Despite accusations of greenwashing, carbon capture, utilisation and storage (CCUS, or CCS for carbon capture and storage) is emerging as a key technology in the global energy transition.

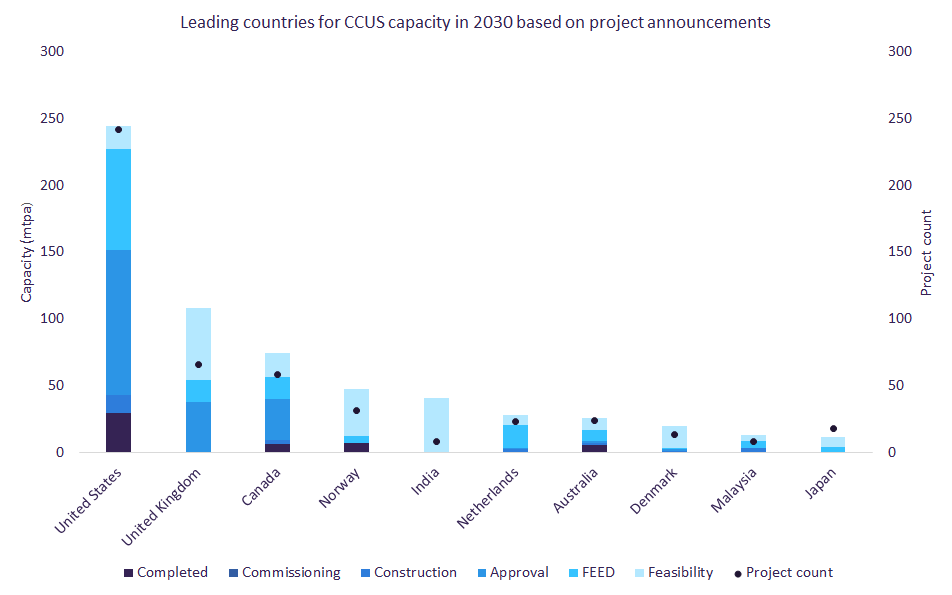

According to Power Technology’s parent company GlobalData’s CCUS Market Outlook and Trends H1 2025 report, global CCUS capacity could reach 735 million tonnes per annum (mtpa) by 2030, based on active and announced projects as of February 2025.

While 57 countries are expected to contribute to this figure, ten countries will be responsible for meeting more than 80%.

Here are the top ten countries set to lead the CCUS revolution by the end of the decade, ranked by projected combined annual capture and storage (active and pipeline) capacity, with additional insights from GlobalData senior energy transition analyst Francesca Gregory.

10. Japan

Japan rounds out the list with a total expected CCUS capacity of 11.52mtpa by 2030 from 21 projects.

Although still early in its development phase, with only 420,000 tonnes per annum (tpa) to be completed and the remaining in the feasibility and front-end engineering design (FEED) stages, Japan’s forward-looking CCUS policy landscape has provided the industry with strong groundwork.

The Japanese Government established its CCS Long-Term Roadmap in 2023, aiming to secure 6–12mtpa of CCUS capacity by 2030 and 120–140mtpa by 2050. In fiscal year 2023 (FY23), the government spent $22.7m (Y3.38bn) to support this plan, starting with 3–5 projects. In FY24, it has selected a further nine projects to receive funding.

It plans to invest around $26bn over the next ten years to aid in developing advanced CCUS value chains.

In addition, as part of the Green Innovation Fund, the government has set aside up to $247.8m to develop carbon separation and capture technologies to lower CO₂ concentration waste streams from natural gas-fired power plants and factories.

9. Malaysia

Malaysia is expected to have a total of 13.3mtpa in active and pipeline capacity across nine projects. Some 3.3mtpa will be under construction by the end of the decade, 5mtpa in the feasibility stage and 5mtpa in FEED.

As part of its 2022 National Energy Transition Roadmap, the Malaysian Government has targeted the development of three CCUS hubs and total storage capacity of up to 15mtpa by 2030. It aims to develop a further three CCUS hubs for a storage capacity of 40–80mtpa by 2050.

The government has also implemented tax and trade incentives for CCUS activities. Companies undertaking domestic CCUS activity are exempted from the investment tax allowance for ten years, immune to full import duty and sales taxes on CCUS-related equipment from 2023 to 2027 and can benefit from tax deductions for pre-commencement expenses within five years from the start of operations.

Companies undertaking CCUS services may also benefit from similar incentives, as well as a 70% income tax reduction for ten years.

8. Denmark

Denmark is forecast to have 19.54mtpa in CCUS capacity from 13 projects by 2030, with 16.18mtpa in feasibility and the remaining spread across FEED, approval and construction stages.

