With Donald Trump returning to the White House, the power industry foresees a period of conflict and potential stagnation. A survey revealed stark contrasts between the industry’s hopes for the sector and what can be expected from a Trump-led administration.

The survey, circulated by Power Technology’s parent company GlobalData, to power industry professionals before the 2024 US presidential election, gauged their take on the implications of a new government for the country’s power sector, including expected and desired outcomes.

The sector’s priorities identified in the survey are at odds with Trump’s stance on energy, signalling an uphill battle for the industry as well as the US’s energy transition.

Trump: bad tidings for power

The survey results indicate that Trump’s victory in the 2024 election may have been a bitter pill for the power industry to swallow.

Industry professionals expected the election results to have significant implications for the power sector, with the majority (57.9%) of respondents believing the future of the sector would be heavily influenced by the election results.

Just more than 21% felt that the sector would improve regardless of the election outcome while 10.5% were more pessimistic, claiming the sector would change for the worse regardless of which party wins.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMeanwhile, another 10.5% believed that the sector’s trajectory wouldn’t change.

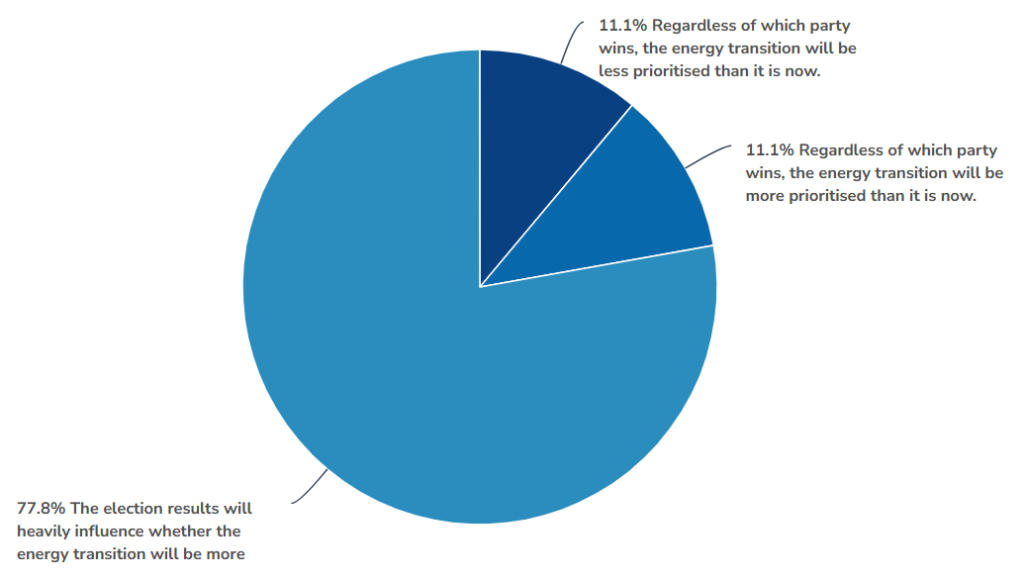

When asked specifically about the energy transition, an even larger majority (77.8%) felt that the election results would be pivotal.

The results reflect industry concerns that under Trump, clean energy initiatives that the power sector has benefited from would be watered down if not completely revoked. Accordingly, the industry also expects the energy transition to slow down, especially given his administration’s previous deregulatory stance and fossil fuel support.

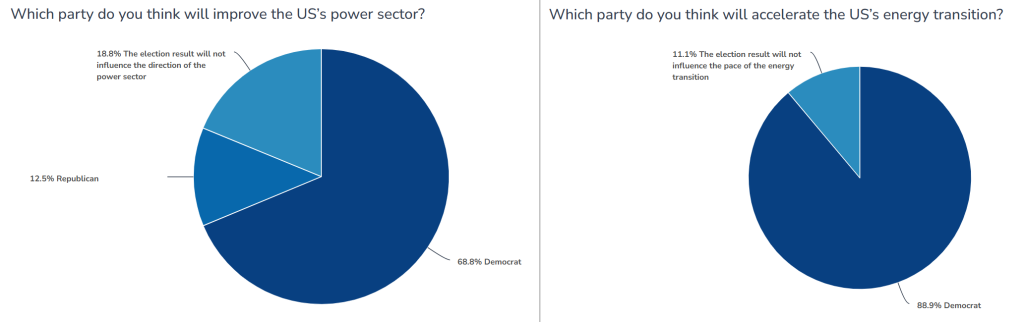

The concerns are further reinforced by only 12.5% of respondents thinking that the Republican party could improve the power sector and 0% seeing the GOP as a force for advancing the transition.

Contrarily, an overwhelming majority of respondents believed that the Democrats would improve both the US’s power sector and transition.

Industry priorities clash with Trump’s agenda

When asked to rank their hopes for the next administration’s priorities around electricity, respondents placed sustainable power at the top (85 points), indicating the industry’s support for low-carbon or clean energy sources to accelerate the transition and fight climate change.

Affordable power came in second (75 points), reflecting concerns over stabilising electricity prices, a pressing issue amid recent market fluctuations.

