The sleepy, rustic state of Arkansas in the south-west of the US is not typically considered to be at the cutting edge of technological innovation. However, last week, 'the Bear State' hosted a technological milestone: the opening of the world’s largest carbon dioxide removal (CDR) plant. Graphyte, a start-up backed by Bill Gates’ climate solutions accelerator Breakthrough Energy, opened a factory that turns carbon-rich biomass waste from nearby paper mills into bricks – 'carbon casting' – that can be safely stored underground, thereby removing carbon dioxide (CO₂) from the atmosphere.

By the end of the year, the facility will have captured more than 15,000 tonnes (t) of CO₂. To put that into context, the much-heralded direct air capture (DAC) plants run by Climeworks in Iceland and Heirloom in California, can annually capture 4,000t and 1,000t of CO₂, respectively.

In November, American Airlines became Graphyte’s inaugural customer, with the purchase of 10,000 tons of permanent carbon removal to be delivered in early 2025.

“One of the great strengths of BiCRS [biomass carbon removal and storage] technologies, and our ‘carbon casting’ process more specifically, is the ability to scale really rapidly,” says Hannah Murnen, Graphyte’s chief technology officer. “So we can start having an impact right away, which is key because as a society we are not moving fast enough on carbon removal.”

Indeed, the Intergovernmental Panel on Climate Change estimates that by 2050, an eye-watering ten gigatonnes (Gt) of CO₂ will have to be absorbed from the atmosphere annually across the planet – today, the world removes less than 0.002% of that. Graphyte is another example of the simple but effective BiCRS suite of technologies that have taken the lead in the CDR space – but are they the long-term answer to the carbon surplus?

Carbon casting

Typically, one of the key impediments to carbon removal technologies is the vast quantity of energy required to capture the carbon. Carbon casting, however, leverages nature's tried and tested carbon capture technology: photosynthesis. Instead of focusing on capture, Graphyte aims to preserve the carbon that has already been captured by plants by eliminating the causes of biomass decomposition – microbes and the water they depend on. Drying the biomass eliminates microbes, and impermeable barriers prevent water and gas from restarting the decomposition process.

Graphtye uses byproducts of the timber and agriculture industries that would otherwise be burned or left to decompose. It dries and condenses them into blocks, which are then wrapped in an impermeable barrier. The blocks are stored in underground sites, which are monitored for decomposition with tracers and sensors. The ground above the sites can be used for other useful purposes such as solar farms and agriculture.

The company says it can store roughly 40,000t of CO₂ per acre, and it can precisely measure the carbon sequestered in blocks and how much is released over time. “The polymer materials we are using typically start to degrade at over 2,500-plus years, so we feel confident in saying that the carbon will stay there for at least 1,000 years,” says Murnen.

The company is also building in legal mechanisms to protect the Arkansas site over the long term so that even if Graphyte ceases to exist, the land will be protected and monitored by the US legal system. “We are trying to demonstrate long-term maintenance and care for the carbon, but it is certainly a philosophical question for all carbon removal companies: how do you make sure the carbon stays there long after you are gone?”

One of the big things Graphyte has going for it is its price. Because of the simplicity of the process, the company is already able to charge as little as $100/t of carbon removal – a price mark many academics and experts see as the holy grail that will lead to widespread commercial adoption. This would make Graphyte’s one of the cheapest CDR technologies on the market.