Despite having no completed or commissioned projects by the end of the decade, Denmark’s projects are expected to progress steadily, benefitting from both domestic and EU-level support for the industry.

The Danish Government has a target of distributing €5bn (Dkr35.5bn) to store an estimated 3.2mtpa of CO₂ from 2030 through CCS projects.

In March 2023, the European Commission (EC) introduced the Net Zero Industry Act, which identified CCUS as one of the eight critical technologies for reaching the EU’s climate goals. Under this framework, the EU required the establishment of a “one stop shop” in each member state to coordinate permitting of CCUS projects and an obligation for EU oil and gas producers to invest collectively in CO₂ storage capacities.

Last year, the EU broadened the scope of activities covered under its Emissions Trading System (ETS) to include all means of CO₂ transport instead of just CO₂ pipelines.

The EU Industrial Carbon Management Strategy outlines plans to increase the deployment of CO₂ transport infrastructure, investment in potential CO₂ storage sites and bolster research and development (R&D) in the field through various funding schemes.

Between 2007 and 2023, the EC invested more than €540m in innovative CCS solutions through its Horizon Europe scheme. The Innovation Fund, funded by revenues from the EU ETS, has provided support to 26 large and small-scale CCUS projects worth more than €3.3bn in grants as of February 2024.

7. Australia

Australia has a total expected capacity of 25.37mtpa from 30 projects by 2030 – 5.7mtpa to be completed and the rest in development. Its abundant CCUS incentives have successfully encouraged growth in the space.

In its 2021–22 federal budget, the Australian Government set aside A$263.7m ($167.17m) to support the development of CCUS projects and hubs. In its 2022–23 budget, it announced A$300m to support low-emissions liquefied natural gas and clean hydrogen production in Darwin, together with CCS infrastructure, due to its excellent onshore and offshore natural gas and greenhouse gas storage resources. Meanwhile, Western Australia’s (WA) Government plans to invest more than A$4m to accelerate deployment of CCUS technologies in WA.

The country’s 2021 CCUS Development Fund provides grants of up to A$25m for Commonwealth bodies engaging in CCUS technologies in Australia, while through the 2024 Carbon Capture Tech Programme, the government is investing A$65m in seven projects that will utilise CCUS to decarbonise hard-to-abate sectors.

The Australian Carbon Credit Unit (ACCU) scheme of 2011 allows companies to earn ACCUs for each tonne of carbon stored or avoided, which can then be sold for revenue.

6. The Netherlands

The Netherlands is forecast to reach 27.69mtpa in active and pipeline CCUS capacity across 26 projects by 2030, with the bulk (17.18mtpa) in the FEED stage and a modest 110,000tpa completed.

Like Denmark, the Netherlands has made great strides thanks to the EU’s comprehensive CCUS policies and generous funding opportunities.

On the domestic front, the country announced in 2023 a budget of €8m ($8.4m) for CCS, aiming to realise up to 4mtpa of CO₂ savings by 2030.

Europe’s overall capture capacity is second only to the US. Europe is set to achieve a maximum capture capacity of 103mtpa by 2030, following the US’ 152mtpa.

5. India

India is emerging as a significant player in CCUS, with a planned capacity of 40.71mtpa across just ten projects by 2030. While the vast majority (40.7mtpa) will still be in the feasibility stage, and 10,000tpa to be completed, the projections demonstrate great potential for the country.

The Cambay storage project – led by Synergia Energy, the current leading CCUS developer in the world – is expected to be one of the largest contributors to India’s carbon capture efforts.

In 2024, India’s planning commission proposed a CCUS policy involving industry clusters, employment generation and financial incentives to reach 750mtpa in CCUS capacity by 2050.

However, concerns have emerged over the viability of achieving this goal due to the country’s relatively limited technical expertise in the field and lack of government support. India will require investment of $100 (Rs8.71trn)–150bn through 2050 to achieve its target.

4. Norway

Norway is a heavyweight in CCUS, with an anticipated 47.74mtpa from 39 projects. With 6.7mtpa projected to be completed by 2030 and the remaining 35.2mtpa scattered across development stages, Norway is well on its way to cementing its role as a leader in Europe’s CCUS efforts.

Although in fourth place for combined capture and storage capacity, Norway holds the second-highest number of carbon storage projects globally behind the US.

Alongside Denmark and the Netherlands, Norway too has benefitted from the EU’s mature CCUS policy landscape and financial incentives.

Most notably, Norway is home to the Northern Lights CO₂ Storage Project, the world’s first cross-border CO₂ transport and storage facility. The project – a joint venture between Shell, Equinor and TotalEnergies – will see various countries including Denmark, Belgium, the Netherlands and Sweden transporting CO₂ to be sequestered in Norway’s storage facility in Øygarden, near Bergen.

