Last year, China installed more wind generating capacity (19GW) than the rest of the world combined. Mainly because of that, the WWEA reports, the wind turbine market as a whole kept its 25% a year overall growth. Last year added nearly 38GW, with a turnover of $60bn and from a workforce of two thirds of a million. The eastern European market grew, too, as did offshore capacity. Total installed offshore is now 3GW, of which 1GW was added in 2010 (mainly in the UK).

This masks a drop in investment in new turbines elsewhere, though. Outside China the market shrank by a third, with many fewer new turbines added in North America and western Europe. While making encouraging noises, politicians in the west have reduced investment. That is ironic as wind power is finally reaching cost parity with fossil fuels – a real achievement competing as it does with mature technologies exploiting the huge energy density locked into fossil and nuclear fuels.

Comparing costs

A report by the International Energy Agency (IEA) and the OECD Nuclear Energy Agency (NEA) recently compared levelised costs from almost 200 plants in 21 countries. The results for generating technologies vary widely from country to country; even within the same region, and the study showed that competitiveness depends more than anything on local market characteristics. Besides fossil fuel prices, which depend mainly on financing costs and CO2 prices – the calculations assume a 5% or 10% discount (interest) rate and a carbon price of $30 a ton of CO2.

For a 5% discount rate, levelised costs range from around 5¢-16¢/kWh for onshore and 10¢-19¢ for offshore (although offshore turbine prices in particular dropped last year). That compares with a reported 3¢-8¢ for nuclear, 5¢-12¢ for coal, 7¢-12¢ for gas and 14¢ for solar thermal.

According to Stefan Gsänger, the WWEA’s Secretary General, offshore prices are still towards the upper range of these figures. “Last year, for example, the Power Purchase Agreement for Denmark’s Anholt offshore wind farm was around 0.14€¢ (US21¢) per kWh. Similarly, the German offshore feed-in tariff is currently at 0.15€¢ (US22¢) per kWh excluding grid connection.”

Gsänger also believes the IEA / NEA nuclear costs to be higher than ¢8 for new installations. “Realistically, and ignoring externalities, nuclear power is in or above the upper range of offshore wind prices. Turkey was in 2009 quoted 21¢/kWh for a nuclear station, for example, and the Finnish 1,600MW Olkiluoto reactor will probably end up costing around €10bn”.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe IEA / NEA figures do however confirm that onshore wind (which is costing only around $2,000kWe to $4,000kWe) now competes with nuclear, coal, gas and hydro. IEA / NEA places onshore wind costs at between $2,000 to $4,000/kWe, but Gs&228;nger disputes these figures, too. “In India and China, they could be as low as $1,000/kWe, and elsewhere they will rarely be much above $2,000/kWe.

Onshore allows power to be injected at many different locations than offshore, and generally using existing infrastructure. TÜV SÜD Industrie Service, which has advised on many wind projects, feels there are many more possible onshore sites. Peter Herbert Meier, head of Wind Cert Services, sees potential for more turbines in commercial monoculture forests. “Larger turbines with hub heights above 100m have recently made forests economically feasible, avoiding the turbulent 15m to 40m region above the tree tops. Sites are generally far from residential areas, and turbines could economically be sited along existing infrastructure routes including national roads, railway lines, overhead power lines and motorways.”

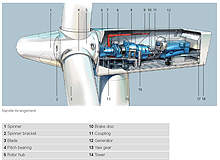

Lower blade loading reduces stresses all round

Early wind turbine blade profiles were adopted from those of aeroplane propellers, but are now optimised for wind generation. Advanced materials like carbon fibre and fibreglass-reinforced epoxy produce slim, stiff and lightweight blades. The blade angle is normally constantly adjusted to develop most power for lowest blade loading, which in turn allows for lighter turbines with longer blades. That reduces the size of foundations, which is a major construction cost.

While China last year installed largest capacity, there are early indications that Sinovel has moved above Vestas and GE Wind Energy to become the world’s largest turbine supplier. Its SL5000 series develops up to 5 MW (10 GWh/year), with 6MW turbines soon to be introduced and higher powers in R&D. Like most machines, the turbine is geared.

Until recently Vestas Wind Systems’ largest machines were rated at 3MW but in March 2011, Vestas announced its next-generation dedicated offshore turbine – a 7MW machine with a rotor diameter of 164m. According to Anders Søe-Jensen, Vestas Offshore president, the company studied direct drive before deciding on a geared medium-speed drive train to keep with existing reliable designs. The first prototypes are expected in Q4 2012 with full production in Q1 2015.

Tomorrow’s technology

Today’s 5MW turbines have rotor diameters of around 120m. The EU-funded UpWind project predicts that offshore turbines could in future quadruple the energy for even lower costs. It believes that 20MW wind turbines will be feasible by 2020, with rotor diameters will be around 200m.

That will need more than a simple upscaling, though. Project leader Jos Beurskens of the Netherlands’ Energy Research Centre (ECN) highlighted improvements in blade design and materials, and turbine control and maintenance. Blades will need to be lighter and more flexible. Individual blade control and two-section blades (like aeroplane wings) help to reduce fatigue loads. Wind farm layout is also important: lowering the power output of the first row of turbines can for example increase overall wind farm efficiency.

Where next?

Wind power is regularly criticised for taking subsidies, which is interesting considering the billions in subsidies still being accepted by oil and nuclear. The EU climate change commissioner Connie Hedegaard recently claimed that offshore wind is cheaper than nuclear. That does not show up in the IEA / NEA analysis, but many of nuclear’s costs are “opaque”. They have for a start historically ignored the huge research costs that were picked up by governments in the 1950s and 60s. They also underestimate decommissioning costs and exclude the costs of Fukushima-type catastrophes (and insuring all nuclear plants against similar disasters).

Wind is also criticised for being unreliable. If countries were planning to supply their loads with 100% wind, then this criticism might be valid, but of course that isn’t the plan. Wind will take its place beside solar, geothermal, hydroelectric, wave, tidal and CHP energy – with the whole network connected by low-loss HVDC (high-voltage direct current) links.

Worldwide wind capacity is now virtually 200GW, producing 430TWh/year (a 1MW turbine produces around 2GWh/year on land and 3GWh offshore), or 2.5% of world consumption. WWEA believes a global capacity of 600GW is possible by 2015 and above 1,500GW by 2020. That would still keep wind’s share to below 20% of total consumption, and Denmark generates more than that without problems.

On continuously windy days, Denmark actually gets all of its electricity from the country’s 5,000 wind turbines. It exports electricity when there is a surplus and imports it when there is a shortfall. Backup and storage technologies are also continually improving, so variability will be less of a problem in the future (Denmark aims to reach 50% by 2030).

Wind power is now a mature technology. Will it (and other renewable technologies) get the investment, though? The IEA points to the need to reduce financing risks (feed-in tariffs, loans or price guarantees) as being critical to takeup. Critical, too, is for local residents to accept it. Denmark has found them much more likely to approve of wind farms if these are owned by the local community. With wind farms taking only one to two years to build, that could be the key to bringing large amounts of renewable power on stream quickly.