With the global demand for renewable energy showing no signs of abating, the fossil fuel industry needs to adapt to a new world energy order.

Investing in renewable energy sources, such as wind and solar, is one approach, while developing technologies such as hydrogen will have their part to play over the next few decades.

But, what role will renewable fuels – such as biodiesel and bioethanol – play in energy production and usage, and how can the oil and gas industry adapt them into their businesses to maintain market share and profits?

Renewable fuels have gained in popularity due to their sustainability, low contributions to the carbon cycle, and in some cases lower amounts of greenhouse gases. The geo-political ramifications of these fuels are also of interest, particularly to industrialised economies, such as the US, which are seeking independence from Middle Eastern oil.

Renewable fuel gaining importance

According to November 2024 research from GlobalData, Power Technology’s parent company, renewable diesel production in particular continues to gain in importance globally, being less carbon intensive, provides superior performance in cold conditions, and can be stored much longer when compared to petroleum diesel.

The report, Renewable Diesel Production Capacity Analysis by Region, Refinery Type, Top Countries, Companies and Forecast to 2030, estimates that renewable diesel production capacity is expected to witness substantial growth during the period 2020 to 2030, potentially increasing from 2,914 million gallons per annum in 2020 to 9,407 million gallons per annum in 2030.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNorth America leads with the highest renewable production capacity of 1,767 million gallons per annum from upcoming (planned and announced) projects in 2030. Renewable standalone refineries are likely to account for about half of the region’s production capacity, followed by coprocessing facilitates with 38%.

A representative from Finland’s Neste, which describes itself as one of the world’s leading producer of sustainable fuels and renewable feedstock solutions, said “mitigating climate change requires a diverse range of solutions to reduce emissions, and renewable fuels play a central role in that equation.”

Neste has continued to expand its production capacity globally which today is at 5.5 million tons of renewables annually, and is set to increase to 6.8 million tons in 2026.

“For the biofuels sector to continue to grow and support the green transition, political decision makers should ensure fair competition and a level playing field in each region,” added the company, as this will “support competitiveness and long-term commercial viability of the biofuels producers against growing global competition.”

The UK makes its move

A UK government report from 2022 found that 1,141 million litres equivalent of renewable fuel had been supplied to the UK market up to that point for the year, constituting 6% of total road and non-road mobile machinery fuel. Moreover, 8% of all verified renewable fuel supplied to the UK in this one-year period was produced from UK origin feedstock.

Of the 400 million litres of renewable fuel verified in the first half of 2022, biodiesel comprised 47% of the supply, and bioethanol 41%, said the report, with verified renewable fuels achieving an average greenhouse gas saving of 82%.

Waste feedstocks made up 65% of verified renewable fuel, and 93% of biodiesel was produced from used cooking oil. Finally, 66% of bioethanol was produced from corn.

And, back in October 2023, FedEx Express Europe began trialling hydrotreated vegetable oil (HVO) renewable diesel to fuel five of its company-owned trucks in the UK. The move to “synthetically made diesel offers an interim solution with the promising ability to drive down ‘well-to-wheel’ carbon emissions by as much as 80-90% per litre,” said the company at the time.

Looking globally, in August 2024, TotalEnergies announced that its maritime arm had supplied its first B100 biofuel – pure biodiesel – bunker to Singapore.

Louise Tricoire, senior vice-president of aviation and marine fuels, said her company would “continue to innovate and find sustainable low-carbon solutions for the shipping industry, which is navigating fast-changing market and regulatory conditions.”

Integrating biofuels and fossil fuels

Preem, a Swedish petroleum and biofuel company, told Power Technology‘s sister publication Offshore Technology that Fit for 55 – a package of proposals aimed at reducing the EU’s fossil emissions by 55% by 2030 – will “increasingly impact demand and price levels in the fuel market, driving the transition from fossil-based to renewable fuels.”

The company has already retrofitted an existing hydrotreater unit to be able to co-process from 40% renewable feedstock.

Notably, added Preem, road transport will be included in the EU’s new emissions trading system, ETS2, set to take effect in 2027, with the “implementation of ETS2, the cost of emissions for fossil diesel will rise, gradually improving the relative competitiveness of renewable fuels.”