The Norwegian Government has provided $2.3bn (Nkr25.57bn) for the project, which is expected to have a capture capacity of 5mtpa and storage capacity of 1.5mtpa.

3. Canada

As an early adopter of the technology, Canada trailblazes to the top of the rankings with 74.49mtpa of forecasted CCUS capacity from 62 projects. A total of 30.46mtpa is set to gain approval by the end of the decade, 18.12mtpa in feasibility, 16.47mtpa in FEED, 3.54mtpa being constructed and 5.9mtpa to be completed.

“Canada is a long-standing supporter of both CCUS and blue hydrogen as a means of delivering a low-carbon economic transition and capitalising on its oil and gas knowledge,” says Gregory.

She adds: “The country’s leadership with carbon pricing has provided a solid foundation for the development of its CCUS sector, with provinces such as Alberta introducing a carbon pricing mechanism as early as 2007.

“The province has since emerged as a hub for CCUS activity, alone accounting for over 30 upcoming projects.”

Canada’s CCUS journey is supported by robust financial incentives. In its 2023 federal budget, Canada committed C$83bn ($58.09bn) towards the decarbonisation of its economy, including the development of CCUS projects. The country has also pledged $319m to support R&D for different carbon management pathways, also involving CCUS techniques.

“However, despite this support, the number of active projects remains relatively low, suggesting that further support may be needed to close the investment gap,” Gregory notes.

2. The UK

The UK is a dominant force in the CCUS landscape, with 107.93mtpa planned across 75 projects. Its active and pipeline capacity by 2030 consists of 53.9mtpa in feasibility, 37.39mtpa approved, 16.6mtpa in FEED and 0.04mtpa completed.

The UK’s CCUS ecosystem is one of the most advanced in the world, with projects like the Drax BECCS (bioenergy with carbon capture and storage) power plant in North Yorkshire and Sumitomo Bacton Hydrogen Hub CCS project in Norfolk among the largest globally.

“The UK continues to make CCUS an integral part of its industrial decarbonisation and broader climate strategy,” Gregory says.

In 2023, the UK Government committed £20bn ($25.33bn) to scale up CCS projects across the country. Confidence in the sector was further bolstered – albeit not without scepticism – in 2024, when the government announced that around £22bn in funding would be made available over 25 years to CCUS projects across the country’s first two clusters.

“Although it was later confirmed that just three projects within the clusters would receive the funding, the UK still holds a strong pipeline of projects that have been facilitated by the cluster framework, with over 50 projects aiming to come online on or before 2030,” Gregory explains.

The UK ranked second, just behind the US, for CCUS-related deals in 2024.

1. The US

The US takes the top spot with a staggering 244.77mtpa of expected capacity across 266 projects. By 2030, the CCUS giant will have 108.79mtpa approved, 75.39mtpa in FEED, 17.15mtpa in feasibility, 13.61mtpa being constructed and 29.83mtpa completed.

The US is home to most of the largest upcoming CCUS projects in the world, such as the Prairie State Energy Power Plant CCS Project in Illinois and the ExxonMobil Baytown Refinery CCS Project in Texas.

Future projections aside, “the country leads current global active capacity by a strong margin, although this is chiefly a product of two large-scale pre-combustion captures projects used within natural gas processing”, Gregory explains.

The nation’s well-established policy frameworks and strong financial incentives have “played a key role in bolstering the business case for CCUS adoption”, she says.

The Inflation Reduction Act (IRA) of 2022 and the Infrastructure Investment and Jobs Act (IIJA) of 2021 – the Biden-Harris administration’s cornerstone climate laws – have been especially valuable. The IRA extended and increased the 45Q tax credit, improving benefits for CCS activities; companies are now eligible for $60–85/ton (t) of CO₂, or $130–180/t in the case of direct air capture (DAC).

The IIJA allocated more than $12bn to CCS initiatives over five years, including a DAC technology competition that offered $100m to innovative commercial solutions, and financed $3.5bn for regional DAC hubs across the country. The act also provided $2.1bn in low-interest loans for shared CO₂ transport infrastructure and $310m for state and local governments to procure and use products that are derived from captured carbon.

President Donald Trump’s return to office this year has raised alarm around the future of the nation’s industry. But “despite recently experiencing a dramatic shift in its energy policy”, Gregory believes “the US will remain the pre-eminent player for CCUS”.

“Although Trump has been critical of much of the clean-tech spending rolled out under the previous administration, CCUS has largely been omitted from the conversation, decreasing the likelihood of a future attempt to dilute or repeal the credit,” she elaborates.