The Renewables Infrastructure Group (TRIG) has divested a 15.2% equity interest in the 330MW Gode offshore wind farm offshore Germany.

The stake was sold for €100m, a 9% premium to its carrying value.

The buyer is a set of funds managed by Equitix Investment Management. The transaction is pending regulatory approvals and consents.

TRIG will retain a 9.8% interest in the wind farm.

TRIG agreed to acquire a 25% indirect equity interest in Gode Wind 1 offshore wind farm in June 2019.

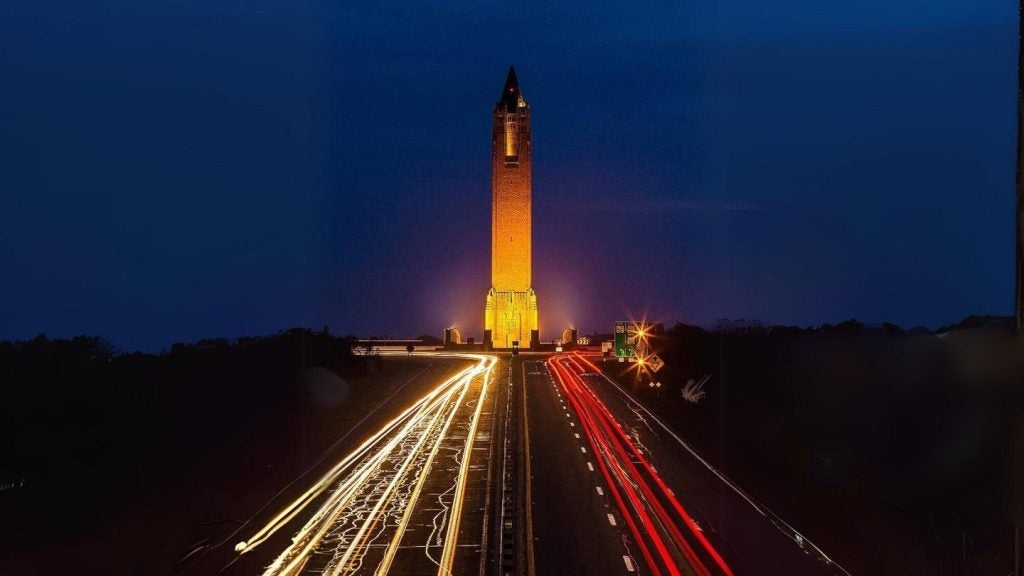

Located in the German North Sea, the offshore wind facility was developed and constructed by Ørsted and began operations in February 2017.

In a strategic move announced in February 2024, TRIG's board expressed its intention to use retained cash and asset sales proceeds to reduce the company's floating rate borrowings.

TRIG aims to reduce borrowings under its revolving credit facility (RCF) to £150m during 2024. As of 30 June 2024, RCF borrowings stood at £334m.

The proceeds from the recent sales, including the divestment of the Pallas onshore wind farm and the 15.2% equity interest in the Gode wind farm, were expected in the first half of 2024.

The funds contribute to reducing TRIG's RCF borrowings to £195m.

TRIG chair Richard Morse stated: “The disposals secured by the managers both enhance TRIG's NAV [net asset value] and create headroom for future growth.

“As part of our commitment to prudent capital allocation, the managers continue to appraise attractive investment opportunities, which include share buybacks, and progress selective disposals.

“Considering the company's strong balance sheet and with the share price trading at a significant discount to the company's NAV, TRIG's shares represent a compelling investment opportunity.

“The board has therefore decided to commence a £50m share buyback programme, providing shareholders with immediate NAV per share accretion."