Global cumulative installed capacity for biopower increased from 49.4 gigawatts (GW) in 2006 to 111.3GW in 2016. The rise in global installed capacity during this period can be attributed to the installations in China and Brazil. Brazil used almost entirely solid-biomass conversion, with negligible biogas capacity addition. China, on the other hand, installed biomass and biogas plants. Steady growth of the cumulative capacity is expected to continue, to reach 165.2GW by the end of 2025, with more than 84% of the capacity using solid-biomass conversion technology. As per GlobalData’s recent report on the Europe Biopower Market, Update 2017, it is expected that the biopower market size will reach $21 billion by 2025.

The biopower market is largely policy dependent, as generation from biopower is not as competitive as generation from fossil fuels in most countries. Governments worldwide are investing in biopower technologies to ensure stability and security of energy supply. Biopower plants also help to curb GHG emissions, generated when biowaste is dumped in landfills, by using this biowaste to generate power. Bioenergy – biopower and biofuels – accounts for 10% of the world’s total primary energy supply, is mainly used in the residential sector for heating and cooking, and is produced locally. It is estimated that around 97% of fuel for biopower is made from solid biomass, 71% of which is used in the residential sector.

The following figure illustrates the cumulative installed capacity of the global biopower market during 2006–2025.

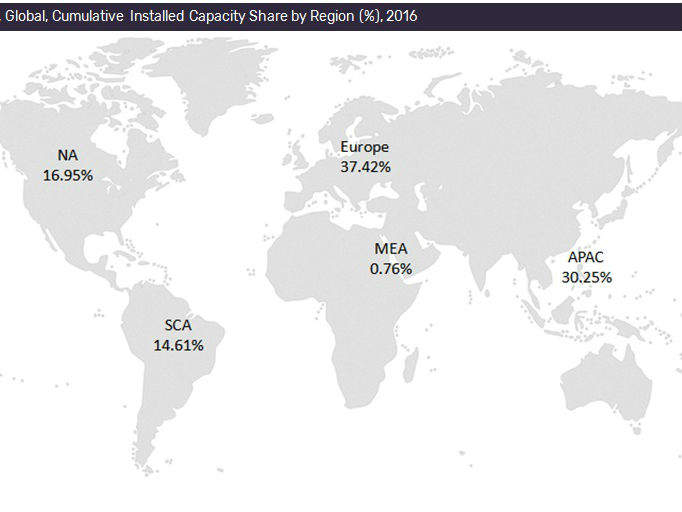

Europe was the largest biopower market in the world with the total market size of $9.33bn followed by Asia-Pacific with $8.83bn in 2016. By 2025, it is expected that the Europe biopower market size will reach to $7.99bn. As of 2016, Europe accounts for 37.4% share of the global cumulative biopower installed capacity with wood and wood byproducts as the major feedstock used in biopower plants whereas, Asia-Pacific was the second-largest region with a share of 30.25%, followed by North America (NA), South and Central America (SCA), and Middle East and Africa (MEA) with 16.95%, 14.6%, and 0.76% respectively. The following figure illustrates the cumulative installed capacity share by region for biopower by 2016.

Europe was the largest biopower market in the world with the total market size of $9.33bn followed by Asia-Pacific with $8.83bn in 2016. By 2025, it is expected that the Europe biopower market size will reach to $7.99bn. As of 2016, Europe accounts for 37.4% share of the global cumulative biopower installed capacity with wood and wood byproducts as the major feedstock used in biopower plants whereas, Asia-Pacific was the second-largest region with a share of 30.25%, followed by North America (NA), South and Central America (SCA), and Middle East and Africa (MEA) with 16.95%, 14.6%, and 0.76% respectively. The following figure illustrates the cumulative installed capacity share by region for biopower by 2016.

One major driver of EU biomass demand is the climate and energy policies promoting the use of renewable energy. The 2020 Climate and Energy package sets a target of 20% final energy consumption from renewable energy by 2020. The recent proposal of the Commission for the 2030 framework for climate and energy policies further increases the share of renewable energy to at least 27% of the EU's energy consumption by 2030. It is expected that the total renewable energy consumption will be more than double by 2020 from the 2005 level. According to the National Renewable Energy Action Plans (NREAPs), biomass used for heating, cooling, and electricity would supply about 42% of the 20% renewable energy target for 2020.

One major driver of EU biomass demand is the climate and energy policies promoting the use of renewable energy. The 2020 Climate and Energy package sets a target of 20% final energy consumption from renewable energy by 2020. The recent proposal of the Commission for the 2030 framework for climate and energy policies further increases the share of renewable energy to at least 27% of the EU's energy consumption by 2030. It is expected that the total renewable energy consumption will be more than double by 2020 from the 2005 level. According to the National Renewable Energy Action Plans (NREAPs), biomass used for heating, cooling, and electricity would supply about 42% of the 20% renewable energy target for 2020.

The EU-28’s top five countries generating bioelectricity represent more than half of the total (66.3%) electricity generated by biopower in Europe. Germany is by far the biggest producer of bioelectricity with 51.47TWh (27.8%) followed by the UK with 29.9TWh (15.9%) and Italy with 19.18TWh (10.4%).