Last year, on 31May 2018, China announced departure from its ambitious photovoltaic (PV) installation targets, shaking the industry around the world. It was estimated that a sharp decline of demand in China would create an oversupply of more than 30GW of PV modules and result in a significant negative impact on solar companies globally, across the value chain.

China retains a high degree of central economic planning; this means that the policy of the Chinese central government has a direct impact on industrial development. As a result of a supportive policy environment, China’s PV industry achieved a record installation of 53GW in 2017. This trend continued through the first half of 2018, and analysts expected further growth for the full year. China Photovoltaic Industry Association (CPIA) data showed that the production output of polysilicon, PV wafers, cells and modules recorded similar growth rates in H1 2018 as they had in 2017, but dropped sharply after June as a result of the new policy.

It was speculated that it would result in the direct reduction of China’s total PV market by about 30% – and being the world’s largest PV end-market, the impact would be felt right around the world. The policy changed the entire industry so significantly that it was considered an abrupt brake which hurt the industry and caused chaos across the Chinese solar supply chain. With the subsidy gone, planned projects had to be financially reevaluated. Most of them were now viewed as undeniable, and were eventually cancelled. Signed contracts between module manufacturers and their distributors had to be reconsidered, and many of these deals were postponed indefinitely, resulting in a number of bankruptcies. In turn, module manufacturers cancelled cell orders from their vendors. This then expanded to the upstream segment, and then the entire industry was affected.

In October 2018, China Photovoltaic Industry Association’s (CPIA) Q3 2018 installation data surprised everyone as new PV installations in Q3 reached 10.21GW, with 4.89GW for distributed PV and 5.32GW for ground-mounted PV. This was much higher than the pessimistic predictions had suggested. However, this growth rate was still a sharp drop, as was expected. Later, full year installations for 2018 were recorded as 44.1GW, showing a year-on-year decline of around 17% –less severe than initial estimates of a 30% or greater retraction. This could be considered a result of the inertia the solar sector had built up over the previous two years.