“Our current assessment of the regulatory landscape suggests that price parity between fossil and renewable products could be achieved sometime in the first half of the 2030s,” said Preem. “Renewable fuels, alongside electrification, play a pivotal role in enabling the transport sector to reduce fossil carbon emissions cost-effectively.”

Strategies and market sectors

And GlobalData research from 2022, which looked at the wider renewable fuels market, revealed that the most commonly used and produced types are bioethanol, biodiesel, renewable diesel, and sustainable aviation fuel (SAF).

“Bioethanol and biodiesel have historically been used in countries where agricultural feedstocks – such as corn, sugarcane and soybean – have been widely cultivated,” said the report. But due to these fuels fast approaching their blending limits, there has been increasing interest in developing renewable diesel and SAF technology to make up the shortfall.

Fuel blending entails a petroleum-based product, such as gasoline and diesel, being mixed with a small amount (up to around 20%) of ethanol or biodiesel, and can often offer better levels of combustion and reduce emissions when compared to unblended counterparts.

In 2020, biodiesel demand was roughly nine times greater than that of renewable diesel. FAME (Fatty Acid Methyl Ester, the generic chemical term for biodiesel derived from renewable sources) is relatively simple to produce and reasonably cost effective, rendering it the first choice of fuel that countries adopt to fulfil government mandates.

The report concluded that renewable diesel is expected to achieve 400% usage growth between 2020 and 2040. This can be attributed to emission reduction strategies that favour the use of waste-based fuels with lower carbon intensities.

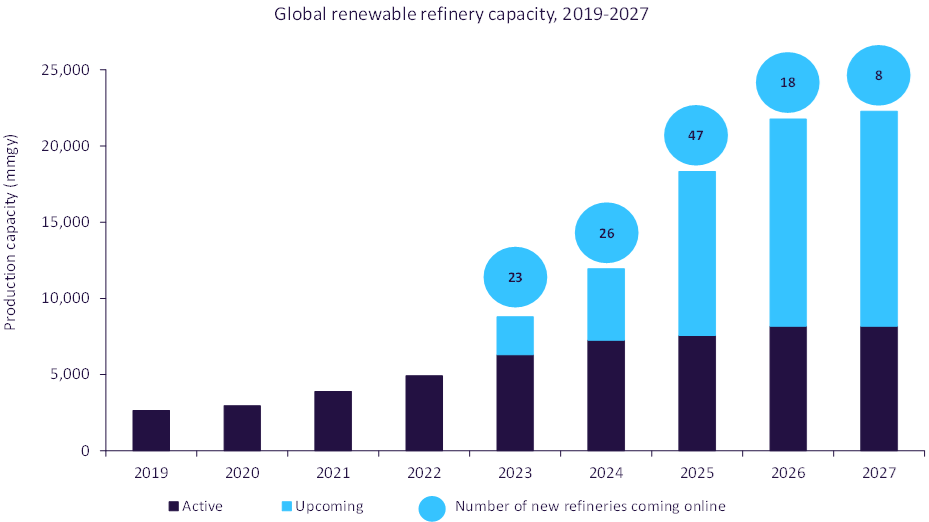

And 2023 GlobalData research also stated that the “decarbonisation potential of biofuels and growing policy support has led to their increasing demand, encouraging many refiners to consider venturing into renewable fuels.”

The report added however that bioethanol is also experiencing increasing competition from the growing electric vehicle (EV) market which seeks to eliminate vehicles running on gasoline, the prime consumers of ethanol-blended fuel.

Taking to the skies

As for SAF, demand growth is expected to be steady, reaching nearly 120 million tonnes by 2050, as well as a spike between 2027 and 2028. Now, three countries (Norway, Sweden, France) have SAF mandates signed into law.

“SAF blending is seen as a promising step in decarbonising the aviation industry, especially because the large-scale electrification of aircraft remains unfeasible with existing technologies,” said the report.

It added that some favoured options for refiners “include co-processing, conversion of conventional refineries to renewable refineries, and standalone renewable refinery projects.”

Producing large amounts of biofuels – and then integrating them into the energy mix – could be both costly and time consuming. There are various issues around water use, land use, food security, and variations in quality that need to be addressed. But, once they are, it highly likely that biofuel will become an integral element of many energy-intensive industries.