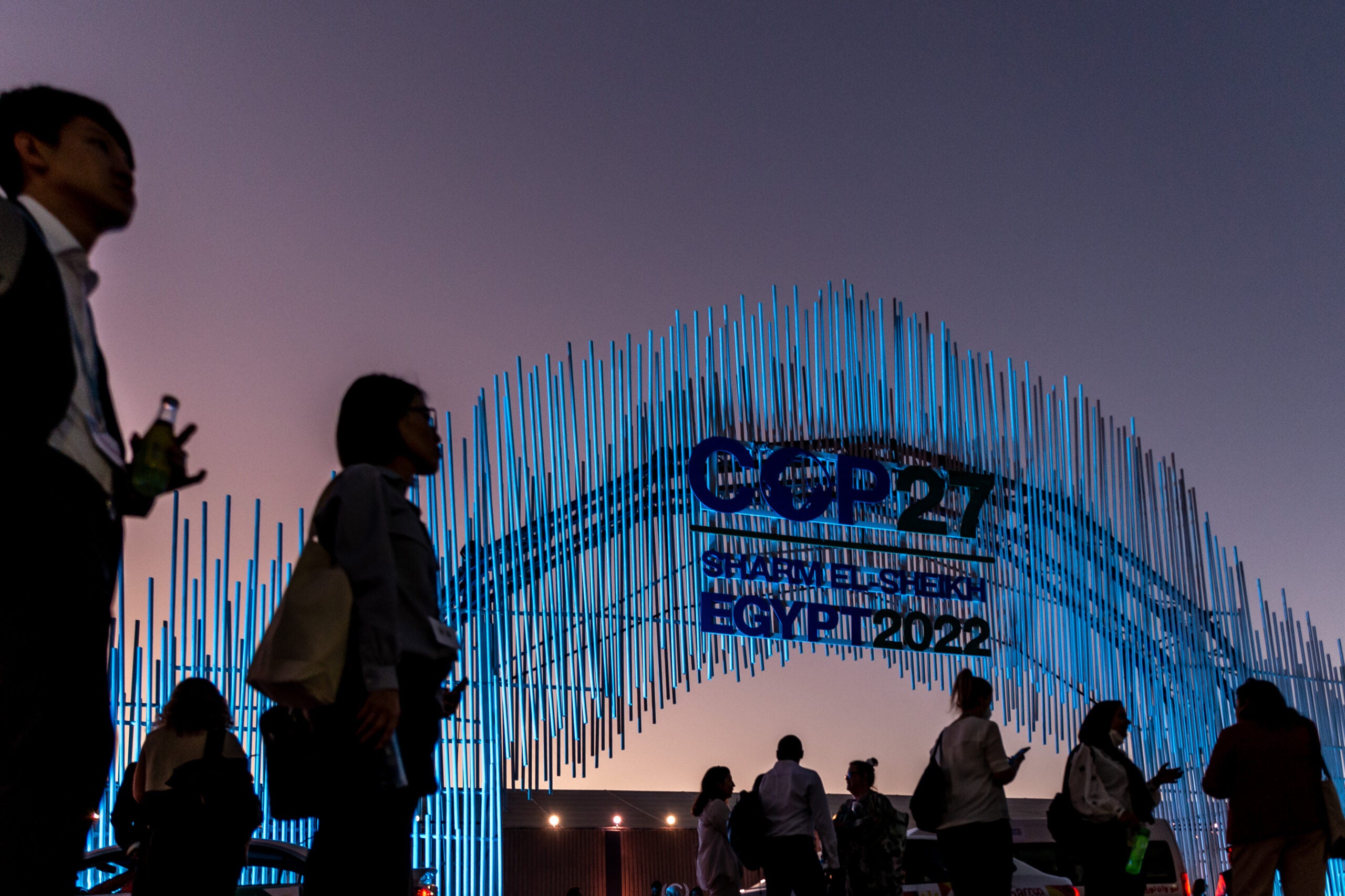

The COP27 summit in Sharm-el-Sheikh, Egypt, is underway. Over the next two weeks, world leaders, delegates, and activists will discuss policy and funding with the aim of moving the world towards a less carbon-intensive future.

This time last year, countries pledged to “phase-down unabated coal power” and support poorer nations in their energy transitions. This year, as ever, the power industry lies near the top of the agenda. Leaders will likely announce new pushes for renewable power, or massive funds changing hands to eliminate more polluting generation.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Last year, climate financiers opened the taps to provide billions of dollars for renewable energy development. New climate pledges saw nations plan to cut emissions faster than ever before, accelerating the energy transition to a level still far below necessary levels. A deal between South Africa and a coalition comprising the US and Europe saw the former pledge to cut its overwhelming reliance on coal down to zero.

