The Inflation Reduction Act (IRA) is a sweeping climate and healthcare bill that will supercharge clean energy in the US for the next decade using $374bn in funding in addition to extensive tax credits. Analysis from Rhodium Group shows that the bill will result in an additional 10% reduction in emissions over 2005 levels by 2050, a significant step closer to its Paris Agreement pledge of 50%-52% reduction. The bill affects ten broad areas of clean energy:

- Hydrogen

- Renewable Energy and Storage

- Nuclear

- Clean fuels

- Clean vehicles

- Carbon capture, utilisation and storage (CCUS)

- Building materials and residential efficiency

- Energy-intensive industrial facilities

- Methane emissions

- Electric appliances, such as heat pumps and electric stoves

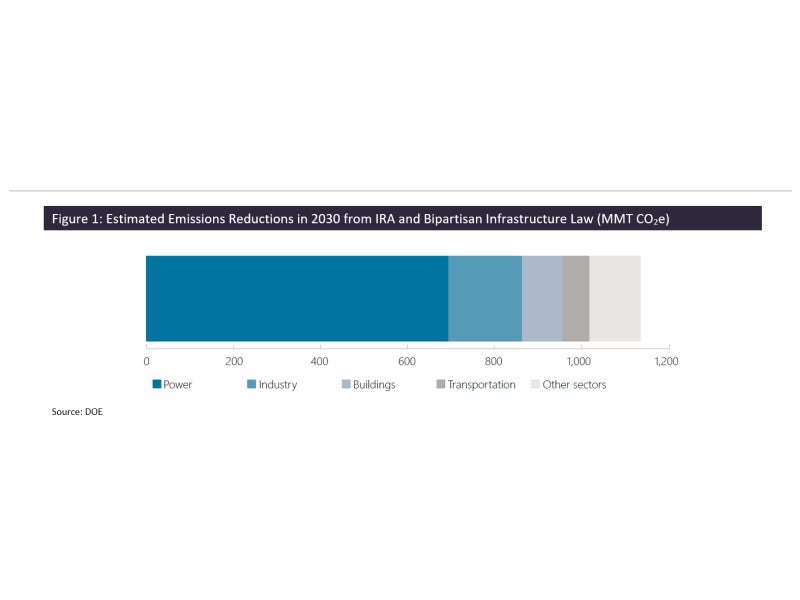

Analysis from the US Department of Energy (DOE) showed that about 60% of the emissions reductions resulting from the IRA by 2030 would come from the power sector. This deep cut is driven by production and investment tax credits for renewable energy and energy storage, a production tax credit for nuclear, investments to retire fossil plants, and a boost to the existing carbon capture tax credit. Coverage of the IRA’s effects in Power can be found in a separate analysis available on GlobalData’s Power Intelligence Center. The industrial sector will also see significant emissions reduction, driven by electrification, low-carbon fuels, carbon capture, and advanced manufacturing processes. The remaining reductions will come from buildings and transportation.

While the bill focuses heavily on decreasing costs in the US and de-globalising the nation’s supply chains, the effects are expected to reverberate globally in many sectors, due to the size and influence of the US market. The bill’s focus on reducing China’s competitiveness will allow greater competition from other free trade agreement countries, notably South Korea for its existing automotive, battery and energy industries. Furthermore, non-US companies that operate in the US can benefit directly by receiving tax credits. A further analysis of the sectors affected can be found below.

