GlobalData’s latest report, ‘Tanzania Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of Tanzania and provides historical and forecast numbers for capacity, generation, and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape, and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

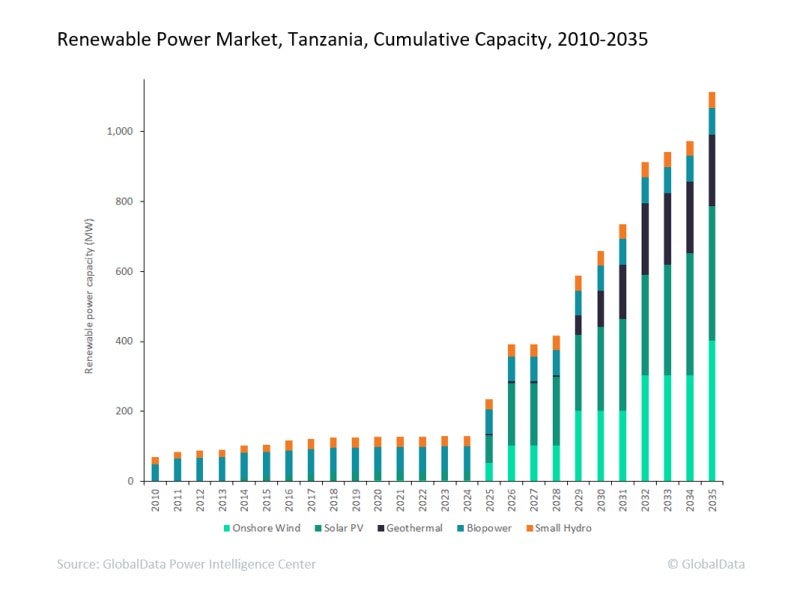

Installed capacity for renewables in Tanzania increased from 69 megawatts (MW) in 2010 to 127MW in 2021, at a compound annual growth rate (CAGR) of 5.7%. The cumulative renewable capacity is expected to rise to 1,115MW by 2035, growing at an impressive CAGR of 16.8% from 2021 to 2035, driven by Feed-in Tariffs (FiTs) and a rural electrification programme.

The Tanzanian Government has placed emphasis on developing renewable power, especially in areas where there is no connectivity to the grid. As a result, renewable power generation is expected to increase from 268GWh in 2021 to 3,040GWh in 2035, growing at a CAGR of 18.9%.

To meet rapidly increasing energy demand, Tanzania is currently implementing the National Rural Electrification Program in which it aims to increase the population’s electricity access from 36% in 2014 to 50% by 2025 and to at least 75% by 2033.

The programme aims to ensure the electrification of rural areas through renewable technologies, such as solar photovoltaics (PV) and onshore wind. The Rural Energy Board (REB), Rural Energy Agency (REA), and Rural Energy Fund (REF) were established to promote, stimulate, and facilitate access to modern energy services in rural areas of Tanzania.

Biopower (55.3%) held the dominant share within renewable power, followed by small hydro (21.9%) and solar PV (20.9%). Tanzania depends significantly on thermal and hydropower for meeting its electricity supply needs. In 2021, hydropower met around 28.4% of the country’s annual generation. The unpredictability of annual rainfall, however, has created considerable risk in depending on hydropower to meet increased generation demand.

Tanzania’s electricity consumption has grown at an average of 4.8% between 2010 and 2021. This rate is expected to rise in the future due to a higher rate of industrialisation, as well as greater residential demand as the government increases electricity access rates and boosts rural electrification. The government should bolster renewable power capacity to reduce its reliance on electricity and imports.

With respect to the power sector, the electricity consumption in the country was stagnant in 2020 with meagre growth of 0.3%. Electricity demand from industrial and commercial sectors declined significantly due to national lockdowns. However, in 2021, the consumption grew by 6.4% with the majority of demand coming from the residential segment. In 2022, the electricity consumption in the country is expected to increase by 5.3% as compared to 2021. The country is also supported by institutions such as the African Development Bank (AfDB), which invested $140m in 2021 to finance the construction of the 50 MW Malagarasi hydropower plant in Western Tanzania.