Europe’s energy transition is moving at a fast pace. A clear and supportive legislative framework, including the Green Deal Industrial Plan (2023), and the Renewable Energy Directive (2023), together with government funding schemes, such as the EU Renewable Energy Financing Mechanism (2020-present), are helping accelerate this process.

The EU has set the ambitious target of becoming the first continent to reach carbon neutrality in 2050. However, even though its renewable capacity and generation shares are fast increasing, Europe still features among the world’s top emitters, together with China, India, and the US. Renewable energy technologies such as solar and wind are showing solid growth. Emerging technologies such as SAFs, CCUS, and hydrogen are on the rise, but at earlier stages of development. However, Europe is investing in their growth as it will play a crucial role in allowing the continent to reach its climate targets, thanks to its ability to decarbonise heavy-emitting industries.

Renewable power

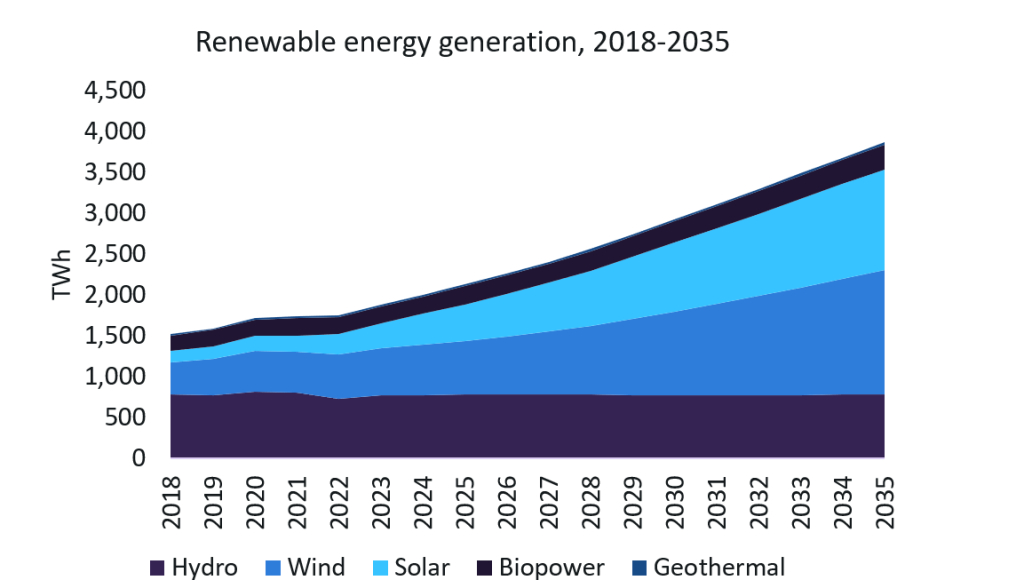

In 2023, the European power capacity share saw renewables contributing 54% of the total figure. This represented an 11% growth from five years prior, in 2018. GlobalData analysis predicts the share of renewable power capacity to grow at a CAGR of 8% between 2023 and 2035, and account for 75% of the overall European power capacity share by 2035.

The share of renewable power generation is also expected to increase from 40% in 2023 to almost 60% in 2035. Combined, wind and solar power generation is set to increase its share within the European power mix between 2023 and 2035, from 18.6% to 42%. By 2035, wind is forecast to reach a generation capacity of 1,524TWh and solar 1,236TWh. In 2023, four European countries had exceeded a 50% renewable generation share, namely, Norway, Sweden, Spain, and Germany. Norway is the current frontrunner, having achieved 98% power generation share from renewables in 2023, with 91% of its 98% renewable generation share coming from hydropower.

Company-wise, the 2024 European leader in solar power capacity is currently Enel, with an active and pipeline capacity of 2GW and 8.6GW, respectively. For wind power, the European leader is currently Orsted, with an active and pipeline capacity of 5GW and 34GW, respectively.

