China’s solar journey has been unparalleled anywhere in the world. In the past seven years, it has expanded from just 2.3GW to 130GW of solar energy, while the country’s solar companies have become some of the biggest in the world.

However, on 31 May, China’s National Development and Reform Commission (NDRC), Ministry of Finance and National Energy Board announced that subsidies would no longer be available.

“In recent years, with the continuous expansion of China’s photovoltaic power generation construction, the speed of technological progress and cost reduction has obviously accelerated,” the government said in an official statement, which notes that the changes are intended “to promote the healthy and sustainable development of the photovoltaic industry, improve the quality of development, and accelerate the subsidy to retreat”.

The statement explains that feed-in tariffs are set to be greatly reduced, and all subsidies for utility-scale solar power will be stopped and replaced with competitive bidding.

The move has prompted concerns that the lack of subsidies would slow solar development in the nation, but with the reduced cost of solar panels and a more developed market, are these fears misplaced?

China’s solar boom and generous subsidies

In 2016, China truly began its renewables revolution in an attempt to lower pollution in light of global warming, and to increase power capacity as demand continued to grow.

After years of fuelling its economic growth with coal power, China became one of the biggest contributors of greenhouse gases in the world. In 2016, it accounted for a third of all carbon emissions, largely due to its booming industrial sector. This has had major impacts on both the environment and health in the country. In 2012, for example, more than a million people died as a direct result of air pollution.

Over the past few decades, China’s demand for energy has grown at an exceptional pace, as the country built its economy and pulled large swathes of its population out of energy poverty. However, as growth slows and the Chinese economy continues to evolve, the demand for energy will slow.

“China is the world’s largest consumer of energy and has been the most important source of growth for global energy over the past two decades, but as China transitions to a more sustainable economic growth model, its energy needs will change,” the BP World Energy Outlook report said.

The country’s energy demand is now predicted to increase by 1.5% each year until 2040, less than a quarter of its level in recent years. This will still necessitate huge infrastructure additions however, as power demand is estimated to reach 11.8 trillion kilowatt hours by 2050, but not on the same scale as in previous years.

Solar additions have already begun to have a major impact on Chinese energy production, accounting for the largest proportion of capacity addition. In 2017, 32.4% of new electricity capacity in China was solar. This growth has been greatly facilitated by generous solar subsidies provided for utility-scale solar projects.

The end of the ride for China’s ‘solarcoaster’?

It is expected that by stopping the subsidies, demand for solar in 2018 will be slashed, causing installations in China to drop 40% compared to 2017. It is predicted to reach just 31.6GW, and cause the global market to drop by 92GW-95GW.

But China is not the first country to cut solar subsidies; Spain was forced to halt its generous feed-in tariffs in 2010 after they caused consumer bills to skyrocket.

Solar subsidies have increasingly become a burden, and Chinese consumers have been bearing the brunt. They have been funded by a state-run renewable energy fund, which is financed using a consumer surcharge. It currently has a deficit of more than 100 billion yuan ($15.5bn).

Furthermore, the installation of solar is not being efficiently managed. “Over 70% of China’s large-scale wind and solar projects have been installed in the resource-rich northern regions featuring low electricity demand and low export capacity,” a 2017 Bloomberg report noted.

Due to the lack of effective transmission lines, much of the solar power generated in the north is simply wasted.

“Renewable power generators face the worst curtailment rates in the world, with the national average curtailment ratio in 2016 at 17% for wind and 10% for solar,” the report expanded. “A slowdown in new build, and additions of long-distance transmission lines to export electricity, will play a major role in alleviating the curtailment for northern regions.”

As such, it seems clear the subsidies, while providing a necessary boost for the technology, had become unworkable. Debt was increasing along with consumer bills, while solar power was simply being wasted as transmission lines could not manage the quantities of power generated.