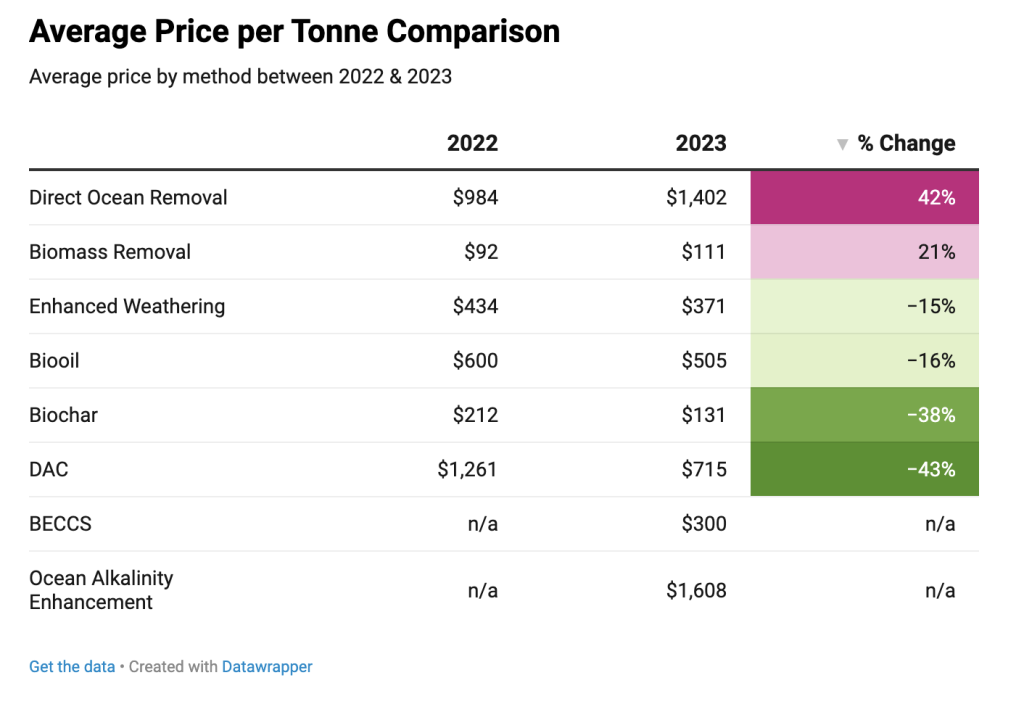

According to market tracker CDR.fyi, ‘biomass removal’ technologies such as Graphyte’s were selling at an average $111/t in 2023. This was cheaper than other BiCRS solutions such as biochar ($131/t), bioenergy with carbon capture and storage or BECCS ($300/t) and bio-oil ($505/t) – although some would argue that BECCS, with its energy first approach, is a step removed from the BiCRS suite. Carbon casting’s price also compares favourably with other, more publicised, CDR approaches such as DAC ($715/t) and enhanced rock weathering ($371/t).

“Generally, the BiCRS processes are pretty scalable because biomass is the input and you are not having to remove CO₂ directly, and the simplicity of our particular project – we are using off-the-shelf equipment – means we are able to very quickly build projects and scale,” says Murnen.

Another thing carbon casting has going for it is its carbon efficiency. Initially, Graphyte will be using natural gas to power the drying of the biomass, which makes the whole process 90% carbon efficient – in other words, the process emits the equivalent of 10% of the CO₂ captured by the plants. However, the company soon intends to replace that gas with renewable electricity, particularly from biomass boilers, which would bring the carbon efficiency up to 98%. “Contrast that with something like DAC, where it takes around eight gigajoules to remove one tonne of CO₂ – we are currently at around a tenth of that,” says Murnen.

Ultra-processed biomass

The path to success for Graphyte, however, is far from guaranteed. There are a number of daunting challenges that the company will have to contend with as it looks to scale up in the coming years. Not least among them is the simple fact that demand for carbon removal is still insufficient for the market to stand on its own two feet. “There are indications that it is getting there; more and more folks are realising the urgency around this and there are newer types of buyers coming into the market – but I think the scale and speed at which they are moving is not yet sufficient,” says Murnen. To reach its 10Gt target, the carbon removal market has just 27 years to become the world’s largest industry by tonnage; by comparison, coal took more than 400 years to hit 8.7Gt of production in 2023.

Graphyte is also not without its competitors. Other companies doing this type of biomass removal, or 'biomass direct storage' as it is sometimes known, include Rewind Earth from Israel, which is looking to sink waste biomass from Turkey in the Black Sea. Boston-based Kodama is being paid by the US Forest Service to cut down bark beetle–killed trees in the Sierra Nevadas in California to bury them in the Nevada desert.

