The rapid expansion of data centres, driven by the surge in digitalisation and the increasing adoption of technologies such as AI, presents both opportunities and challenges for the energy sector. As the demand for data storage and processing power grows, so does the need for vast energy resources to sustain this infrastructure.

The data centre boom: can we keep up with unprecedented energy demand?

The growth of data centres over recent years has been nothing short of explosive. According to a report from the International Energy Agency (IEA), investment in new data centres has surged in major economies, particularly in the US, where annual investment in data centre construction has more than doubled in just two years. Companies such as Google, Microsoft and Amazon are leading the charge in AI adoption and data centre installations, recording a higher capital investment than that of the entire US oil and gas industry, totalling approximately 0.5% of US GDP.

The result is an unprecedented increase in energy demand, with hyperscale data centres now requiring more than 100MW of power, chiefly due to cooling requirements and electricity for computational power. Data centres already account for approximately 1% of global electricity consumption, and this is set to rise sharply in the coming years. The IEA forecasts that data centre electricity consumption could surpass 1,000 terawatt hours (TWh) by 2026, effectively doubling its consumption from 2022. In contrast, according to GlobalData forecasts, global power consumption and demand across all other end-user segments is only forecast to grow at a compound annual rate of 3.3% between 2022 and 2026. In the US specifically, the power demand from data centres is expected to increase dramatically, potentially accounting for as much as 9% of US electricity demand by 2030, with risks of straining grid reliability.

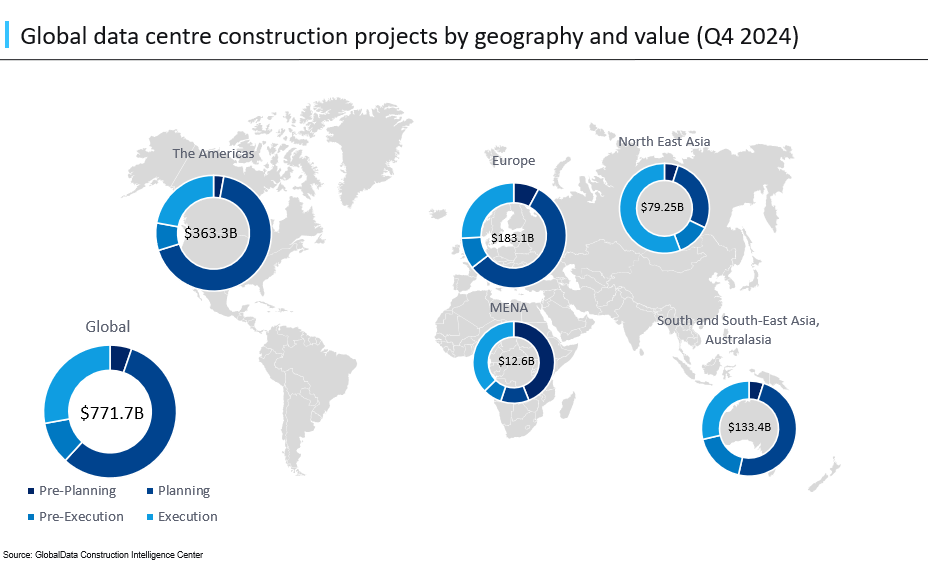

As demand for data storage and processing surges globally, data centre expansion is becoming increasingly evident. According to GlobalData’s construction database, between 2024 and 2025 (year-to-date), 1,601 construction projects for data centres were announced, with the US unsurprisingly leading the way with 469 upcoming projects, followed by China with 142 and India with 123. GlobalData Technology forecasts that the data centre market size is expected to reach $162.5bn by 2028.

This rapid growth across multiple regions reflects a global trend likely to further exacerbate the pressure on energy grids, as the expansion of data centres outpaces the development of energy infrastructure. The mismatch between the speed of data centre construction and the often-slow expansion of power generation and transmission infrastructure could create bottlenecks in energy supply.