As renewables are growing, coal power is decreasing, with almost 100GW set to be decommissioned between 2024 and 2035. However, the same is not true for gas, as the technology is still seeing additions of approximately 66GW during the same period.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn terms of energy storage, in 2023, Europe’s capacity was 31% of the global share. This gap is currently predicted to widen as Europe’s energy storage capacity is set to contribute to only 13% of the global share in 2030. However, due to recent geopolitical crises, the EU is endeavouring to increase funding for the technology and implement legislation such as the Critical Raw Materials Act (2023) to increase capacity and ensure that the EU has access to a secure and sustainable supply of critical raw materials, such as lithium.

Transportation (EVs and SAFs)

As transport is responsible for one-quarter of all GHG emissions in the EU, investing in technologies that can reduce such emissions, such as EVs and SAFs, is a crucial step for Europe to achieve carbon neutrality by 2050.

In 2023 already, BEVs were the most popular alternative to petrol and diesel cars, representing more than 14.6% of all new cars sold in the EU. Furthermore, BEVs are set to account for 85% of all light-vehicle sales in 2036, growing at a CAGR of 25.3% between 2019 and 2036. However, not all European countries are moving at the same pace.

Several European countries have set targets to reach 100% zero-emission vehicle (ZEV) sales in the decade between 2025 and 2035. Norway, once again, is the frontrunner, aiming to achieve this target by 2025. Austria, Iceland, Ukraine, Israel, and the Netherlands are aiming to achieve it by 2030. The UK had initially announced intentions to achieve this target by 2030 as well, but in September 2023, former PM Rishi Sunak made a U-turn on the country’s climate commitments and delayed this goal by five years. Other countries, such as Denmark, Sweden, Ireland, Scotland, and Slovenia have also backtracked on meeting the 2030 100% ZEV sales target.

The EU is mobilizing to ensure emissions are cut in the aviation sector as well. With the new regulation RefuelEU Aviation (2023), EU airports and fuel suppliers are legally obliged to ensure that by 2050, 70% of jet fuel must be sustainable. This has led to a sharp growth in sustainable aviation fuels (SAFs), which are forecast to grow at a CAGR of 34% between 2020 and 2035. The Netherlands is set to have the highest SAF capacity in 2035, with 2.3 million tonnes (mt), and is aiming to completely replace fossil-based jet fuel by 2050.

Emerging technologies (CCUS and H2)

CCUS, a suite of technologies encompassing carbon capture, usage, and/or storage, plays a fundamental role in decarbonising hard-to-abate industries, such as power and cement. In terms of predicted 2030 CCS capacity, Europe ranks second, with 103mtpa, and North America first, with 152mtpa. However, the EU has laid out a clear framework, including plans such as the EU Industrial Carbon Management Strategy (2024), which will facilitate the growth of this technology in the upcoming decade. Through funding schemes too, such as Horizon Europe, the EU has already invested more than €540m in innovative CCS solutions. For this reason, Europe’s capture capacity is set to grow at a CAGR of 111% between 2023 and 2030. Still, to reach climate neutrality by 2050, the EU will need to be able to capture a staggering 450mtpa of CO₂ by 2050.

Hydrogen will play a crucial role in the energy transition of every region. Whilst North America has the highest active capacity for hydrogen production, Europe’s pipeline capacity is improving within the global standing. Additionally, Europe’s hydrogen pipeline is secure on two fronts. Firstly, it consists of multiple small-scale projects which average a similar capacity. North America’s entire pipeline, on the other hand, hinges upon a very small number of large-scale projects, meaning that if a single large-scale project fails to reach completion, the entire landscape changes dramatically. Secondly, a high proportion of Europe’s pipeline has already reached the post-feasibility (23%), and feasibility (24%) stages, indicating a high likelihood that the projects will be completed. This is due to a supportive framework of policies and investments, such as the Hydrogen and Decarbonized Gas Market Package (2024), and the Hydrogen Public Funding Compass (2021-2027). To conclude, Europe has taken substantial steps forward in its energy transition. However, the achievement of its climate targets will ultimately hinge upon continued legislative and financial support from the EU, as well as individual countries sticking to their commitments.