Similar deals and pledges will be just one of the expectations of this COP, as the world’s power industries will be among the most significantly affected. But first, familiar topics must be addressed.

How will COP27 treat coal-fired power?

Coal dominated the subject matter of talks last year, and was the main focus of the Glasgow Climate Accord. At the time, Power Technology suggested that this would not be the end of the discussion, as the coal project pipeline continues to crumble and companies increasingly divest their coal assets.

Since then, Russia’s invasion of Ukraine has started an economic conflict across Europe. Now an economic downturn looms over the continent’s future, causing critical eyes to look again at funding deals. Decreases in investment remain hard to count in the short term, but economic forecasts paint a picture of a world with little cash to spare.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataPower is the one area where this may not apply. Renewables present a logical path to energy self-sufficiency, and some European lawmakers have redoubled their calls to accelerate the energy transition in Europe.

In October, the G7 group of rich democracies offered Vietnam and Indonesia $5bn and $10bn, respectively, to cease coal generation. Politico reports that talks over terms of these potential deals remain ongoing, but represent power investments on a scale not seen in other sectors following Russia’s invasion of Ukraine.

In Indonesia, the recent approval of a 5GW coal-fired power plant has provoked doubt over whether the deal will succeed. Meanwhile, Vietnam feels that their offer does not compare favourably to the $8.5bn deal with South Africa to end coal generation there, announced during COP26.

The Western nations also made a similar deal to India, which has a much larger reliance on coal. However, the Indian Government has more interest in a deal to incentivise renewables rather than phasing out coal, likely as a result of the country’s rapidly growing demand for electricity. If any of these deals can be reached, leaders will likely announce them during COP27.

China presents a massive unknown

At the last conference, the move to spare coal from its end predominantly came from India and China. China now faces its own financial difficulties, both as a result of its own policies and as a distant consequence of a fall in exports to Europe. Zero-Covid-19 policies have resulted in frequent lockdowns, disrupting industries still recovering from power shortages in 2021.

These caused China’s leaders to impose a price cap on coal, which they will now maintain into 2023. The rush for coal has caused the country to increase coal mining, offsetting the country’s significant renewable construction. Regardless, China’s rulers remains reluctant to source its consumption for abroad, so any deal with the country will likely come in the form of a partnership such as those that were seen at COP26.

On one hand, more climate-conscious nations may attempt to make the case against coal again. The willpower is there, and China has now seen huge industrial difficulties due to the lack of supply of coal.

On the other, climate-conscious nations may consider their political capital best spent elsewhere. As with much of China’s foreign policy, the outlook remains uncertain, and may be best understood in hindsight.

What does Egypt’s power come from, and why is it hosting COP27?

Egypt itself remains behind-the-curve on climate policy. The country generates an overwhelming and increasing majority of its power from natural gas; its flagship construction project, the New Administrative Capital, will generate power through a 4.8GW combined-cycle gas plant at its heart. The US lists Egypt as Africa’s third-largest natural gas producer, and the country continues to offer offshore drilling licenses along its northern and eastern coasts.

Egyptian politics remain mostly unconcerned by climate policy, with much more emphasis on economic stability following the invasion of Ukraine. Recent headlines have covered a deal with the International Monetary Fund, as well as the freeing of several imprisoned journalists.

Independent climate policy assessment organisation Climate Action Tracker rates Egypt’s emissions reductions as “highly insufficient”. The country’s emissions policies would see it increasing its emissions into 2030. Its current nationally-determined contribution, submitted this year, has no ambition to reduce emissions, even allowing them to grow faster than their current rate.

While any host is best judged by their actions, this may explain why most of the talk thus far has not centred on decarbonisation.

Reparations for climate damage

Most of the buzz around this COP has focussed on “loss and damages”, a term used to address payments to countries that will take the biggest hit as climate change continues. Naturally, this has proven somewhat unpopular among those expected to pay the bill, but most accept it as a necessity.

This year, most analysts expect a loss and damages fund to occupy the most attention at the event. This would only affect power through the money routed to developing economies, and how they spend the funds to improve their climate resilience.

But buzz generates buzz, and those interested in the outcomes of COP27 should not see it as a reliable guide. The conference schedule allocates days for discussion of the energy system, decarbonisation, and how these efforts are financed. While few expect greater announcements than at COP26, and all need greater efforts from delegates to be able to live on a sustainable planet, ultimately, only time will tell how effective COP27 will be.