. There is good news, though. While we wait for further advances in complex areas like chemistry, there are already practical ways to make cells last longer.

“Having expertise in this allows us to help the market accelerate development in BESS.”

He says companies tend to approach nVent with a rough idea but need their expertise to integrate systems and resolve mechanical and thermal issues.

“We provide design flexibility, robustness, safety, modularity, and customisation,” Serhan explains. “All clients start with a prototype, which we help design and test over three to six months. Our application engineers collaborate deeply with clients during this phase.”

Discover some key ways to overcome hurdles in the design and manufacture of battery energy storage systems in this free whitepaper from nVent Schroff.