Tied in last place (72 points) was modern power, making power “smarter” and more resilient through digitalisation, and reliable power, obtaining a reliable and uninterrupted supply of energy.

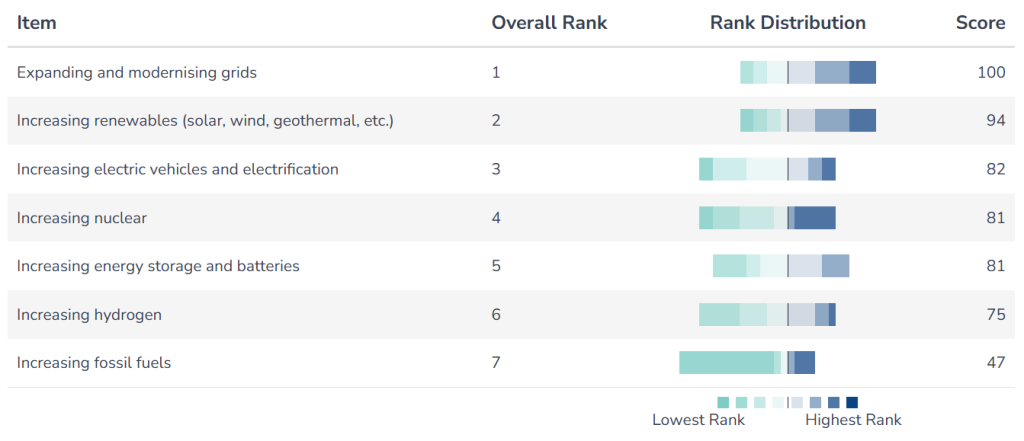

On the power sector’s future direction, the survey underscored the industry’s emphasis on expanding and modernising grids, which received the highest priority ranking (100 points), closely followed by increasing renewables (94 points).

Other areas the industry hoped for further mobilisation were the expansion of electric vehicles and electrification (82 points), nuclear power and energy storage, all of which are seen as vital components of the transition.

Increasing hydrogen ranked second last (75 points), reflecting the industry’s divided view of the energy source while increasing fossil fuels placed at the bottom (47 points).

These results point to likely tensions between federal policy under Trump and industry aspirations.

Trump has made clear his intentions to expand fossil fuel operations in the US, citing their necessity in securing a reliable supply of energy – which industry respondents considered least important in ranking priorities – and lowering costs for consumers – the second-ranked priority.

His vocal opposition to clean energy initiatives rolled out under the Biden administration also does not align with the industry’s preference for sustainability and increasing renewables.

Strife looms over hydrocarbons, renewables and hydrogen

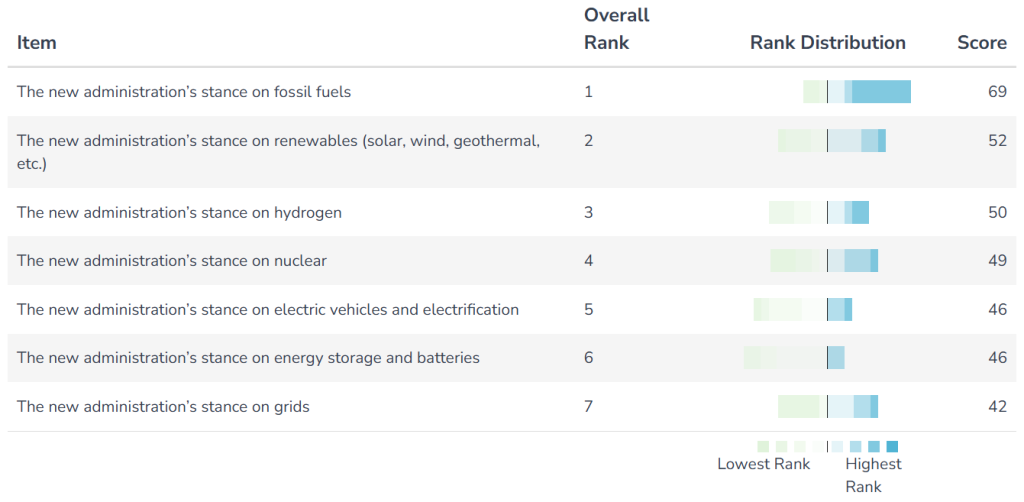

Unsurprisingly, the industry expects fossil fuels (69 points) to become the most contentious issue under the next administration. Trump’s pro-hydrocarbons stance will likely face opposition from environmental groups and industry members hoping for a shift toward cleaner energy.

Respondents also identified renewables (52 points) and hydrogen (50 points) as areas of likely conflict.

Despite their growing role in the US energy mix, renewables could face slower expansion under Trump, who has not shied away from declaring his distaste, especially for wind power. At the same time, renewables have spurred billions in investments and thousands of jobs across the country, the majority of which benefitted Republican-led states. Therefore, their expansion may receive bipartisan support after all.

Meanwhile, hydrogen has been a unique source of controversy not just between political parties but also within.

Just as the final rules of the US hydrogen tax credit sparked controversy this month, advocates see the potential of all types of hydrogen to boost low-carbon energy production while critics believe any praise for hydrogen apart from green would serve as an incentive for carbon-emitting energy production to continue.