Europe has been effective in driving sector trends necessary for the energy transition through strong investment, target setting and policy employment. Prime examples include the ‘Fit for 55’ deal in electric vehicles (EV), the Renewable Energy Directive and European Green Deal in renewable power. Such policies and strategies have instigated governments to set their own strategies to meet or exceed EU targets as a result.

Efforts to source and refine CRMs on European soil need to be a focus

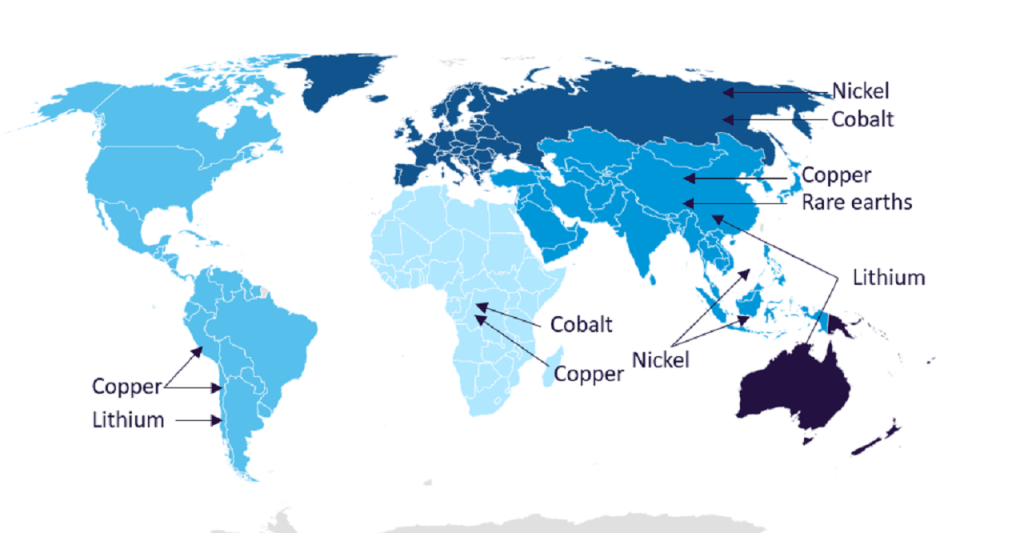

Whilst these are arguably the most crucial sectors to tackle, Europe’s progress in these sectors is heavily reliant on the supply of critical raw materials (CRMs) which are largely sourced and refined abroad over geographically restricted areas. For example, the Democratic Republic of the Congo mines more than 70% of the world’s cobalt, and China is unchallenged in its dominance over rare earth element (REE) production - in addition to its worldwide dominance in processing for a whole suite of CRMs.

Consequently, Europe’s ability to deliver an Energy Transition is potentially vulnerable to geopolitical tensions and supply chain volatility in these regions, not to mention the potential for shortages in these CRMs, which will occur without significant upscaling in mining.

Europe is a leader in the renewable power and electric vehicle rollout, but for how long?

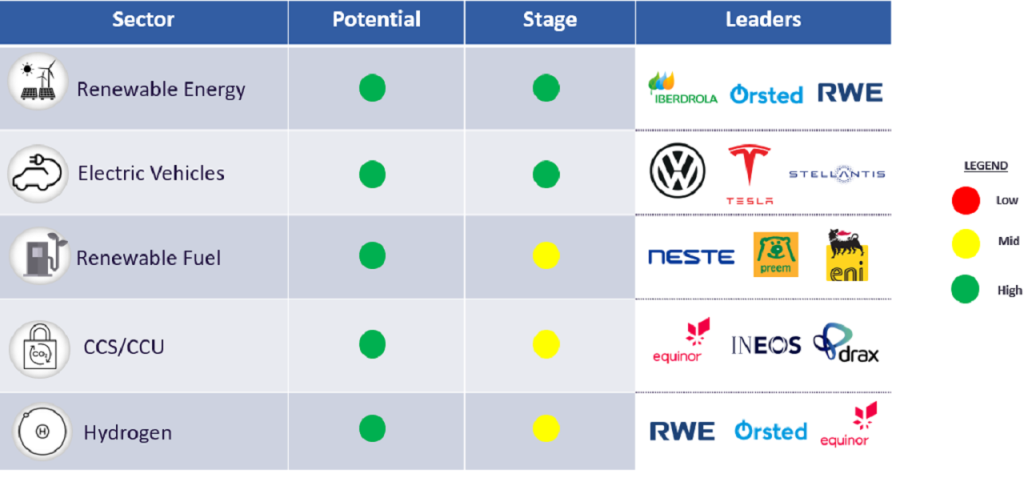

Europe’s accelerated investment towards net-zero targets is predicted by GlobalData to drive continued growth in renewable power generation over the next decade. Still, power generation is Europe’s largest source of emissions despite an 18% reduction in associated emissions being achieved from 2010-2017, as well as a reduction of 10% in overall emissions in the continent.

Strict EU targets have been implemented in line with the UN Paris Agreement and as part of the established campaign, 'Europe Beyond Fossil Fuels'. Incentivisation for renewable energy development, the decommissioning of fossil fuel power plants, and a fall in the cost of renewable power production should continue the increasing renewable power generation share from 51% in 2022 to almost 75% by 2035.

This is expected to largely be achieved by increasing wind and solar generation capacity, the largest players in each being Orsted (wind), and Iberdrola SA (both), with pipeline capacities of over 35GW each.

The other sector in which Europe is leading the way in terms of development is EVs. Strong EU and government targets, funding, and policies have guided the phasing out of internal combustion engine vehicles and resulted in a tripling of EV registrations in 2020 from 2019 (right car registrations).

Lawmakers have endorsed a 55% reduction in automobile emissions by 2030 when compared to 2021. Development of charging infrastructure that facilitates the increase in EVs on roads has been encouraged by subsidies, and major companies are now involved with EV rollout in Europe including Volkswagen, Tesla, and Stellantis.

Can Europe source its own minerals?

Progress in the power and EV sectors demands a need for Lithium, Cobalt, REEs, and other CRMs, thereby increasing the need to upscale the production of these resources within the EU. The slow response by Europe to source and refine such resources locally has only been recognised recently. According to the UK government, as of November 2022, 89% of lithium processing occurred in East Asia, and no lithium refineries existed in Europe.

Recently the UK government provided a £600,000 grant to Green Lithium to open a refinery in Teesside. Considering that lithium is crucial to both the power and EV sectors and is not particularly scarce, more European governments should follow suit. Similarly, the geology of Europe may be favourable for novel sources of cobalt (Horn et al 2021), with a 2018 EU report on cobalt highlighting that existing nickel mines on the continent could provide up to half the cobalt necessary for European lithium-ion battery plants.

Only as recently as March this year, the European Commission released its Critical Raw Materials Act, permitting reduced timeframes for mining projects and setting clear priorities to futureproof Europe’s supply chains. This comes after the US Inflation Reduction Act with similar aims, illustrating the recent trend towards regionalised supply chains as powers recognise the need to escape dependency on China’s mineral monopolies. China’s recent restrictions on its exports in gallium and germanium highlight the risks of such dependency.

Whilst the CRMs Act is a step in the right direction, the timeline for prospecting and setting up an operational mine is around a decade, and in addition to Europe’s reluctancy to harm the environment through mining, it might be too little and too late to meet energy transition demand for CRMs - putting Europe’s strong growth thus far in key energy transition sectors at severe risk.