Long-term PPAs: tech giants race to secure renewable energy

To meet the growing energy needs of their data centres, companies are employing a variety of strategies. One of the most common approaches is the use of power purchase agreements (PPAs), through which companies secure long-term renewable energy contracts to ensure a stable and cost-effective energy supply. According to the IEA, Amazon, Microsoft, Google, Meta and Apple are currently the largest corporate buyers of renewable energy globally, having contracted almost 50GW to date, equal to the generation capacity of Sweden. The GlobalData power database shows that these companies have signed long-term PPAs spanning a diverse range of renewable energy sources, including wind, solar, hydro and geothermal, allowing them to hedge against potential fluctuations in availability and ensure a more resilient energy supply. Recent examples include Google’s 12-year PPA to buy renewable energy from a 435MW solar plant to be developed, owned, and operated by energyRe. The project is set to support Google’s 2030 goal of running solely on carbon-free energy on every grid where the company operates. Another example is Microsoft’s PPA with Statkraft, Energia Group and Power Capital Renewable Energy, totaling 900MW, to cover its data centre operations in Ireland.

Through the PPAs, these companies help drive investment in renewable energy projects, which could support wider efforts to decarbonise the energy sector as well as hasten the development and growth of renewable technologies. The involvement of new renewable power plants set to come online to meet Microsoft’s PPA means that Microsoft will cover about 28% of Ireland’s entire renewable energy target for 2030.

Balancing the grid: battery energy storage and nuclear power to the rescue

While PPAs help secure renewable energy for data centres, they do not guarantee a constant supply, as the intermittent nature of renewable sources does not always align with the constant energy demands of these facilities. Battery energy storage systems (BESS) present a promising solution to this challenge. By storing excess renewable energy during periods of high production, they balance supply and demand, ensuring a reliable and continuous power supply for data centres even when generation fluctuates. BESS also improve the overall efficiency of renewable energy use by reducing reliance on backup systems such as diesel generators. A recent example of this was Microsoft replacing its diesel backup generators with BESS – worth 16 kilowatt hours of storage – from the company Saft, a subsidiary of Total Energies, at one of its data centres in Sweden. Although cost has been a barrier to wider deployment, ongoing declines in BESS component costs, driven by increased production and design advancements, have made them a more viable and attractive investment for data centre operators.

However, the challenge posed by variable weather conditions has also led to increasing interest in nuclear power as a potential solution, thanks to its high energy density and low carbon output. For example, Microsoft has recently signed an agreement with Constellation Energy to restart a shuttered nuclear reactor at the Three Mile Island site in Pennsylvania, subject to regulatory approvals. The power plant will supply 835MW of electricity to support its data centres. Google and Amazon have also both announced plans to invest in next-generation nuclear energy and small modular reactors (SMRs) as part of their strategy to secure reliable, low-carbon energy for their operations. According to the American Nuclear Society, Google has backed the start-up Kairos Power with a 500MW development agreement while Amazon, as reported in World Nuclear News, led a $500m financing round to support the start-up X-energy, which is developing a gas-cooled SMR.

SMRs are smaller, flexible and can be deployed closer to power transmission lines, potentially reducing costs and enhancing safety. However, regardless of the technology adopted, the costs associated with building the transmission and distribution systems required to support the increasing energy consumption by data centres are substantial. For this reason, it will prove challenging to ensure that these costs are not being passed down to ratepayers.

Action needed: safeguarding the grid and climate goals

The energy demands of the data centre industry are set to continue rising, and without continued investment in energy infrastructure, there is a risk that the growth of data centres could outstrip the capacity of local grids, putting both energy supply and climate goals at risk. For this reason, the European Union is implementing binding measures through its Energy Efficiency Directive, which requires data centre operators to conduct energy audits and report on their energy consumption. The directive exemplifies how a collaborative effort from policymakers, regulators and industry players is required to ensure that data centres can continue to grow sustainably.