Mineral demands from clean energy technologies increased from 4.6 million tonnes (mt) in 2010 to 7.1mt in 2020, according to the International Energy Agency (IEA), representing a compound annual growth rate (CAGR) of 4.3% over the period. Even more significant growth is expected over the coming decades, with mineral demand projected to reach 12.2mt in 2030 and 15mt by 2040.

Due to its energy-dense properties, lithium is arguably one of the most-at-risk materials over the long term. It is used in electric vehicles and battery storage technologies, both of which are expected to triple by 2030.

Silicon, on the other hand, represents a “medium-to-low risk” of demand exceeding supply during the energy transition, according to GlobalData’s report Critical Raw Materials Shaping the Energy Transition, published in June. Nevertheless, an international effort to maintain and secure the supply of silicon is still needed due to its importance in the hydrogen and solar industries.

Cobalt, nickel, graphite and copper all have “medium-to-high level of risk” related to the future supply in the energy transition because all of these materials are used in large quantities in wind and solar power, electricity grids and energy storage, the report notes.

Lithium: the most-at-risk material

Lithium is very difficult to substitute, making it “the energy transition’s most volatile critical mineral”, according to GlobalData, Power Technology’s parent company. GlobalData expects lithium production to register a CAGR increase of 14% between 2024 and 2030, with supply set to reach 500 kilotonnes (kt) by 2030.

However, the global supply of lithium needed for energy transition technologies must reach 530 kilotonnes, under the IEA’s revised 2030 scenario, which aims to limit global temperature rise to 1.5°C. The International Lithium Association (ILA) has even higher estimates, projecting a massive 4,000kt of lithium will be needed in 2035.

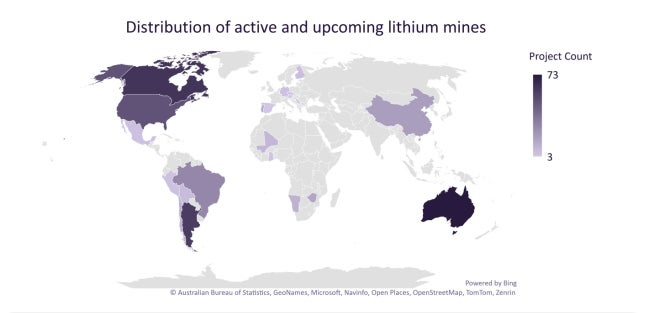

Despite lithium production almost doubling between 2019 (90.7kt) and 2023 (170.8kt), it is still at a “high risk” of supply chain issues. Australia currently leads the global production of lithium, registering a production capacity of 77.6kt in 2023. The nation also has the highest number of active lithium mines. Chile and China were the second and third-largest producers of lithium globally in 2023, registering 42.7kt and 18kt, respectively.

Map showing distribution of active and upcoming lithium mines. Credit: GlobalData – Critical Raw Materials Shaping the Energy Transition.

Lithium refining is heavily dominated by China, which accounts for 57% of global capacity. Chile is second with 15% and Argentina is third with 13%.

What is being done to meet rising lithium demand?

Significant shifts in lithium’s production landscape are expected by 2030, as countries rapidly build their lithium supply pipeline.

Argentina is expected to increase its lithium output from 16kt in 2023 to 81.2kt in 2030, overtaking both Chile and China to become the second-biggest lithium-producing country. Argentina has a strong lithium mining pipeline, comprising 43 projects. Although the bulk of these are in the exploration stage, three new Argentinian lithium mines – Salar del Hombre Muerto, Cauchari Olaroz and Salar de Centenario Ratones Project – are due to start producing in 2024. All three of these are expected to be among the top ten producing projects by 2030.

Australia is expected to remain the leading lithium producer, with its production doubling to 155.5kt by 2030.

For the industry to ensure lithium supply can reach expected demand, the ILA contends that 74 new mines, equivalent to 45,000 tonnes of capacity, need to be opened before 2035. Companies have identified this issue and have begun ramping up production.