Hydrogen

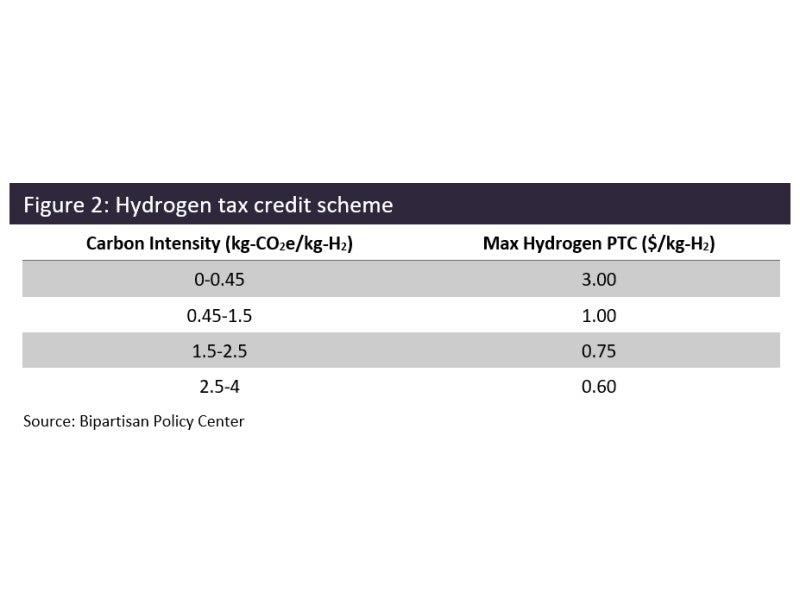

A production tax credit (PTC) is enacted for clean hydrogen, defined as having no more than 4kg-CO₂e/kg-H₂. The credit amount varies according to the carbon intensity of hydrogen, with any hydrogen having less than 0.45 kg-CO₂e/kg-H₂ receiving a credit of $3/kg. Essentially, this credit can make green hydrogen competitive with grey hydrogen by 2030. Green hydrogen in the US currently costs about $5/kg to produce, whereas grey hydrogen is close to $1/kg. US clean hydrogen will become among the cheapest in the world, creating a domestic hydrogen economy and competing in European and Asian markets. Supply chain effects of creating a US hydrogen economy will also create ripples to other markets as supply chains are built up and investments increase.

Clean fuels

The bill creates a PTC for low-carbon transportation fuel from 2025-2027, including sustainable aviation fuel (SAF). The maximum credit is $1/gallon or $1.75/gallon for SAF. This should go a long way toward reducing the green premium on SAF, which can help accelerate the adoption of the fuel globally. Credits and incentives are extended through 2024 for second Generation Biofuels, Biodiesel and Renewable Diesel.

$10m was allocated to support advanced biofuel industries that provide a 50% emission reduction over conventional fuels. $500m goes to infrastructure improvements for blending, storing, supplying or distributing biofuels.

Clean vehicles

The $7,500 credit for new electric vehicles (EV), plug-in hybrids and hydrogen fuel cell vehicles is extended with changes in criteria. The previous cap on vehicle sales per manufacturer is eliminated, which will allow models from Tesla, GM (Hummer, Cadillac Lyriq) and Chevy Bolt to regain eligibility, beginning in 2023, if they are under the price cap of $80,000 for vans, SUVs, and pickup trucks or $55,000 for other vehicles. A new feature of the credit, which has already taken effect, is that the vehicles must be assembled in North America. This removes eligibility for brands that include Kia, Hyundai, Mazda, Volkswagen, Porsche, and Toyota, which currently assemble their EVs elsewhere. About 20 models are eligible for credits through the end of 2022, with a few more to be added in 2023 when the manufacturer cap is lifted. In 2024 new restrictions begin to kick in that require a percentage of battery components to be extracted or sourced in the US or a Free Trade Agreement country, and for batteries to be assembled in North America. These stipulations are causing auto manufacturers to scramble to retool their supply chains in the next year and a half, and will likely bring a new wave of investment into the manufacturing of batteries and extraction of their raw materials in North America. In fact, two weeks after the IRA was signed into law, Honda and LG Energy Solution announced a deal to build a battery manufacturing facility in the US, likely in response to the legislation.

There is also a tax credit of up to $4,000 for used clean vehicles with a lower cap on price and income. For commercial use vehicles, up to $40,000 for clean trucks and buses. $1bn is allocated for clean heavy-duty vehicles, such as school buses and garbage trucks. $2bn is allocated through 2031 to retool auto manufacturing facilities for the production of clean vehicles. Properties tax credits are available for properties having EV chargers or other alternative refuelling infrastructure.

Carbon capture

The 45Q tax credit now has a later construction deadline of 2033, and the credit amount increases to $60-$85 per ton. Direct air capture is singled out for even larger credits of $130-$180/ton of CO₂. Additionally, the eligibility is expanded greatly to include small-scale carbon capture projects. According to analysis by the Clean Air Task Force, the higher level credit should more than cover the cost of capture and storage for applications in ethanol, ammonia and gas processing. It should cover most or all of the cost for a variety of other industries as well, including cement, hydrogen, and gas or coal-fired power plants.

Energy-intensive industrial facilities

The Advanced Industrial Facilities Deployment Program allocates $5.8bn to invest in reducing emissions from industries such as iron and steel, concrete, glass, pulp and paper, and chemicals.

Methane emissions

The extensive IRA is touted as the US’s largest climate investment to date, but lost in the coverage is one equally important milestone: the first nationwide emissions pricing scheme. The methane fee equates to $36/ton of CO₂e in 2024 and $60/ton of CO₂e in 2026. $40-$80/ton is considered the necessary range to spur levels of decarbonisation required by the Paris agreement. The fee will apply to 87% of upstream O&G methane emissions as reported to the Environmental Protection Agency’s (EPA) Greenhouse Gas Reporting Program.

Electric appliances

The High-Efficiency Electric Home Rebate Program will provide up to $14,000 for households, including $8,000 for heat pumps, $1,750 for heat pump water heaters and $840 for electric stoves. This funding will speed up electrification in the many US regions that mainly use gas-powered appliances. $500m was allocated to carry out the Defense Production Act for the production of heat pumps until 2024, which will direct manufacturing facilities to produce heat pumps. These could be sold in Europe as well as the US to alleviate the ongoing gas shortage there.

Sources: Bipartisan Policy Center, National Law Review, DOE, New York Times, Rhodium Group, BloombergNEF