The power industry continues to be a hotbed of patent innovation. Activity is driven by increasing global power demand, renewable energy auctions, and the growing importance of technologies such as offshore wind turbines, floating platforms, and interconnectors. In the last three years alone, there have been over 695,000 patents filed and granted in the power industry, according to GlobalData’s report on Innovation in power: offshore wind turbine pre-assembly. Buy the report here.

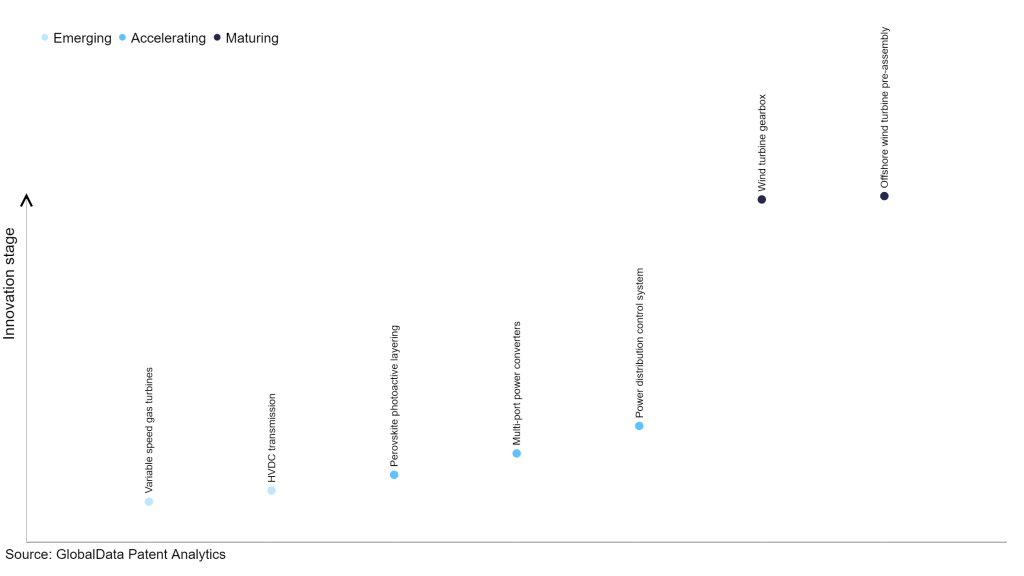

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

45+ innovations will shape the power industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the power industry using innovation intensity models built on over 83,000 patents, there are 45+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, variable speed gas turbines and HVDC transmission are the disruptive technologies that are in the early stages of application and should be tracked closely. Perovskite photoactive layering, multi-port power converters, and power distribution control system are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are wind turbine gearbox and offshore wind turbine pre-assembly, which are now well established in the industry.

Innovation S-curve for the power industry

Offshore wind turbine pre-assembly is a key innovation area in power

A tower for an offshore wind farm typically consists of multiple components. All the pieces must be put together to create a complete tower and be prepared for installation at their final offshore location. The assembly work can be undertaken at the final offshore location, but it can be exposed to risks. Assembling and installing the foundation, tower and other parts of wind turbines before they are transported to, and erected at, their ultimate offshore location is known as offshore wind turbine pre-assembly.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 120+ companies, spanning technology vendors, established power companies, and up-and-coming start-ups engaged in the development and application of offshore wind turbine pre-assembly.

Key players in offshore wind turbine pre-assembly – a disruptive innovation in the power industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to offshore wind turbine pre-assembly

