Italian cable manufacturer Prysmian has concluded the acquisition of the American cables producer Encore Wire, marking a significant expansion in the North American market.

Prysmian has purchased all outstanding shares of Encore Wire at $290 per share in cash.

Prysmian expects to gain from increased cross-selling opportunities and the efficiency and innovation inherent in Encore Wire's distinctive production, distribution processes and service levels.

Prysmian CEO Massimo Battaini stated: “This acquisition will significantly strengthen Prysmian’s leadership position in North America while creating value for all stakeholders.

“There is also a strong cultural fit between Encore Wire and Prysmian because of our shared spirit of innovation and commitment to accelerate the transition towards a low carbon economy.”

With the completion of the transaction, Encore Wire transitions to become a privately held entity and will cease trading on NASDAQ or any other public market.

Encore Wire CEO Daniel Jones stated: “With the successful completion of the transaction with Prysmian, we are ready to begin an exciting new chapter in our company’s history.

“Encore Wire and Prysmian are two highly complementary organisations, and we look forward to leveraging our enhanced product offerings and strong customer relationships to drive even greater opportunities as part of a larger, global organisation.”

Goldman Sachs Bank Europe, Succursale Italia [its Italian branch office] provided exclusive financial advice to Prysmian for the deal, while Wachtell, Lipton, Rosen & Katz served as its legal counsel.

JP Morgan Securities offered financial advice to Encore Wire, with O’Melveny & Myers as legal advisors.

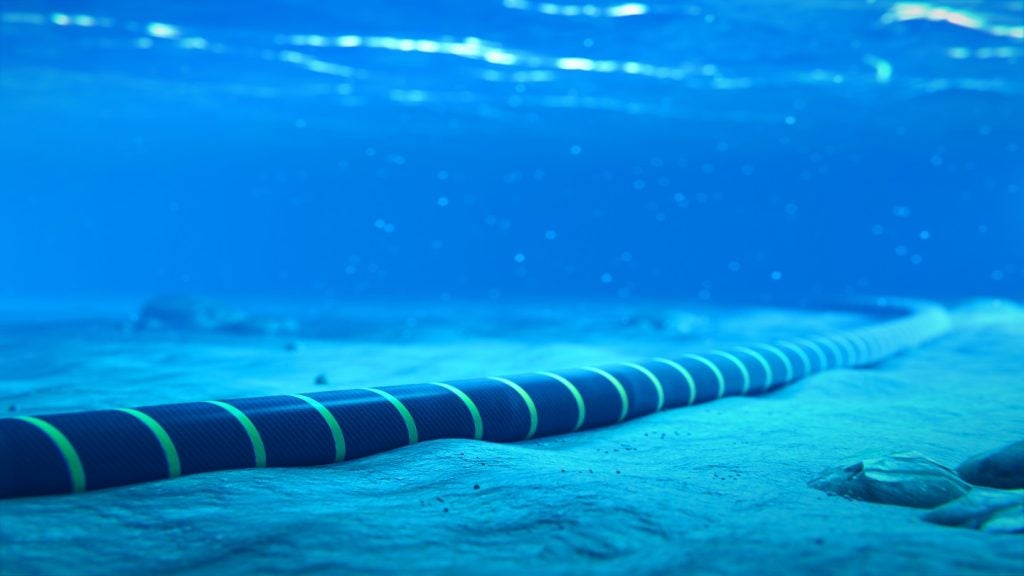

In February 2024, Prysmian secured three substantial cable supply contracts from German transmission system operator Amprion.

The contracts were for Germany's BalWin1 and BalWin2 offshore grid connection systems and the DC34 underground cable project.