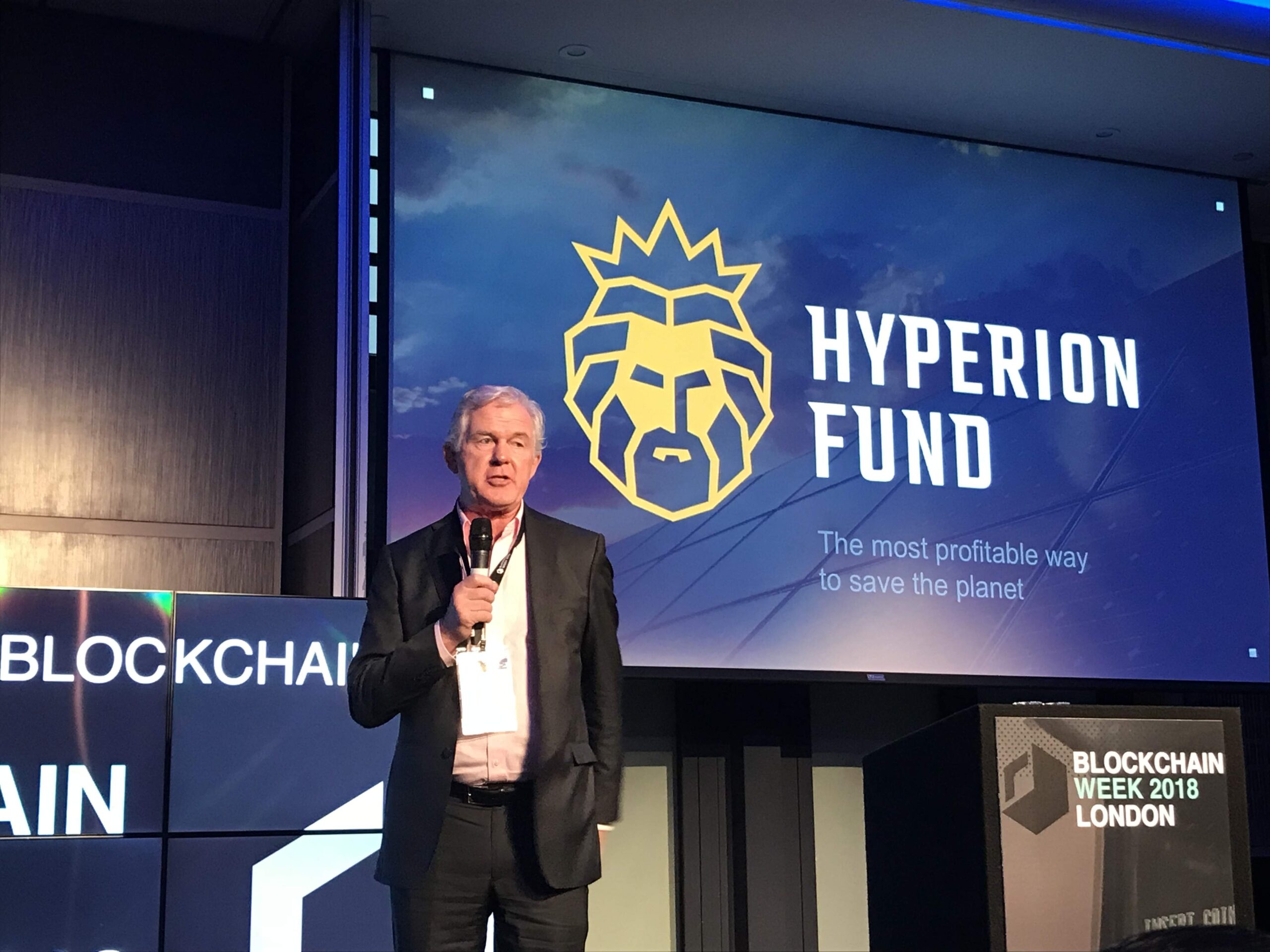

At this year’s Blockchain Week, held in London on the 19-26th January, Hyperion Fund’s COO Noel Shannon, along with a panel of energy experts, talked about how blockchain is changing the solar industry.

Hyperion Fund was set up in 2017, to enable faster solar plant development in the emerging markets through blockchain. It aims to fund projects that have already achieved a Power Purchase Agreement (PPA), the contract given by a government ensuring the purchase of all electricity produced usually for a period of about 20 years.

Investors, both public and private, will be able to buy tokens through an initial coin offering (ICO) that represent 1W of the solar power project. Through the sale of 72 million tokens, they can bypass the traditional capital raising routes, to gain funding quickly from a broad range of investors.

Blockchain keeps a digital ledger of these transactions, publically visible to ensure transparency for investors keen on becoming part of the booming solar industry. In 2016, the amount of solar power installed grew 50% compared to the year before; growth is expected to continue with an estimated $2.8 trillion being invested by 2040.