“There are a couple of companies just straight up burying trees – that is probably the simplest way to take biomass carbon and sequester it,” says Rudy Kahsar, manager of the CDR team at the climate think tank RMI. “Then there are some doing a bit more processing to the biomass before they store it, like treating it and storing it in containers. I think Graphyte is doing even more processing – drying is generally a very energy-intensive process. They will also have to compete with the likes of Charm for feedstock.” San Francisco-based Charm Industrial turns agricultural biomass into carbon-rich ‘bio-oil’, which it injects deep underground.

For Kahsar, there are a number of question marks hanging over Graphyte’s offering: when can it stop using natural gas for drying? Does it have enough supply of the biomass feedstock to scale up? Is there any additional use it could get out of the processed bricks, such as for building? “Compared to other woody biomass burial companies, Graphyte’s extra processing is going to make them more expensive,” he says. “So, is there anything they can do to the product to make it more sustainable or economical?”

BECCS, for instance, produces energy as well as carbon removal. Biochar improves the soil health of agricultural land, on top of its primary goal of removing CO₂. Murnen holds, however, that carbon casting is a much more efficient use of biomass. Biochar, she points out, loses 50% of the carbon in the pyrolysis process, and BECCS uses considerable energy to capture carbon from the flue gas stream produced by the combustion of the biomass. From a practical perspective, she adds, biochar involves convincing large numbers of farmers to use it, and considerable trucking logistics; BECCS is very capital-intensive and has specific biomass needs that require sourcing from various locations.

Murnen recognises the cost of the biomass feedstock will increase as competition for the limited resource grows, but Graphyte has factored that into its modelling, she says, and believes its process is cost competitive enough to absorb that price increase.

