The most significant impacts on corporate sustainability strategies globally over the next five years will come from just three strands of climate regulation, a new framework outlines.

GlobalData’s Navigating Climate Regulation framework cites reporting and transparency requirements, carbon pricing and state support for low-carbon industries as the regulatory areas that will most impact businesses. It notes other areas of climate regulation – such as broader environmental policies to do with recycling, product-level standards and building standards – and climate resilience regulations as being less impactful for business strategies.

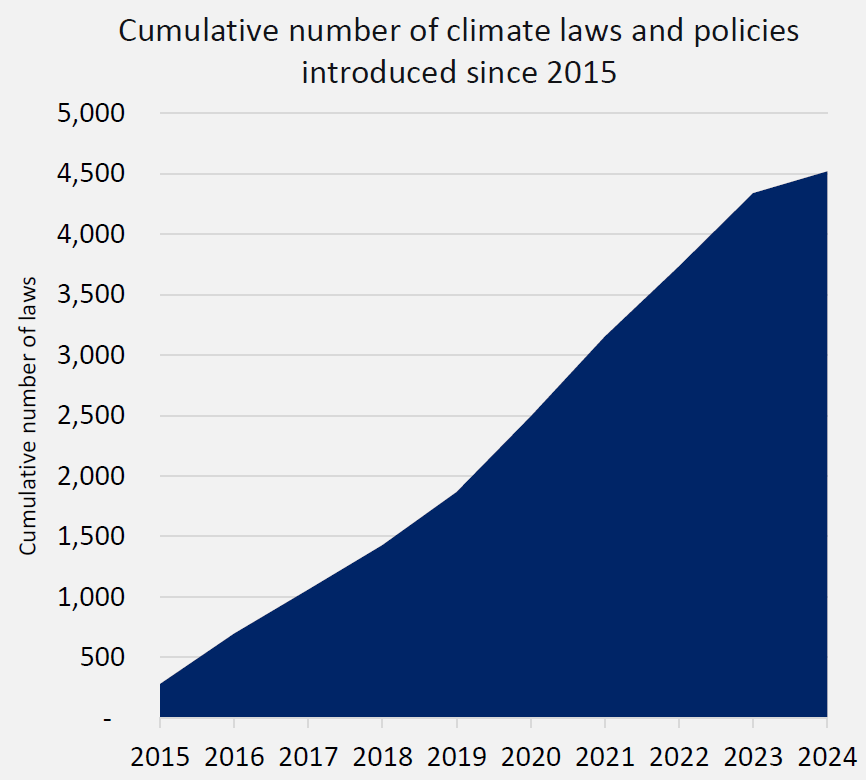

The increasing need for businesses around the world to navigate climate regulation is set against the backdrop of signatories to the 2015 Paris Agreement having set target years for net-zero greenhouse gas emissions. To achieve these targets, the countries have introduced thousands of new laws and policies since 2015.

Reporting and transparency

Reporting and transparency climate regulations comprise the likes of mandatory reporting standards and rules to do with due diligence and anti-greenwashing.

GlobalData details that the sustainability reporting standards produced by the International Financial Reporting Standards (IFRS) Foundation are becoming a global baseline for sustainability reporting. Per the IFRS Foundation, these were developed “to enhance investor-company dialogue so that investors receive decision-useful, globally comparable sustainability-related disclosures that meet their information needs.”

The EU is introducing the most comprehensive reporting and transparency rules but plans to scale them back. Some US states and large economies like China, Japan and India are also introducing reporting requirements, but federal rules in the US will be scrapped.

GlobalData’s framework advises: “Companies can benefit from and adapt to growing greenhouse gas reporting expectations by adopting and embedding sustainability frameworks into their operations, reporting consistently and transparently and aligning with sustainability goals across their value chains.”

Carbon pricing

Examples of carbon pricing regulations include emissions trading systems (ETS), carbon import taxes and carbon taxes.

The framework explains that ETS adoption is growing globally, especially in the EU and China. This spread will directly impact carbon-intensive industries like power, steel, cement and chemicals, with knock-on effects in other industries, and high-emitting companies will therefore need to invest in decarbonisation technologies to mitigate impacts.

“Companies must understand emissions across their value chain to mitigate ETS risk,” GlobalData advises. “Greater ETS coverage means more companies and more aspects of companies’ value chains will have to contend with ETSs.”

Of carbon import taxes, GlobalData’s framework notes that the EU’s planned Carbon Border Adjustment Mechanism (CBAM) will be the world’s first and will complement the bloc’s ETS.

State support for low-carbon industries

Among the areas in which state support is provided for low-carbon industries are fossil fuel phaseouts, subsidies, tax incentives, loans and investments made available and the streamlining of approval for renewable energy projects.

“State support has been instrumental in developing clean energy supply chains and will continue to be a key driver in the future,” the framework says. However, it notes that support will not necessarily remain at the same levels it has always been.

In the EU, the main state support has been delivered as part of the 2019 EU Green Deal. Support there will decline over the next five years, though, meaning less financial support will be available for decarbonisation technologies and projects.

“The focus of EU support will shift away from state financing and subsidies and toward less costly methods such as streamlining planning approval processes for renewable energy projects,” the framework explains.

In the US, the Trump administration will also reduce support for low-carbon industries through halting Inflation Reduction Act (IRA) funding. This will make it more expensive for US companies to decarbonise. Extensive government support has made China a climate tech leader.

Of this, the framework adds: “China will continue to dominate in solar and other clean technologies. This will continue to spur some reactive tariffs and investment from the EU and US and raise the cost of low-carbon technologies for EU and US companies.”