GlobalData’s latest report, ‘Germany Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations and Competitive Landscape’, discusses the power market structure of Germany and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

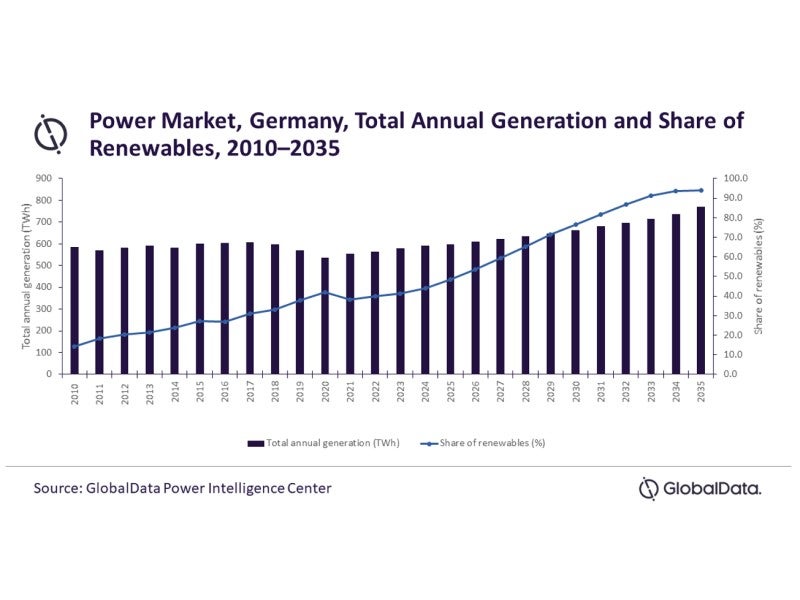

To help divert a potential energy crisis, renewables are expected to play a major role in meeting Germany’s power demand as a result of the country’s gas and coal supply being stunted due to EU sanctions placed on Russia.

However, as a result of Germany’s plans to phase out nuclear power by the end of 2022, few conventional plants will be present to pay off the fluctuations in the renewable sector. Although, based on the current energy crisis, the country is in talks to reconsider the phase-out of two nuclear stations.

Although the country has plans to rapidly develop renewable power, the country lacks the infrastructure to accommodate the distribution. Germany is also having to create transmission infrastructure for transporting electricity produced in the north of the country, where most of its renewable power generation assets are situated, to the south of the country, where most of the consumption is.

Currently, in the absence of this infrastructure, Germany has to export most of its renewable-generated electricity to neighbours, such as Poland and the Czech Republic. In turn, these countries have had to invest in technology that would protect their grids from blackouts resulting from power surges originating from Germany on particularly windy days. Germany has identified 3,800km of electricity lines that would need to be laid between the north and the south of the country, but this proposal has been opposed by local municipalities.

Since 2003, Germany has been one of the largest exporters of electricity in Europe. However, in order to meet climate protection obligations and decarbonise its energy systems, the government is working towards shutting down all 84 of its coal-fired power plants by 2038. The government has already initiated this process by shutting down around eight coal power plants in 2020. This is expected to increase the country’s dependence on imported electricity from neighbouring countries if the power generation gap is not filled by renewable energy sources.

Old thermal plants are being transformed into energy storage facilities so that excess power generated from renewables can be supplied at peak demand. Overall, the country will focus more on energy storage, combined heat and power generation, and the modernisation of grids to maintain energy security.

Germany’s GDP (at constant prices) increased from $3,396.4bn in 2010 to $3,873.0bn in 2021, at a CAGR of 1.2%. The GDP (at constant prices) of the country declined sharply from $3,944.4bn in 2019 to $3,764.1bn in 2020 because of the Covid-19 pandemic. After the recommencement of regular industrial and trade activities, the GDP grew by 2.9% in 2021 from 2020. The GDP is expected to cross pre-pandemic levels by the end of 2023.