Iran has – after Saudi Arabia and Russia – the world’s third-largest oil and natural gas reserves. With around 10% of proven petroleum reserves, the country has some 5% of global crude oil production.

This figure would be much higher but for the history of the last 30 years, with the devastating war with Iraq being recently followed by punitive US sanctions.

That has meant serious underfunding for plant reconstruction and technology improvements. Even so, Iran is still OPEC’s

second-largest exporter, and the world’s fourth-largest crude oil exporter.

Its oil has helped make the country the second-largest economy in the Middle Eastern and North African region after Egypt, and at just over 65 million it also has the second-largest population. Iran’s oil sector provides 85% of government revenues, and has allowed the country to amass nearly $70bn in foreign exchange reserves.

MAJOR CRUDE OIL EXPORTER

Iran has 40 active oil fields. Most of its crude oil reserves are in the Khuzestan region, in the south west of the country. The IEA reports that Iran is producing around 4 million barrels/day, against a consumption of around 1.6 million. The difference dominates Iran’s exports, with the resulting near 2.5 million barrels/day in 2006 bringing in export revenues of over $50bn.

With the US refusing to trade with Iran, these exports go mainly to Japan, China, India, South Korea, Italy and other OECD nations. The Iranian government would like to increase production to above 6 million barrels/day by 2015 to take it back to 1976 levels. That will need around $30bn in investment, however, which at the moment looks unlikely. Its oil fields need a major upgrade with enhanced oil recovery (EOR) and other equipment. Nearly 500,000 barrels/day of crude production a year is

being lost, for example, because of reservoir damage and decreasing deposits.

The country has nine refineries, which can process around 1.5 million barrels/day, which is well below its own domestic demand. The Iranian government is planning to increase refinery throughput, but may need overseas joint ventures to do this. Overseas cooperation will in fact be key to increasing the country’s oil and gas supplies.

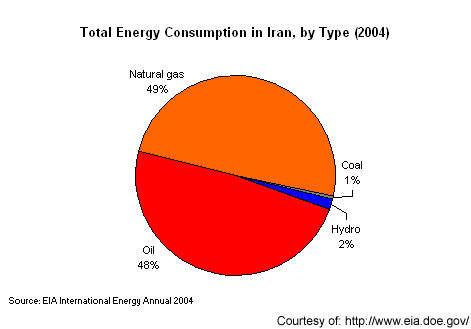

GAS NOW SUPPLIES DOMESTIC DEMAND

Iran also has, after Russia, the world’s second-largest gas reserves. Both production and consumption have grown rapidly over the past 20 years, with production pretty well swallowed up by domestic demand.

Production is wasteful here, too. Around a fifth of Iran’s natural gas is injected into oil fields for EOR. Another fifth is used in reduction of wet natural gas from hydrocarbon extraction, or simply wasted by flaring.

In February 2008, Asia Times Online reported an expansion in cooperation between Iran and Russia over energy. US pressure on European gas companies to isolate Iran has left the door open for Russia, and Gazprom is reported to be developing two or three blocks of the huge South Pars gas fields.

That would allow Iran to increase its gas exports from around 1% to 10% of world supply over the next 20 years. Russia and Iran are looking to set up a gas equivalent of OPEC, which would make a

formidable negotiating body.

Europe could find this difficult. As former Soviet countries have been finding out, Russia is quite prepared to halt deliveries if its bills are not paid. There has been much hypocrisy in criticism of Russia over this, however. After the breakup of the Soviet Union, Russia was largely abandoned to free market’ economics, and we can hardly complain if the country is a fast learner.

By definition suppliers set the bills and customers either pay them, or go elsewhere. With fixed gas pipelines, however, this is a little difficult. Russia is not likely to respond to any pressure put on it, like it is now refusing to bow to US pressure on the contentious expansion of Iran’s nuclear capabilities.

NUCLEAR ON THE INCREASE

A member of the NPT (Non Proliferation Treaty) since 1974, Iran would also like nuclear power. The restarting of its nuclear programme has led to many of its problems in the West. The US in particular has used Iran’s non compliance with UN inspections to bring international pressure on the country.

However, Russia has finally started supplying nuclear fuel for the Bushehr nuclear power station, which will generate 1GW. The 6–7TWh/yr output from the plant will free either 11 million barrels of oil or 1,800 million cubic metres of gas a year.

Iran actually brought 6GW on line in 2007, and this will somewhat relieve the pressure it is feeling from its own rapidly rising fossil-fuel consumption.

FUTURE STABILITY

Despite its huge oil incomes, Iran is running budget deficits – largely due to a growing population and large government subsidies on petrol and food products. Oil and gas is heavily subsided at home, with petrol costing below 50 cents/gallon. That has in itself brought large increases in domestic vehicle and petrol demand. With its refineries primarily producing crude oil, this has led to Iran becoming the second-largest importer of petrol for vehicles, second only to the US, and

costing around $6bn a year. That cuts heavily into its exports.

Economic growth in Iran has been slow and there is double-digit unemployment and inflation. The West often points to this as the result of ‘inefficient government’, but sanctions can make that a self fulfilling prophecy. Two of any country’s most important indicators are health and education, which for Iran are among the best in the region. It has a young and increasingly well-educated population and the subsidies often described by Western commentators as ‘inefficient’ are at least intended

to redistribute some of the oil wealth directly to its people.

The fundamentalism that drives Iran could undoubtedly be dangerous to the West. If we want to make the world safer, though, we should start with some of our allies – the countries we can actually influence. Iran points out the hypocrisy, for example, of focusing on whether Iran is or isn’t meeting rigorous UN inspection demands while simply ignoring Israel’s nuclear arsenal (which has been estimated at over 100 weapons).

Even now in the US there are high-level calls for an invasion of Iran, and the lessons from Iraq seem unlearned. In 2003, the US went to war to protect its oil supplies and the result has been a disaster.

Aside from the human and environmental costs, the war has cost the US an estimated three trillion dollars (some estimates estimate the final cost at seven trillion) while pushing up oil prices up from under $40 a barrel to over $100.

Oil prices can only rise. The world’s dwindling fossil fuel resources are now increasingly in demand by countries like China and India with growing financial power. Concerns over gas supplies have already led to increasing straining of tension between Russia and Europe.

From the other side, the US is concerned that Europe will in the long term be forced closer to Russia because of its reliance on gas.

There is only one long-term solution to our addiction to fossil fuels, and that is a shift to renewable energy sources. Solar sources like Ausra’s parabolic mirrors are now costing less per kWh than new builds for fossil fuels and nuclear, and are ideal for Middle Eastern countries. So, there is really no argument left against a massive expansion in renewables. It would ease pressures on oil supplies and reduce political pressures throughout the world, particularly in the Middle East and

particularly with Iran.