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Siemens AG | 57 | Unlock Company Profile |

| General Electric Co | 54 | Unlock Company Profile |

| Wobben Properties Gmbh | 48 | Unlock Company Profile |

| Vestas Wind Systems AS | 40 | Unlock Company Profile |

| Holcim Ltd | 29 | Unlock Company Profile |

| GFG Alliance Ltd | 26 | Unlock Company Profile |

| Actividades de Construccion y Servicios SA | 24 | Unlock Company Profile |

| Nordex SE | 23 | Unlock Company Profile |

| Hitachi Ltd | 21 | Unlock Company Profile |

| Keppel Group | 20 | Unlock Company Profile |

| Ihc Holland Ie B.V. | 19 | Unlock Company Profile |

| JMV GmbH & Co KG | 17 | Unlock Company Profile |

| Cargotec Oyj | 16 | Unlock Company Profile |

| ROSEN Swiss AG | 16 | Unlock Company Profile |

| Toda Corp | 14 | Unlock Company Profile |

| Esteyco SAP | 13 | Unlock Company Profile |

| Max Bogl Bauservice GmbH & Co KG | 13 | Unlock Company Profile |

| Ackermans & Van Haaren NV | 12 | Unlock Company Profile |

| Maritime Offshore Group GmbH | 11 | Unlock Company Profile |

| Royal BAM Group NV | 11 | Unlock Company Profile |

| Bonheur ASA | 10 | Unlock Company Profile |

| Nippon Steel Corp | 10 | Unlock Company Profile |

| Naval Group | 10 | Unlock Company Profile |

| Sumitomo Chemical Co Ltd | 10 | Unlock Company Profile |

| RWE AG | 9 | Unlock Company Profile |

| Boegl Max Bauunternehmung Gmbh | 9 | Unlock Company Profile |

| Kirin Holdings Co Ltd | 9 | Unlock Company Profile |

| Samsung Heavy Industries Co Ltd | 9 | Unlock Company Profile |

| Inneo Torres S.L. | 9 | Unlock Company Profile |

| Floating Windfarms Corporation | 8 | Unlock Company Profile |

| Mitsui E&S Holdings Co Ltd | 8 | Unlock Company Profile |

| Royal IHC | 8 | Unlock Company Profile |

| Vertical Wind AB | 8 | Unlock Company Profile |

| Orsted AS | 7 | Unlock Company Profile |

| Saipem SpA | 7 | Unlock Company Profile |

| SNC-Lavalin Group Inc | 7 | Unlock Company Profile |

| GeoSea nv | 7 | Unlock Company Profile |

| Seatower AS | 7 | Unlock Company Profile |

| Heerema International Group Services SA | 7 | Unlock Company Profile |

| Vivoryon Therapeutics NV | 7 | Unlock Company Profile |

| Senvion SA | 7 | Unlock Company Profile |

| The Engineering Business Limited | 6 | Unlock Company Profile |

| E.ON SE | 6 | Unlock Company Profile |

| Acciona SA | 5 | Unlock Company Profile |

| Subsea 7 SA | 5 | Unlock Company Profile |

| TETRA Technologies Inc | 5 | Unlock Company Profile |

| YuekChun Construction Co Ltd | 5 | Unlock Company Profile |

| NOV Inc | 5 | Unlock Company Profile |

| Nuclear Damage Compensation and Decommissioning Facilitation Corporation of Japan | 5 | Unlock Company Profile |

| Nova Innovation Ltd | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Siemens is one of the leading patent filers in offshore wind turbine preassembly. In May 2023, FairWind was awarded the turnkey pre-assembly contract for the offshore wind farms Vesterhav Nord and Syd at the Port of Esbjerg, Denmark. FairWind will be responsible for the pre-assembly erection of 41 Siemens Gamesa’s SG 8.0-167 DD turbines. In August 2023, Global Wind Projects was awarded a contract by Siemens Gamesa for the pre-assembly of 54 wind turbine towers for the 450MW Neart na Gaoithe (NnG) offshore wind farm, being developed by EDF Renewables and ESB off the coast of Scotland. Some other key patent filers in the automotive industry include General Electric, Wobben Properties, and Vestas Wind Systems.

In terms of application diversity, Actividades de Construccion y Servicios leads the pack, while Orsted and GFG Alliance stood in the second and third positions, respectively. By means of geographic reach, Sumitomo Chemical held the top position, followed by Keppel Group and Bonheur.

To further understand the key themes and technologies disrupting the power industry, access GlobalData’s latest thematic research report on Power.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.