Germany’s federal government has acquired a 24.95% stake in TransnetBW, a transmission system operator and subsidiary of EnBW, through its investment and development bank KfW.

EnBW and KfW did not disclose the financial details of the transaction.

The deal’s closure is subject to approval from the relevant antitrust authorities, and is expected in November 2023.

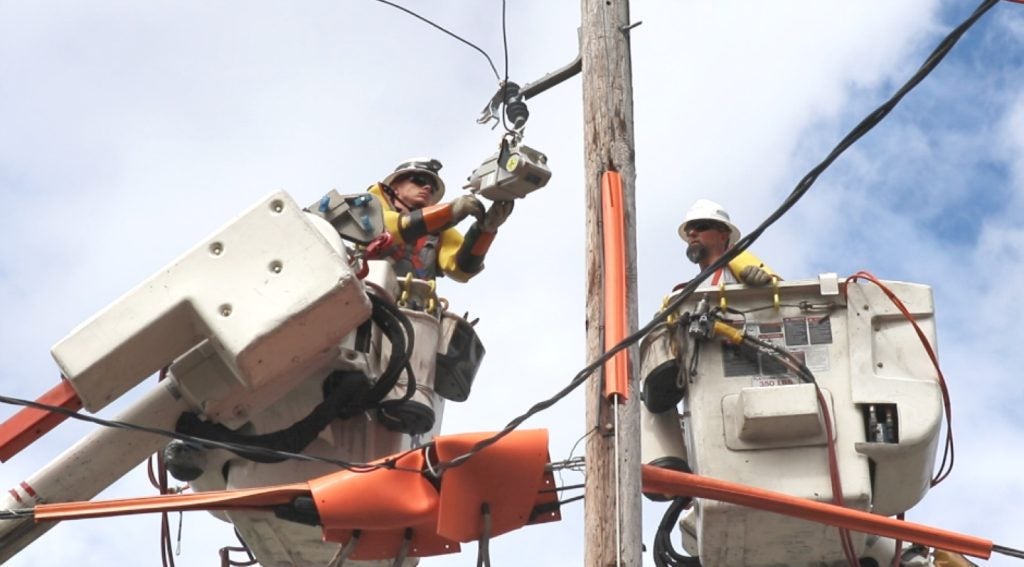

TransnetBW covers a grid area of 34,600km² and serves 11 million Germans in the state of Baden-Württemberg.

The company is building infrastructure for the energy transition, to maintain, optimise and expand the national grid to meet future requirements.

The deal follows in the footsteps of the Südwest Consortium, led by insurance group SV SparkassenVersicherung, which acquired a 24.95% stake in TransnetBW in May 2023 for €1bn ($1.1bn), as reported by Reuters.

KfW's option to acquire a second minority stake of the same size has now been exercised.

With its transaction with KfW, EnBW has completed the partial sale of TransnetBW, which it announced in February 2023. It retains a majority stake in the company.

EnBW chief financial officer Thomas Kusterer stated: “We are delighted to welcome two long-term oriented and reliable co-investors on board at TransnetBW. At the same time, this provides EnBW with additional funding for growth investments to accelerate the implementation of the energy transition in Germany.”

EnBW system critical infrastructure chief operating officer and TransnetBW supervisory board chairman Dirk Güsewell stated: “EnBW has fully embraced its responsibility for the transmission grid from the very beginning of the sale process.

“This is part of our basic philosophy as a reliable and sustainable infrastructure partner for the state, municipalities and our customers. TransnetBW is of outstanding importance for the security of supply in Germany.”

In order to achieve its climate targets by 2030, Germany will need to expand and upgrade its electricity grids with an investment of €600bn ($641.16bn).