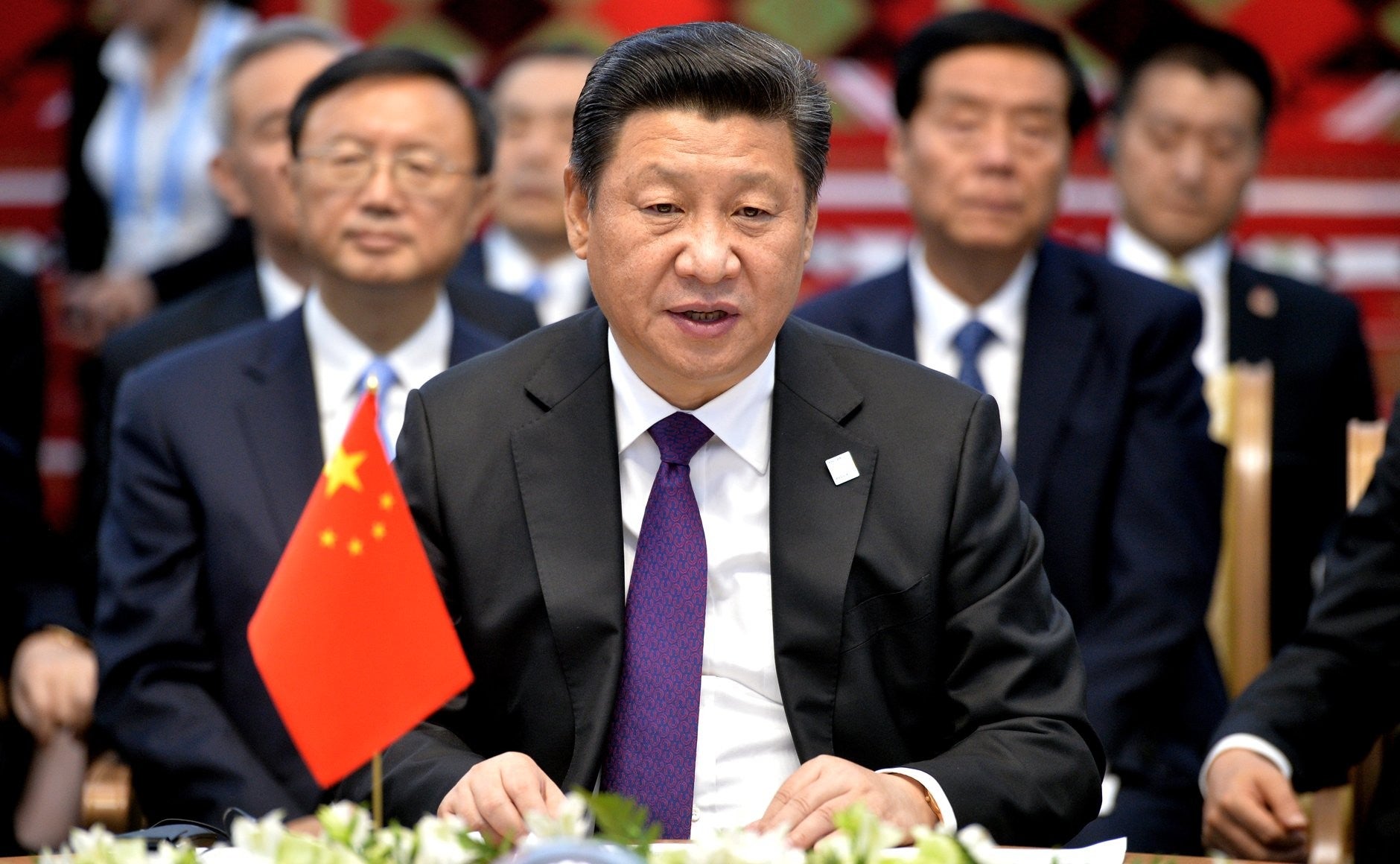

On 1 November 2018, Chinese President Xi Jinping had a high-level meeting with entrepreneurs from China’s major private enterprises where he reaffirmed the importance of private enterprises to the country and committed to continuing government support. The next day, China’s National Energy Administration (NEA) organised a meeting with major PV players and made two cordial announcements. First, the NEA proposed to increase the previous PV installation target set as a part of China’s 13th Five-Year Plan. The new potential target is between 250 and 270GW by 2020. This means it will continue to be 40 to 50GW of solar installations to be realised in each of the following two years. Second, NEA formally committed to ongoing subsidies for PV through 2022.

The core issue remains intact that surcharge fund is no longer sufficient to pay for existing installations, let alone new capacity. According to the NEA, in 2017, China’s Renewable Energy Development Fund reached a deficit of RMB 112.7 billion (US$16.bn). The rapid uptake of solar has contributed significantly to this shortfall. Reduction in the cost of PV market subsidies was clear motivation for the policy announced in May 2018. It appears that either new funds must be collected or made available, or the price of PV power must become genuinely competitive with other energy sources.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataNew push on grid parity solar

On 9 January 2019, the National Development and Reform Commission (NDRC) and NEA announced that there will be no quotas for solar projects developed without central government subsidies for the next two years, however, there will still be limits on project development to some extent. For instance no new PV will be permitted in the autonomous region of Xinjiang or in the province of Gansu due to curtailment problems there. Similarly, the central government will impose some control on new solar capacity across a further 12 provinces and parts of seven others. The new policy has removed any limits on non central-subsidized PV projects across 12 provinces and parts of three others.

Local authorities will be permitted to offer incentives without risking the ‘grid parity’ special status of such schemes. All central-government-subsidy free projects upon which construction has started by the end of next year (2020) will be eligible for the new regime and planned projects need only secure development permission from provincial authorities with reference to irradiation levels, power consumption requirements, grid connections and other local factors.

The policy insists that local authorities minimise non-technical development costs including land fees, taxes and other charges and ensure there are no ‘binding conditions’ which could hinder projects. Provincial energy management companies are required to provide sufficient grid connections for all grid-parity projects and any curtailment losses by such PV schemes will be passed on to the national power market, ensuring that developers do not suffer losses for any electricity generated which does not reach end-users. The direct supply of energy to nearby consumers is to be incentivised with lower costs and local power companies will be encouraged to sign long-term PPAs, even when transmission takes place between provinces. The move away from subsidies requires regional governments, state-run banks and grid operators to help expedite the development of zero-subsidy solar projects.

Green Power Certificates will also be made available to grid-parity projects as an additional source of income for developers. This will be particularly important because the pricing of such certificates, dependent on a renewable portfolio standard, could carry broad implications for the pricing of power-purchase agreements.

A positive step forward

Though grid parity policy needs further operational guidance, pointing to the need for procurement policy mechanisms to facilitate deployment as well as clearly defined methods for identifying regions suitable for subsidy-free PV, it seems to explore market readiness for a permanent policy shift away from subsidy.

China has been looking for new ways to sustainably continue its support of renewables without feed-in-tariffs (FITs). Shifting to auctions could be a strong solution in a post-FIT world, particularly as they can be adapted to various market mechanisms. Auctions are likely to produce a more narrow range of pricing and should help address the need to reduce investment cost while continuing deployment of low-carbon energy. With several other nations having observed how reverse auctions have rapidly reduced the cost of solar electricity, China is preparing to switch to an Auction System soon.

Related Company Profiles

National Energy Administration

Dogpatch Labs Management DAC

NEA

China Photovoltaic Industry Association