Powin, a provider of energy storage solutions, has secured a revolving credit facility of up to $200m, primarily from insurance accounts managed by investment company KKR.

This funding is set to bolster Powin’s working capital needs and drive innovation while enhancing its financial flexibility during a period of expansion in the storage industry.

The facility aims to address market demand and strengthen Powin’s position in the global energy storage sector.

The liquidity package indicates investor confidence in Powin’s plans and growth potential.

Given the expansion of the energy storage market, this funding will help Powin respond to increasing demand.

Powin CEO Jeff Waters said: “We are excited to have KKR, a renowned leader in the investment community, supporting our mission to be the most trusted energy storage partner in the industry.

“This facility enables us to accelerate our expansion, drive innovation, and maximise value for our customers, reinforcing our commitment to advancing a sustainable energy future.”

Equity investors in Powin include Greenbelt Capital Partners, Trilantic, and Energy Impact Partners.

Guggenheim Securities, a global investment and advisory company, played a crucial role as Powin’s financial advisor.

Its expertise was pivotal in facilitating the successful completion of this capital raise, demonstrating the value of strategic financial partnerships in the energy sector’s growth and innovation efforts.

KKR director Sam Mencoff said: “Powin stands out as a leader and innovator in the clean energy space. We are proud to support them and their efforts to expand the use of battery energy storage systems through our deep experience in asset-based finance.”

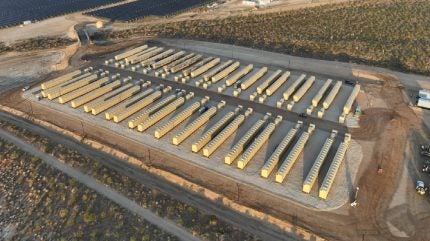

Last month, Powin collaborated with BHE Renewables to create one of the largest solar and storage microgrids in the US.