Molly Lempriere: Could you tell me a little bit about Hyperion Solar Energy?

Noel Shannon: Hyperion is a fund set up to invest in solar projects, addressing a problem and creating an opportunity. There are so many opportunities for more solar in the world, the renewables market is growing and solar is a big part of that. The challenge facing solar development companies is scale, being able to do a lot fast and grow fast. There are many limitations to this, in particular it takes a lot of time to get funding, to get banks, debt, and equity, as there are a lot of negotiations that take forever. Blockchain, and an ICO, offers a way of resolving that, by effectively crowd funding.

So it solves a problem, and then the opportunity that it creates is for the token holders to come into the Hyperion fund, and have transparent investment into solar projects where the coin is directly related to the solar watts produced. Hyperion has been set up to do that.

I joined Hyperion because I have experience in developing solar projects in the past. Using that, I’m going to develop projects that already have the PPA. The PPA is the critical piece, because I know from my work in developing and getting PPA’s that it takes a lot of time. You need to get the land lease, the environmental approval, studies, and grid connection. Getting all of those licenses together to get the PPA takes time. But once you’ve got it then you still need to get the finance to build the solar farm.

What Hyperion will address is the financing of PPA projects and building, using my experience, these projects. Then we will either run the projects or sell them on.

ML: As an investor, how would you keep track? Do you have a specific platform for this transparent look into your investment?

NS: It’s going to use the Ethereum platform, using smart contracts to give total transparency through the investor portion of the website to see how the projects are performing, what energy is being produced and what returns you are going to accrue at the end of the period. I think there’ll be dividends every six months, not sure if that’s defined by the financial team yet.

ML: What is problematic for people who want to get involved in renewable energy?

NS: Ordinary people cannot invest in solar power at the moment, the only way a solar project can get funding is by going to the debt or equity markets, and that entails all of the traditional challenges of negotiating with multiple potential partners to decide who is going to team up with you on a potential project. That can take an enormous amount of time, and sometimes it can end in no result.

This is where smart contracts with blockchain can allow a kind of a crowd funding to take place to alleviate all of that negotiation with equity partners, and then we can leverage the fund with debt through our debt partners. Therefore it gives us the ability to go at scale to address the opportunities in the market, whilst all the time giving the token holders total transparency.

I’m there to make sure that the projects are built. Using experience I’ve gained from Shannon Energy where we built projects in the past, I can identify those PPA projects and start the building process as soon as possible. We’ve already identified a number of PPA projects that we could start building the month after next.

ML: You mentioned your experience with Shannon Energy, could you tell me a little bit about your background?

NS: Sure, so Shannon Energy started about five years ago building large projects in South Africa, and subsequently built various smaller projects in Europe, and we’re now building in Iran. Shannon Energy has lots of experience of getting PPAs and building power plants.

We’ve seen the challenges that have come about through this process, and that’s why I’ve joined Hyperion to help them overcome these challenges. We will also be joined on our advisory board by one of our project directors in Shannon, Nathan Schmidt. Hyperion will have a team of solar experts to draw on so it can build rapidly.

ML: You come very much from a renewable background, what do you think the effect of blockchain has been on the energy industry?

NS: I’m new to blockchain, I’m fascinated by how it is beginning to pervade every aspect of what we do, removing middle men and disintermediating, to allow ordinary investors to bypass all those intermediates and invest in asset based projects. That to me is fascinating and I think it’s the first step in a peer-to-peer relationship that an investor can have with an asset. I think solar is just one aspect, I’ve seen other coins through ICO’s, I’ve seen property, I’ve seen wine, art, everything really.

What I think the next stage is, because blockchain permits it, is to allow trading of those coins in the market. Again it’s not something I’m familiar with, but blockchain permits it and I think it’s great.

I think legislation will come to make people more comfortable about investing in this marketplace; although obviously the early movers are probably the ones who get the biggest advantage like in most things. I would welcome more legislation because it makes it better for people who worry if it’s going to be compliant with any future rules.

We’re seeing that at Davos already, there was also an article recently in the Financial Times saying that the banking community cannot ignore cryptocurrencies and ignore ICOs so it’s going to happen. Bring on the legislation and let everybody have access – without paying the intermediates big commissions – to invest in these projects.

ML: In terms of Hyperion’s ICO, how optimistic are you feeling?

NS: Very, I think it’s going to be a huge success. All the indicators from people who know and have done ICOs – and I understand that there have been more than a thousand ICOs done to date – have been positive. I suppose what makes Hyperion different to many previous ICOs is that there is an identifiable asset class underpinning it, which is PPA projects with an identifiable return. That makes the Hyperion ICO a bit different from other ones that you might be worried about.