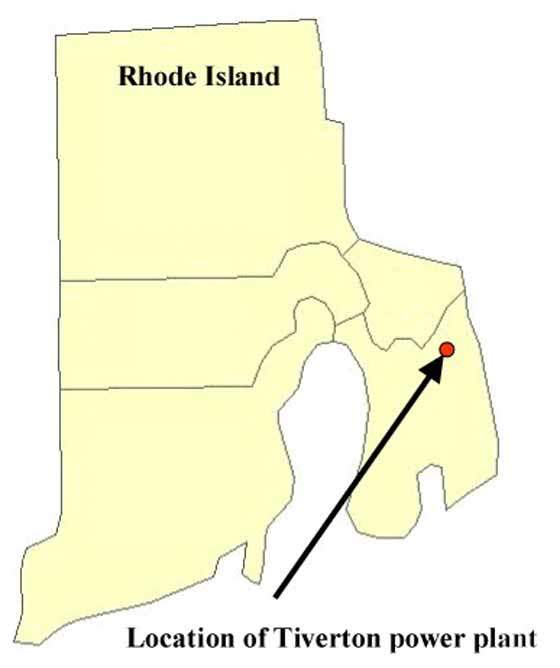

The Tiverton combined-cycle gas turbine plant is now supplying 267MW to the New England power market. The plant owner is Calpine, which estimates that it cost in the region of $172.5 million. The turbines were ordered from General Electric in 1998. Construction began in late 1998. The plant was commissioned in 2000, and started commercial production in Tiverton, Rhode Island, in October 2000.

PROJECT FINANCE

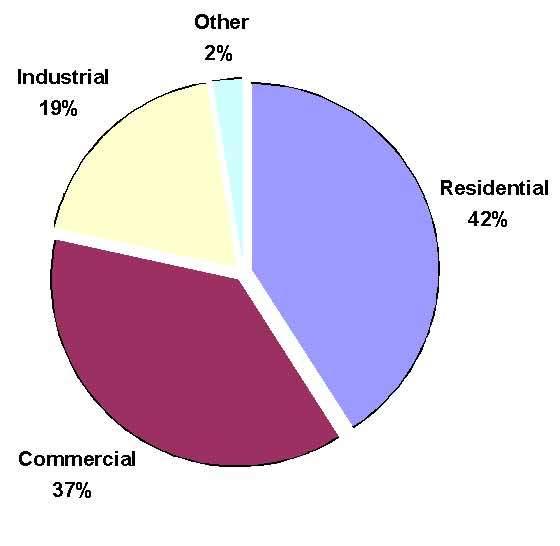

The owners of the plant are Calpine Corporation and Energy Management, Inc. (EMI). Calpine Corporation is an American Independent Power Producer (IPP). It invested $40 million and receives 62.8% of the project’s cash flow under the agreement until it receives a set pre-tax rate of return. After this, both partners have equal shares. The plant sells its output into the New England power market and to wholesale and retail customers in the northeastern United States.

Energy Management has several plants in the north east of the USA. Calpine and EMI also co-operated over plants in Dighton, Massachusetts and Rumford, Maine. In February 1999 the two companies announced they were forming a joint marketing venture. Based in north Dartmouth (Massachusetts), the company markets power and energy in New England.

The consortium financing the project included the New York branches of Bayerische Hypo-und Vereinsbank AG and Landesbank Hessen-Thurigen Girozentrale and CoBank, ACB. The turbines were supplied by General Electric. The design, procurement and construction was done by Stone & Webster. The finished plant is being operated by Energy Management.

When the plant was constructed, New England was seeing a boom in merchant power plants. This was a result of the deregulation of electricity utilities, catch up with the delayed capital projects of the early 1990s, increasing electricity loads in the region, and the shutdown of much of the region’s then existing capacity.

PLANT MAKE-UP

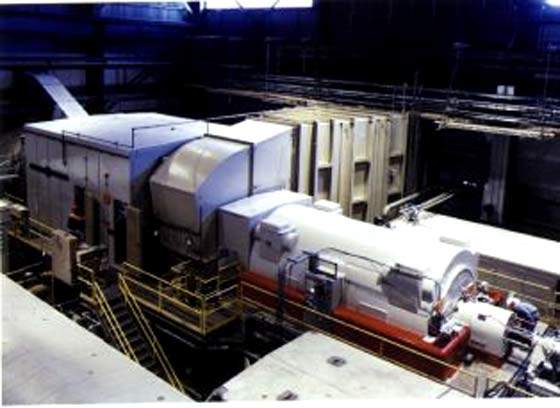

One of the combustion turbines is routed to a heat recovery steam generator, which provides steam to one steam turbine. The plant also features a zero discharge water treatment system.

The new plant was claimed to be about 40% more efficient than the rest of the region’s gas fired capacity. Indeed, the raison d’etre of merchant power plants is their efficiency. Since plants such as Tiverton cannot expect stable long-term contracts, they have to be the cheapest available to survive. The plant is based on the GE 7FA turbine (168MW) and EPC services for the plant are being carried out by Stone & Webster.

ENVIRONMENTAL CONCERNS

In 2004, a Washington DC-based watchdog group (The Working Group on Community Right-to-Know) listed the plant as one of 24 believed to pose the USA’s greatest risk for the release of a hazardous chemical (anhydrous or gaseous ammonia), which is stored on site.

Tiverton uses uses the anhydrous ammonia in the chiller system. The storage tank is located in a secure area and has sensors that should activate a water deluge system if any leak is detected. The watchdog group however pointed to the risk of terrorism, and say that the plant is on the list because around 75,000 people live close to it.

Acute ammonia exposure can irritate the skin and cause headaches, nausea, vomiting and even blindness. High levels can lead to death. Chronic exposure can damage the lungs and cause bronchitis. The company is seeking alternatives for use at the plant.

ORDER SURGE IN THE US

The order surge in the US market brought more work for the US EPC contractors, as getting hold of gas turbines direct from the manufacturers had proved increasingly difficult. GE and Westinghouse reported that they were sold out of gas turbines until late 2002, and many potential purchasers turned to EPC contractors to jump the queue. The order rush also caused a price rebound in the market as demand escalated.