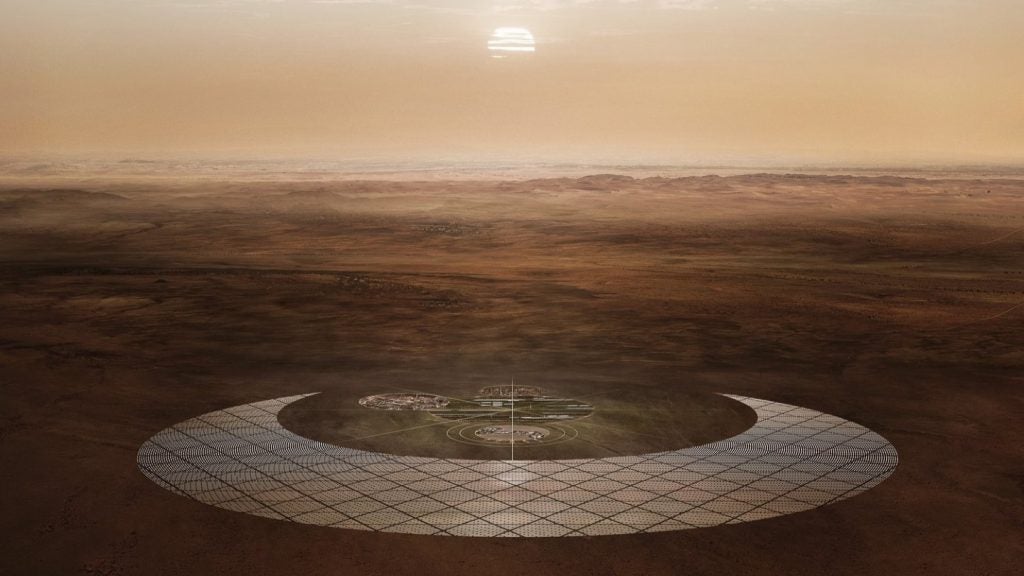

Excelsior Energy Capital, a North American renewables investor, has secured a financing package of $1.3bn for its 683MW Faraday solar project in Utah County.

The ground-mounted solar project was acquired from Parasol and Clenera earlier in 2023.

It is currently under construction and due to begin operations in the third quarter of 2025.

The clean electricity will be supplied to PacifiCorp, which will supply it to Meta as part of the social media giant’s commitment to powering its operations from 100% renewable energy.

Excelsior secured a commitment of $400m in tax equity from US Bancorp Impact Finance through a solar production tax credit (PTC) partnership.

It also secured a loan of $460m, a $300m tax equity bridge loan and $250m in ancillary facilities from MUFG and Nord/LB, which acted as coordinating lead arrangers.

CIBC, DNB, Huntington Bank, the National Bank of Canada, Société Générale, the Sumitomo Mitsui Banking Corporation and Zions Bank acted as joint lead arrangers while Sumitomo Mitsui Trust Bank, Associated Bank and Comerica participated in the financing.

Excelsior mergers and acquisitions head Jason Frooshani stated: “The acquisition and financing of the Faraday transaction was the result of an immensely collaborative effort with Parasol and Clenera, Excelsior’s innovative financing approach, and the efforts of our exceptional team.

“This transaction demonstrates Excelsior’s continued commitment to acquiring superior quality projects from our partners in the renewable energy sector.”

US Bancorp renewable energy investments director Darren Van’t Hof stated: “US Bancorp Impact Finance is thrilled to be a part of such an impactful project. It has created jobs and clean electricity in the state of Utah for generations.

“A project of this size requires an enormous amount of collaboration, and we were pleased to work with a talented group of professionals from the Excelsior team to spearhead it.”

Excelsior is investing in the Faraday project through its first flagship fund, Excelsior Renewable Energy Investment Fund I.

The $504m infrastructure fund focuses on late-stage, middle-market solar, wind and battery storage projects and is the single largest investment by the company, which now has 1.9GW of operating and in-construction projects across ten US states.