‘Evolution’ might not be a strong enough word to cover the changes that have been taking place in the global energy landscape. Over the past decade or so, a surge of innovation in renewable generation, grid technology and community energy schemes has been prompting a shift away from the utility-centric power provision paradigm of old and towards a more decentralised system that helps integrate new energy sources, empower customers and allow consumers – from individual homeowners to large industrial users – to feed power into the grid as well as draw from it.

As expectations around electricity supply and a host of associated issues continue to change, power systems will have to change with them. New digital technologies have the potential to make this transition smoother. Take blockchain, for example, a distributed database system that is swiftly becoming a hot-button topic in energy circles, not to mention a host of other industries.

Blockchain’s energy potential

The blockchain concept was originally developed by a mysterious programmer (or programmers) using the pseudonym of Satoshi Nakamoto in 2008, and the system was first implemented as part of the core infrastructure underpinning the cryptocurrency bitcoin. Essentially, a blockchain is a digital ledger used to record and log transactions (financial or otherwise), grouping them into chronologically-ordered ‘blocks’.

A simple enough premise, but it’s the associated advantages that come with a blockchain that make it such an attractive proposition. The database is distributed across a network of computers, leaving no centralised entry point that could be targeted by hackers. The system is also completely transparent, with all users able to see transactions and changes to public blockchains, and once data is entered into a block on the chain, it is inherently resistant to any modification as any change would require a brute-force attack on the whole chain.

Now that the blockchain concept has proven itself by ensuring stability and transparency for bitcoin – the total value of which has now passed $14bn – other sectors are working out how blockchains could complement their businesses. Clear advantages in the energy industry are already being found, with solar-incentivising cryptocurrency SolarCoin implementing blockchain to log data and automatically make SolarCoin payouts to solar producers.

Consumers, power networks and utilities stand to gain a great deal from blockchain, if they can get their heads around its implementation and implications, and a start-up eco-system has sprung into life to seize the opportunity. But what blockchain-enabled applications are being developed for the energy sector? The four case studies below illustrate the wide-ranging scope and scale of the technology’s potential for the grids of the near future.

The Brooklyn microgrid: a community perspective

Blockchain has immense potential at the local level as a means of tracking and verifying transactions as part of community energy schemes. LO3 Energy’s Brooklyn microgrid has been an early advertisement for blockchain’s facilitating role in local energy.

The microgrid, currently installed in a small Brooklyn neighbourhood, allows for peer-to-peer trading between local residents, so those with rooftop solar panels can sell excess power directly to their neighbours. The well-established, blockchain-based distributed computing platform Ethereum is used to track and log the contracts that are automatically generated between users, providing reliability and transparency between the energy vendor, recipient and anyone else on the network.

“Blockchain is a really good communications protocol for what we want to do,” LO3 Energy founder and CEO Lawrence Orsini said at MIT Technology Review’s Business of Blockchain conference in April. “This isn’t just about settling energy bills,” he added, “It’s about self-organising at the grid edge, which can’t be done with normal databases.”

The Brooklyn microgrid might be small-scale, but the company has plans to expand its concept, and there’s evidence that consumer appetite is high. At the same conference, Orsini quoted an Accenture survey which found that 69% of consumers are interested in an energy trading marketplace, while 47% planned to sign up for community solar schemes.

Large-scale energy trading trialled in Austria

It could be assumed that this process of distributed, decentralised energy systems facilitated by blockchain represents a threat to large utilities and other traditional industry stakeholders. But it’s not just smaller community projects that are starting to leverage blockchain tech; power companies – the more progressive firms, at least – are keen to get ahead of this trend and assess how blockchain could work for them.

