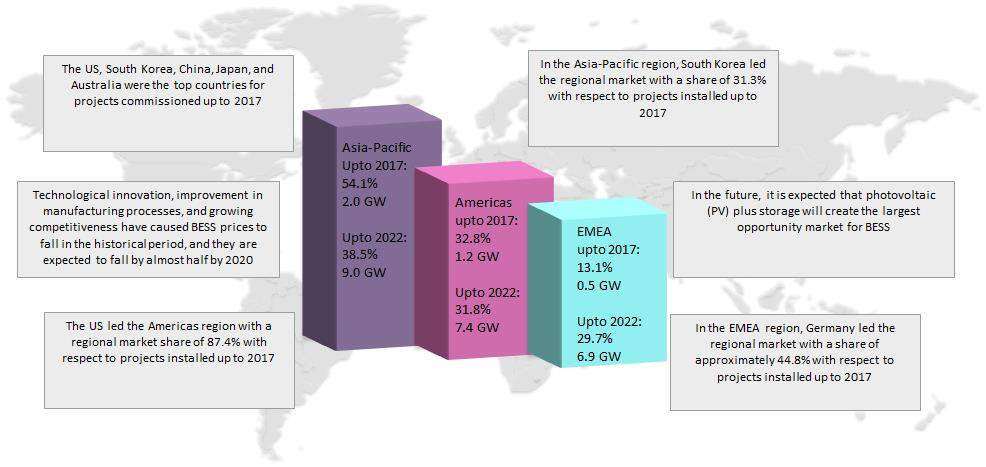

The global grid-connected battery energy storage systems (BESS) market witnessed a market volume of 3.8 gigawatts (GW) for projects installed up to 2017, which is expected to reach 23.4GW for projects installed up to 2022. According to GlobalData’s latest report Grid-Connected Battery Energy Storage Systems, Update 2018 – Global Market Size, Competitive Landscape, Key Country Analysis, and Forecast to 2022, the top five countries in the global market were the US, South Korea, China, Japan, and Australia for projects commissioned up to 2017, with the US having a 28% market share and leading the global BESS market.

The top five countries represented over 80% of the global market in terms of cumulative installed capacity in 2017. In 2017, the Asia-Pacific region led the global market by holding a 54.1% market share, followed by the Americas with 32.8%, and Europe, Middle East, and Africa (EMEA) with 13.1% for installations up to 2017. With respect to technology, lithium-ion has been the preferred choice to date and shared approximately over 75% of the global market with respect to BESS installations up to 2017. It is expected that lithium-ion will be the key technology throughout the study period.

In the Asia-Pacific region, South Korea led the regional market with a share of 31.3% with respect to projects installed up to 2017. South Korea is expected to show promising growth in the forecast period. This is because the South Korean government has earmarked KRW40 trillion ($35.7 billion) for the renewable energy sector over the next five years, as it unveiled a plan to reward solar plant operators for installing energy storage facilities. The country is attempting to reduce its reliance on fossil fuels. It plans to shut down 10 obsolete coal-powered plants in the country during the period, and supplement their closures by delivering 6% of total power from green energy sources by 2020. The Korean Electric Power Corporation (KEPCO) is working already with Korean battery provider Kokam to provide more than 500 megawatts (MW) of battery storage for frequency regulation.

The US led the Americas region with a regional market share of 87.4% with respect to projects installed up to 2017. Among the regional markets in the US, California had the largest deployment of energy storage capacity. The Aliso Canyon gas leak pushed California toward the construction of energy storage pipeline projects and development of new projects, representing an installed capacity of over 200MW in 2016. In terms of applications, ancillary services remained the leading application sector for energy storage in the US.

In the EMEA region, Germany led the regional market with a share of approximately 44.8% with respect to projects installed up to 2017. Ancillary services and solar plus storage are the main opportunity segments in the country. Storage subsidies from the KfW Development Bank and the fall in feed-in tariff (FiT) rates will help boost the market for energy storage during and beyond the forecast period. As with BESS developments in Germany, the rising share of renewable energy on the grid is causing a greater need for grid-balancing and several stand-alone battery installations have gone online or are under construction. Europe is on the way to building up its own value chain for battery storage systems including cell production. The EU battery industry is shifting its focus toward decarbonisation of the energy system.

Battery energy storage systems, global market snapshot

| Source: GlobalData, 2018 |

Other markets such as Africa, Middle East, and Latin America have only a few existing projects. It is expected that the rapidly increasing levels of renewable energy penetration in countries across the globe will help spur energy storage adoption. In the future, it is expected that photovoltaic (PV) plus storage will create the largest opportunity market for BESS.

Battery energy storage systems, global market drivers and restraints

| Source: GlobalData, 2018 |

According to the report, there are several factors that drive the uptake of the battery energy storage systems market globally. The rising share of renewable energy sources has necessitated the need for adoption of BESS technology. Secondly, with strong requirement for improved performance and proven solutions in niche market sectors such as telecom and data centers, there is a growing demand for battery storage. Thirdly, energy storage facilitates total utility bill savings regardless of the presence of PV generation. Fourthly, frequent power cuts are also forcing the adoption of this technology. Finally, the year on year fall in battery prices is driving the worldwide deployment of this technology and is one of the main reasons for the registered rapid industrial growth.

On the other hand, the BESS market is still facing several challenges. For example, the non-existence of equitable regulatory environment delays the rapid uptake of BESS projects. The market for BESS depends on reducing institutional and regulatory hurdles and encouraging public–private sector collaboration. Currently, no common codes or standards have been developed for energy storage devices, so each manufacturer is free to develop its own internal standards, leading to compatibility issues during installations and maintenance. The use of unique or customised spare parts, deployed in technologies manufactured by different companies, delays the effects of economies of scale for the industry. National regulations for promoting energy storage technologies should be put in place to enhance energy storage penetration. This would benefit the national power scenario by improving stability and reliability. Likewise, reliability and safety concerns in the BESS systems, lack of sufficient financing, need for support mechanism and policy drivers, and non-clarity on energy storage systems ownership are some of the factors that may hinder the rapid growth of BESS in the forecast period.

For more insight and data, visit the GlobalData Report Store – Power Technology is part of GlobalData Plc.