BiCRS leading the way – for now

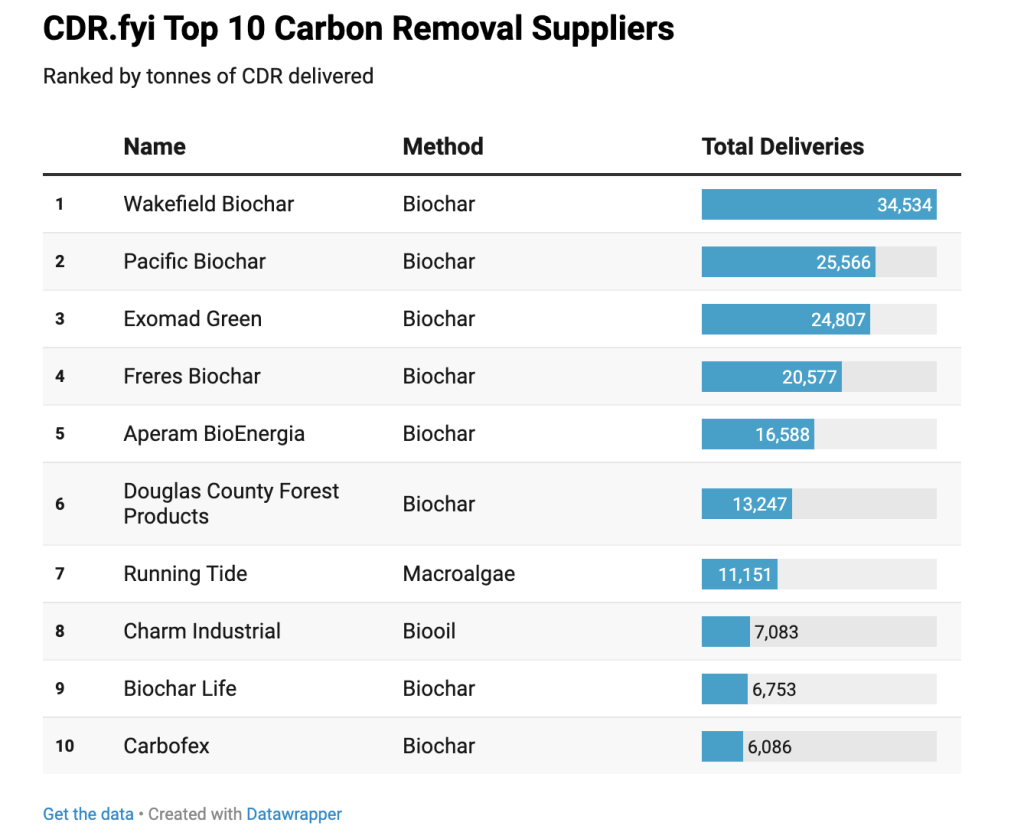

So far, BiCRS carbon removal technologies like carbon casting – those that use biomass from plants or algae to remove CO₂ from the air and then store it permanently, either underground or in long-lived products – have made all the early headway in the carbon removal market. Each of the market’s top ten companies by tonnes of CDR delivered is using a BiCRS technology, with biochar far and away the most prolific approach. The leading company by sales of future CDR deliveries is a BECCS supplier, Danish energy company Ørsted, whose 2.8 billion tonnes sold is almost four-times that of the second placed supplier.

“BiCRs is the low-hanging fruit that we can deploy right now,” says Kahsar. “In the longer term we will need other approaches like DAC and enhanced rock weathering, but they are not ready yet. They will be the really scalable approaches as we approach our net-zero target in 2050, but BiCRS is what we can use in the meantime.”

In the long run, BiCRS’s scalability will be limited by the diminishing availability of biomass feedstock. A 2021 report from the Energy Transitions Commission, a global private-sector coalition, warned that demand for biomass is likely to exceed sustainable supply, pushing industry and policymakers to prioritise bioresources for materials, aviation and niche energy applications.

“All the world’s biomass has already pretty much been allocated by the IEA [International Energy Agency] out to 2050 and that is for energy transition activities, not CDR,” says Kahsar. “And there will be priorities: sustainable aviation doesn’t have too many alternatives to biofuels right now – which is already very controversial from the food-versus-fuel perspective. That will be a real limiting factor on scaling for these biogenic CDR solutions.”

In fact, we are already seeing the negative consequences of the growing competition for biomass. BECCS has regularly found itself at the centre of scandals involving unsustainable practices in the sourcing of its feedstock. In 2019, a decade-long investigation by media, independent watchdogs and NGOs revealed that global demand for wood pellets to burn for biomass energy – primarily in the UK and Europe – was devastating forests in the south-east US. The investigation exposed damaging logging practices used by Enviva – the world’s largest wood pellet manufacturer – to supply wood pellets to the bioenergy industry, including the clearcutting of iconic wetland forests. That involved chopping down vast quantities of native hardwood trees in biodiversity hotspots. Enviva would then ship the pellets from these ravaged forests to utilities overseas such as the UK’s Drax Power Station.

Murnen refutes the comparison, however. Graphyte uses low-value byproducts such as mill residues and rice hulls that are either burned or left to decompose by industry, she says; BECCS plants have specific requirements for the heating value and ash content of their feedstock, making it hard to source sustainably.

“We are biomass-agnostic; we don't care if it's rice, wheat, chips from sawmills, sugarcane bagasse or whatever, we can run it through the same process and store the carbon. We are not cutting down trees, we are taking piles of the stuff that is just sitting around decomposing. In the global timber and agricultural industries, there are byproducts produced with more than three billion tonnes of CO₂ equivalent every year. That should keep us running for a while!”

Back in Arkansas, Graphtye has big and bold ambitions. The company is already expanding its processing line, and hopes to open new sites outside of the Bear State by the end of 2024. By the end of 2025, the company hopes to have the capacity to remove 50,000t of CO₂ from the atmosphere annually. “But demand is the biggest piece of the puzzle,” caveats Murnen. “We need to have buyers for the credits we are producing.”