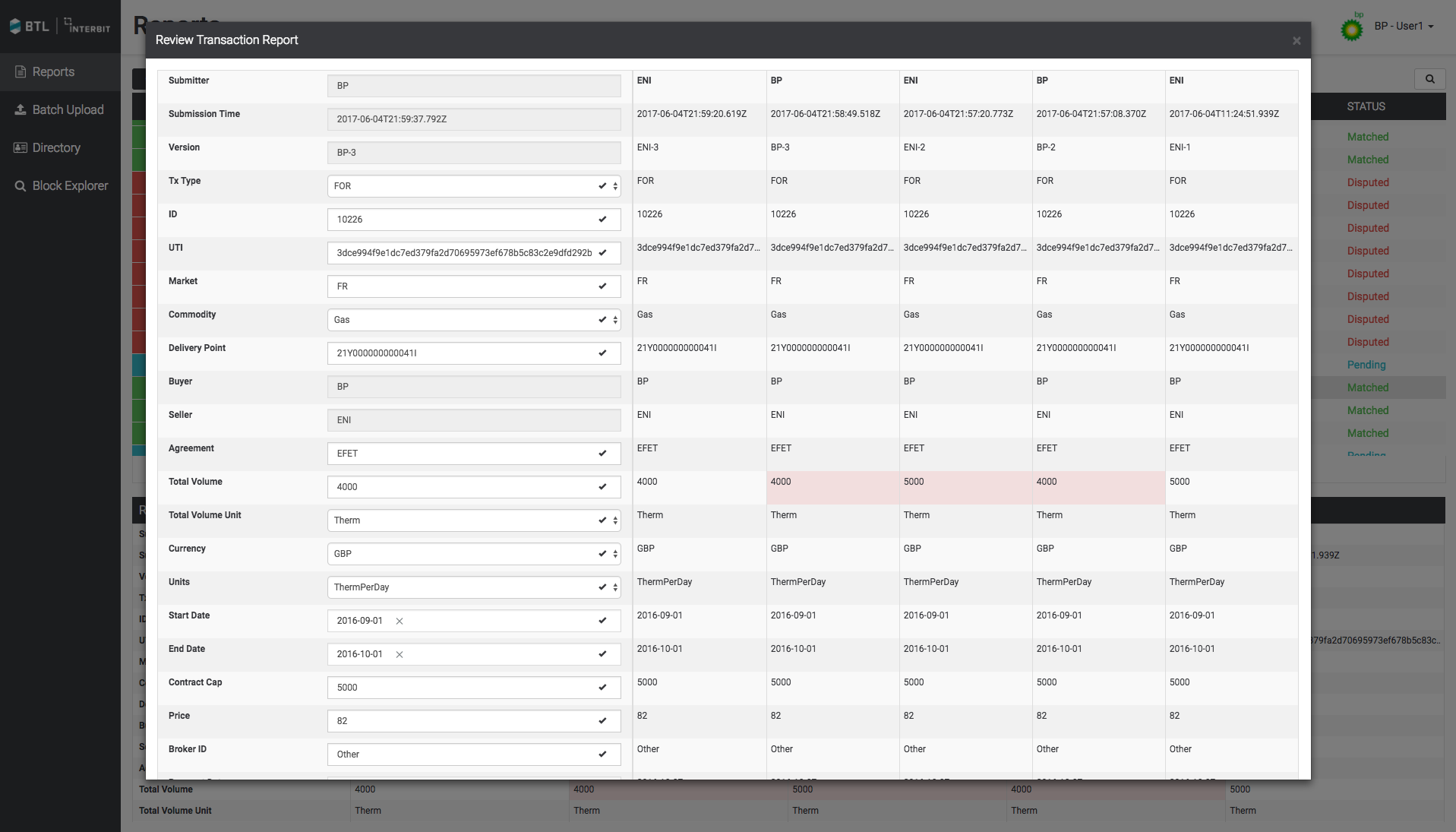

Austria’s largest utility, Wien Energie, is one example. In February the company, which serves more than two million customers, signed up to a trial run by Canadian blockchain specialist BTL testing blockchain as an enabler of large-scale, cross-border energy trading. The trial, which concluded recently, was intended to test BTL’s Interbit platform as a tracker of energy assets for gas trading. The trial involved Wien Energie, as well as BP and Eni Trading & Shipping.

“Having demonstrated the reductions in risk and cost savings that are achievable we now have an opportunity to deliver the first successful blockchain-based application to the energy market,” said BTL co-founder and CEO Guy Halford-Thompson after the trial’s conclusion, also noting that the company is now working to expand its roster of energy clients as it works towards launching a live, commercial version of the energy trading over the next six months.

Electric vehicle charging and vehicle-to-grid

Electric vehicle (EV) adoption is gradually picking up, and one of the keys to load-balancing in an advanced grid network will be to leverage the demand-response potential of these cars, each of which essentially represents a mobile battery unit, through emerging vehicle-to-grid technologies that allow available EVs to feed electricity back into the grid during peak hours.

German energy company Innogy is working on its Car eWallet system, presenting its technology prototype at the Consumer Electronics Show in Las Vegas earlier this year. Initial EV applications are likely to involve simplifying charging for vehicle owners through blockchain, which could be programmed to automatically charge users small amounts for topping up on-the-go via inductive charging, forgoing the need to plug into a charge station.

The potential of vehicle-to-grid technology is still getting off the ground, but there’s little doubt that blockchain systems could facilitate these more complex load interactions at a range of scales, including microgrids, by simplifying the process and cutting out transaction middle-men.

“The owner of the microgrid might be the owner of the charging stations. There would be no bank in between and zero transaction costs,” said Steve Davis of California-based start-up Oxygen Initiative, which is working with Innogy to bring blockchain-enabled eWallets to the US, in a March interview with Microgrid Knowledge. “The microgrid would be treated like a utility. They can give us their grid conditions and the EVs can respond accordingly.”

Blockchain-powered utility switching

In the UK, meanwhile, another start-up is taking a different approach in its use of blockchain tech. Increased market competition means that today’s energy consumers have a wider array energy providers to choose from, but the process of switching can be inefficient, time-consuming and bewildering enough to put off many of those who might otherwise jump ship.

Blockchain energy firm Electron is in the process of developing a UK-wide, blockchain-powered platform that could reduce the time to switch from days to as little as 15 seconds. The company says the system, which is currently being tested using dummy data, could handle 55 million supply points. Electron CEO and former head of Npower Paul Massara told Utility Week in May that 22 independent suppliers have expressed interest.

“This is not theory. We have a working model showing how we could do it,” Massara said. “What you really want is quicker and more accurate switching, with lower costs. Blockchain can do all that because it can switch suppliers with meter points, so you don’t have all the reconciliation issues. And you can put in smart contracts, so you can start flagging things like if a person is on the priority register service.”

It’s clear that there are a multitude of applications for which blockchain could be invaluable in the push for more customer-centric and renewables-friendly decentralised grid systems. The technology could support clearer and more transparent relationships between customers and energy providers, reduce the wastage of excess renewable power, eliminate manual meter reading and facilitate the building of fair community energy initiatives and microgrids.

As with any developing technology there are challenges to overcome, including regulatory issues, upfront costs and potential resistance from key stakeholders. But if these stumbling blocks can be hurdled, blockchain systems could make an ideal partner for 21st century energy systems.