American Electric Power (AEP) has entered into a strategic partnership with KKR and PSP Investments to sell a 19.9% equity interest in its Ohio and Indiana & Michigan transcos.

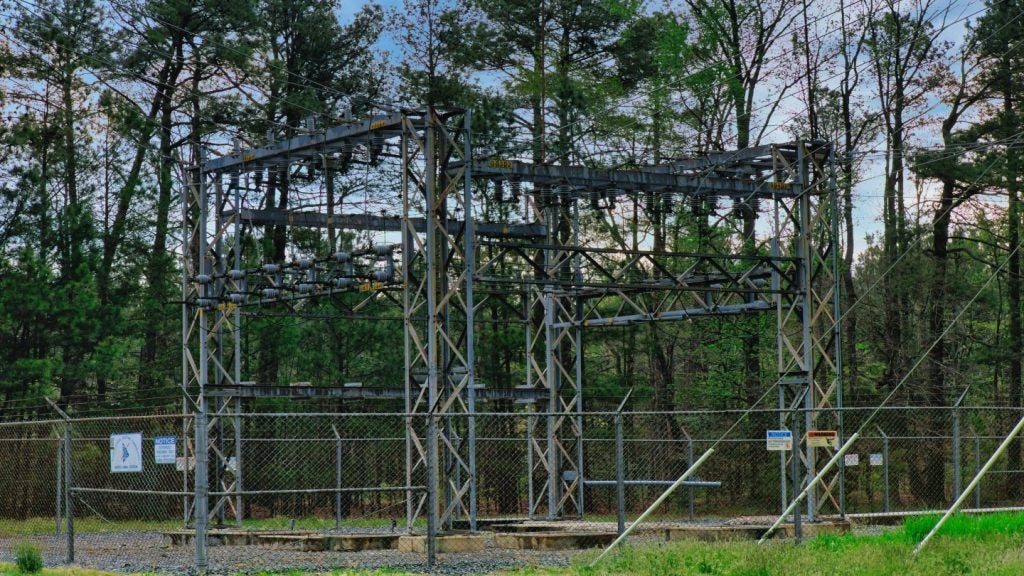

These companies are transmission-only utilities responsible for building, owning and operating transmission infrastructure and are regulated by the Federal Energy Regulatory Commission (FERC).

The transaction, valued at $2.82bn, a multiple of 30.3 times the past 12 months' price-to-earnings ratio, represents a significant premium over AEP’s current stock price.

This minority equity interest accounts for approximately 5% of AEP’s total transmission rate base, allowing the company to finance its growing Midwest business segment efficiently.

AEP plans to use the proceeds to support its five-year, $54bn capital growth plan.

The plan outlines investments in transmission, distribution and generation projects, which are expected to alleviate a significant portion of AEP’s $5.35bn equity financing requirements by 2029.

AEP president and CEO Bill Fehrman said: “Areas such as Ohio and Indiana are experiencing growth that has not been seen for decades. This transaction allows us to address a portion of our capital needs efficiently and at a very attractive valuation, benefitting our customers and supporting economic development in our states.

“We are pleased to launch this strategic partnership with two of the world’s premier global infrastructure investors. KKR and PSP Investments are experienced investors in the utilities and energy space with a proven track record of successful infrastructure investments.

“This transaction allows AEP to maintain a controlling interest in our valuable transmission assets, which we will support through growth and modernisation initiatives.”

The transaction is expected to enhance AEP’s earnings and credit profile upon closing. It will not result in any changes for employees and customers.

AEP’s employees will continue operating and maintaining transcos assets, while states and customers may benefit from increased economic development opportunities.

The transaction is subject to approval from Federal Energy Regulatory Commission and clearance from the Committee on Foreign Investment in the United States, with closing expected in the second half of 2025.

J.P. Morgan Securities is serving as the exclusive financial advisor to AEP, with Morgan Lewis & Bockius providing legal counsel.