While solar power installation rates are expected to slow this year, China is expected to continue the expansion of its solar network and meet its renewable energy targets. The country is aiming to generate 20% of its energy from non-fossil sources by 2030, including 200GW from solar. Even with more subdued expansion, it is predicted to generate 200GW-215GW by 2020.

Work is underway to improve the transmission system throughout the nation, thanks to an $88bn programme to install ultrahigh-voltage direct-current (UHVDC) lines. The completion of the upgrade will ease solar installation again.

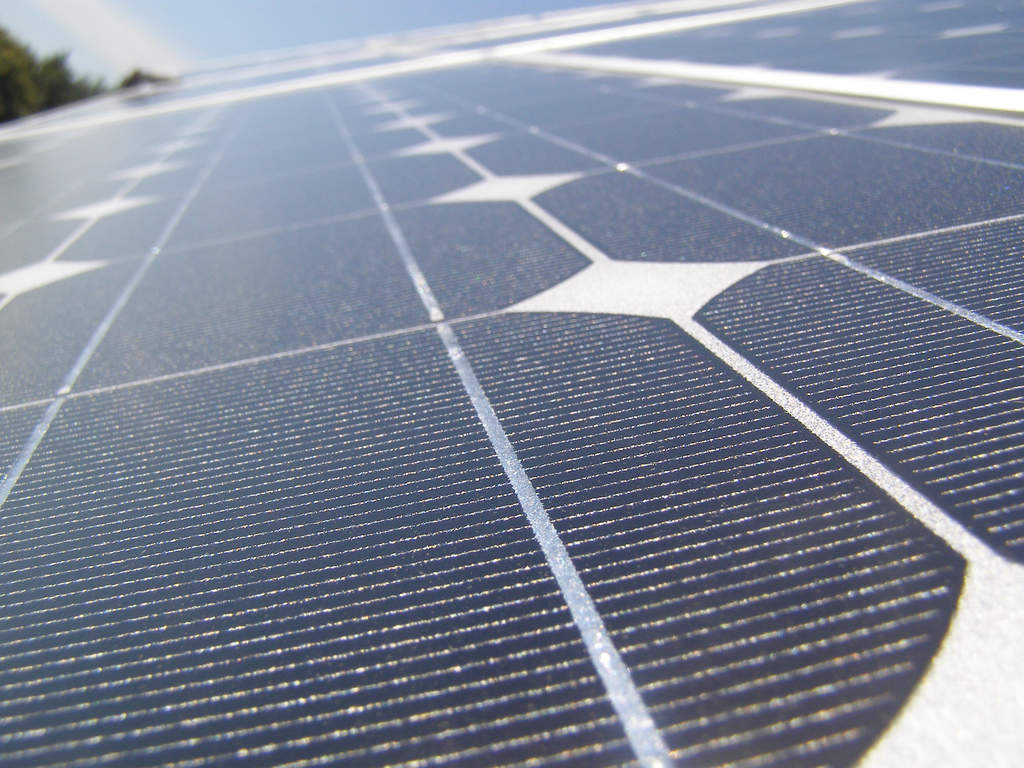

Solar panels have dramatically reduced in price in recent years, falling by 90% in the decade between 2007 and 2017. This has already facilitated adoption of solar technology around the world and will undoubtedly boost the market in China in a post-subsidy market.

The group most likely to suffer from the lack of subsidies is the manufacturers, as they are driven to increase cost efficiencies and continue to lower the price of panels. This comes in addition to the strain placed on them by US tariffs on solar panels, which were increased by a further 25% in June on top of the 30% set by US President Trump’s administration in January.

These tariffs have already cost the solar industry $2.5bn in cancelled projects, and will continue to place it under pressure as China seeks retaliation.

While stopping the subsidies is likely to harm solar manufacturers, its effect on the general installation of solar panels in China appears to be limited. As demand for power slows, costs drop, and transmission eases, China’s ‘solarcoaster’ may yet prove to be unstoppable.