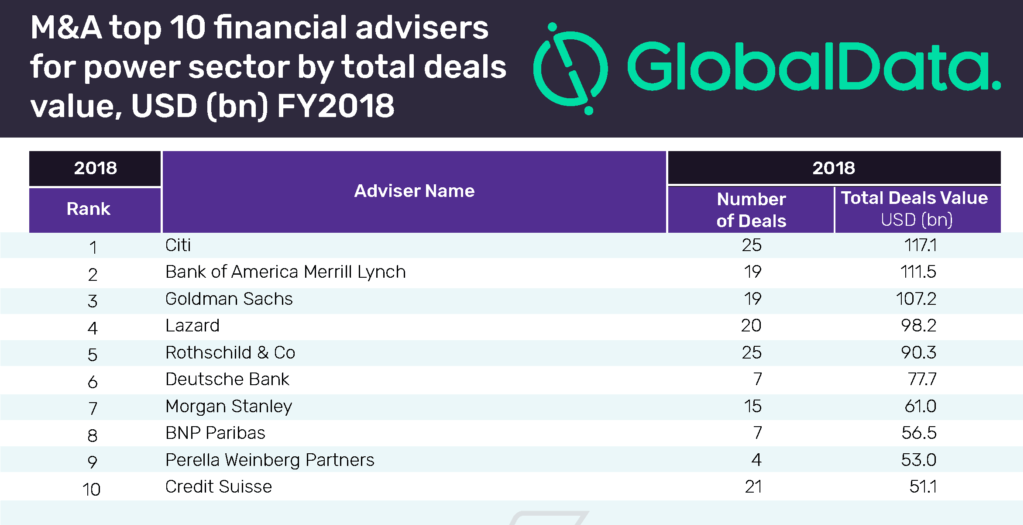

Citi has topped the latest M&A league table of the top ten financial advisers for the power sector based on deal value in FY2018, compiled by GlobalData.

The US bank advised on $117.1bn worth of deals, which included the industry’s top deal by value, E.ON’s acquisition of an 86.2% stake in Innogy for $52.9bn. Citi and Rothschild & Co worked on 25 deals each, the highest in terms of volume.

Bank of America Merrill Lynch and Goldman Sachs are the other two banks featuring among the top three advisers in the list. The two banks advised on 19 deals each, worth $111.5bn and $107.2bn respectively.

GlobalData financial deals analyst Tokala Ravi said: “The top three financial advisers crossed the $100bn deal value mark in 2018. However, none of the legal advisers could achieve this. The top legal adviser Linklaters missed it by ~$2bn.”

The power sector deals saw a slight drop in value in 2018 as against the previous year. The total value dipped by 2.84% to $461.9bn in 2018 from $475.4bn in 2017. The year 2018 recorded three deals more than the 2017’s tally of 2,326.

Citi topped the power league table of M&A financial advisers. It finished fourth in the global league table of top 20 M&A financial advisers released by GlobalData recently. Goldman Sachs topped the global rankings chart, followed by JP Morgan.

UK-based law firm Linklaters came out first in terms of deal value in the top ten legal advisers list. The firm provided legal services to 28 deals worth a combined $97.7bn. Freshfields Bruckhaus Deringer secured the second spot with nine deals, although these were worth a total $69.8bn.

Interestingly, the one big deal of E.ON’s acquisition of 86.2% stake in Innogy for $52.9bn lead to German legal firm Hengeler Mueller and UK-based Robey Warshaw sharing sixth place on the list.

In the global league table of top 20 legal advisers, Linklaters was ranked tenth, while Freshfields Bruckhaus Deringer came in above in ninth position.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain.

A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

The company also seeks submissions through adviser submission forms on GlobalData, which allow both legal and financial advisers to submit their deal details.