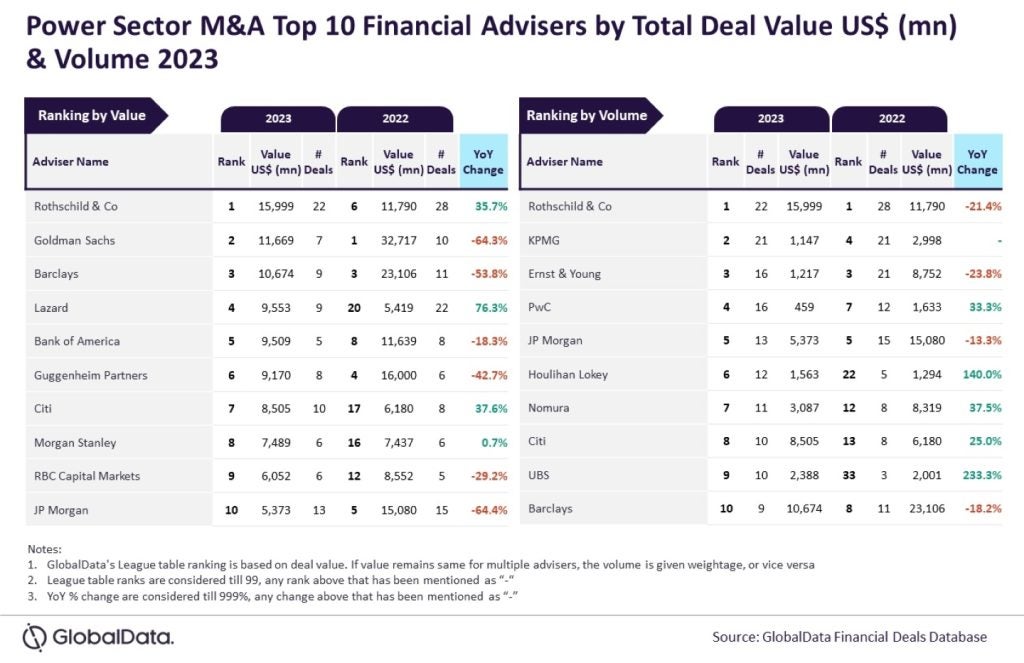

Rothschild & Co has emerged as the leading financial adviser in the power sector's mergers and acquisitions (M&A) space for 2023 in terms of value and volume, according to GlobalData’s latest league table.

The company's dominance is marked by its advisory role in 22 deals cumulatively valued at $16bn, according to the deals database of GlobalData, a leading data and analytics company that is the parent of Power Technology.

Claiming the second position by value is Goldman Sachs, which advised on transactions worth a total of $11.7bn.

Barclays followed closely behind, securing the third rank with its involvement in deals amounting to $10.7bn.

Lazard and the Bank of America were also key players, positioned fourth and fifth, having advised on deals worth $9.6bn and $9.5bn, respectively.

GlobalData lead analyst Aurojyoti Bose said: “Rothschild & Co was the top adviser by volume in 2022 and managed to retain its leadership position by this metric in 2023 as well despite a decline in the number of deals advised.

“However, it registered a jump in deal value and improvement in its ranking by value in 2023 compared with 2022. Rothschild & Co went ahead from occupying the sixth position by value in 2022 to top the chart in 2023.

“Involvement in two billion-dollar deals including a mega-deal valued at more than $10bn was pivotal for it in leading the chart by value.”

In terms of volume, KPMG stood second, having advised on 21 deals, followed by Ernst & Young and PwC with 16 deals and JP Morgan with 13.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory company websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To further ensure the robustness of the data, the company also seeks deal submissions from leading advisers.