Sociedad Quimica y Minera de Chile SA, the world’s biggest lithium producer, recently announced an agreement with Chilean mining company Codelco.

The government-backed partnership aims to produce an additional 300kt of lithium carbonate equivalent (LCE) in the period from 2025 to 2030 and to up annual production to 280–300kt per annum between 2031 and 2060.

New Australian projects will also contribute, including Pilbara Minerals’ Pilgangoora P1000 expansion, coming online in 2025, and Global Lithium Resources’ Manna Lithium in 2026.

An increase in production capabilities will not be enough for lithium supply to keep up with demand throughout the energy transition.

“Although a broad and diverse geography of supply will help to counter some of this volatility, alternative routes to production such as direct lithium extraction (DLE) as well as battery recycling will be key to reliably meeting increasing demand in the longer term,” says Francesca Gregory, senior energy transition analyst at GlobalData.

According to the ILA, DLE technologies allow companies to extract lithium from deposits that were previously difficult or too costly to reach with traditional technologies.

Silicon: shining a light on mineral needs of the energy transition

While silicon remains a material of high importance in the energy transition, it only registers a “low-to-medium” risk of experiencing supply chain issues.

Silicon, used as a semiconductor in solar PV cells, is present in 95% of all solar modules sold, according to the US Department of Energy.

The increased global rollout of solar PV, which GlobalData forecasts will grow at an 8.8% CAGR between 2023 and 2035, will continue to drive silicon demand. IEA projects that it will reach 452kt by 2030, a 16% increase from 2020 levels.

“Although, silicon currently presents a medium-low risk in terms of its supply chain, the surge in demand for solar PV modules will inevitably add pressure to supplies,” says Gregory.

“Silicon is by no means rare and is the second most abundant element. Silicon also tends to have shorter lead times in terms of mine development allowing mine owners to scale their supplies relatively quickly,” she adds.

China currently dominates the mining and processing of silicon. The country also remains the leading manufacturer of solar modules, with solar exports totalling $30bn (214.73bn yuan) annually and representing almost 7% of China’s trade surplus between 2016 and 2021.

However, the US currently bans the sourcing of silicon from China due to human rights concerns in its Xingjiang region, where silicon is predominantly sourced.

Issues such as these have opened a wider discussion on silicon resourcing and a reassessment of solar supply chains.

Can silicon supply chains be diversified efficiently?

In 2018, the Trump Administration introduced a 30% tariff on all Chinese solar imports to remove Chinese dominance of the solar market.

The Biden Administration kept this tariff in place and recently pledged $400m to the support domestically produced silicon wafers. The US Department of Commerce and GlobalWafers America’s agreement envisions the development of two 300mm silicon wafer manufacturing facilities in Texas and Missouri, together creating 2,000 jobs.

The Government in Australia is also planning to establish a new silicon supply chain to develop domestic solar modules, after a report identified a need to increase capacity by 10–12 times to meet the demand of the energy transition.

The country has also launched the Solar Sunshot programme, pledging almost $660m (A$1bn) in production subsides and grants to capture more of the global solar manufacturing supply chain.

Australia has the highest uptake of rooftop solar in the world but only uses 1% of its domestic produce, with Prime Minister Anthony Albanese pledging that “Australia should not be the last link in a global supply chain built on an Australian invention”.

As Australia has limited research and development activity in silicon production, it may take time to develop its own supply chain, but the country may be able to leverage capabilities from other metal industries.

Onshoring lithium and silicon supply chains

While lithium and silicon have differing market needs and risk profiles attached to them, a diversification of supply chains is essential for both materials to keep up with the demand of the energy transition. For lithium, where demand is outpacing supply, new supply chains are essential to increase stockpiles of supply to cater for rising demand. Diversifying silicon supply chains allows countries to move away from unsustainable and potentially unethical supply routes, subsequently creating their own value chain.