The Turkish Akkuyu nuclear power plant (NPP) project has restarted after the Turkish Government signed a deal with the Russian Government. The intergovernmental cooperation agreement on the NPP was ratified in 2010.

Delayed in 1999 and cancelled in 2000, the project was originally intended to produce 3,000MW. The first unit was commissioned in 2006 and the second in December 2007.

The first unit is expected to achieve its first criticality in the second half of 2019. The remaining three units will come online in yearly intervals once Unit I begins commercial operations in 2020. The project is estimated to cost $20bn and will be Turkey’s first nuclear power plant.

The foundation for the power plant’s offshore hydraulic engineering structures (OHES) was laid in April 2015. The Cengiz Insaat Sanayi ve Ticaret JSC (joint stock company) was awarded a $394m contract to design and construct the OHES.

The Akkuyu site is connected by sea, enabling transportation of heavy machinery to the site. It is close to centres of electricity consumption such as Adana, Konya, Antalya and Mersin. There is also a relatively lower population density in the region.

The first public hearing session on the project’s environmental impact assessment (EIA) report was held in March 2012. Participants of the meeting, especially representatives from Greenpeace, objected to the EIA, saying that it fails to address the environmental impacts of the plant.

The EIA report was approved by Turkey’s Ministry of Environment and Urbanisation in December 2014.

Developer for the nuclear power plant project

The nuclear plant will be built, owned and operated by a Russian subsidiary of Rosatom, a state-owned nuclear company. In December 2010, Rosatom created a project company named the Akkuyu Electricity Generation JSC. JSC Atomstroyexport, JSC Concern Rosenergoatom, Atomenergoremont and Atomtekhenergo, and JSC Inter Rao Ees founded the new company. Foreign investors are allowed to invest up to 49% in the new company.

State-owned company Elektrik Uretim (EUAS) provides the site required for the four reactors.

Akkuyu NPP scheme background and history

Bidding for the plant was originally announced on 13 December 1996. Bids were received by October 1997. The contract was supposed to have been awarded in October 1999, but the deadline was extended to 31 December 1999 and the project was eventually cancelled in July 2000.

The plant was first suggested in the 1970s, and bids were invited in 1977. However, the project fell through for financial reasons. The second round of bidding was originally for a turnkey project, but this was changed to a build-operate-transfer (BOT).

Discussions with a Canadian consortium led by AECL fell through partly for financial reasons and partially because the Chernobyl accident threw uncertainty over the whole project. In the mid-1990s, the project was resumed, creating the current round of bidding.

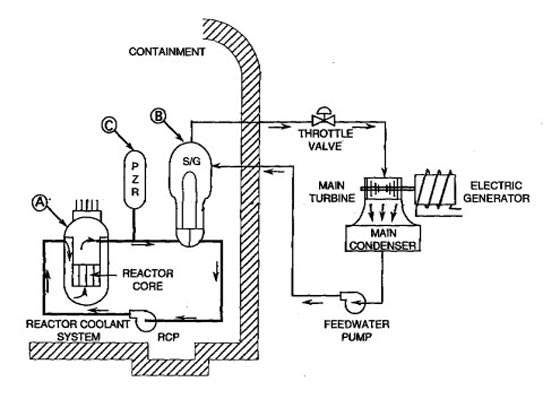

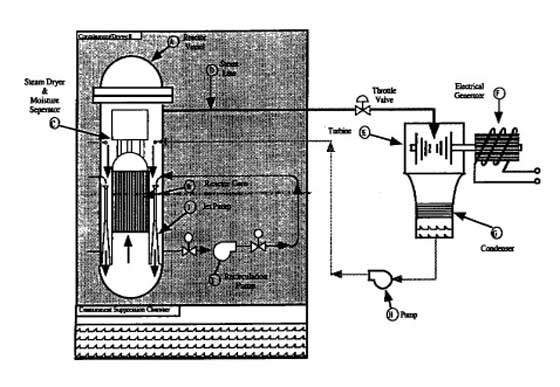

Two bids for the 3,000MW plant were originally requested. The first (main) option had to have a maximum net output of 1,400MW (with one or two units according to the size offered). The second option was to have a maximum net output of 2,800 MW (two or four units according to the size offered). Both options highlight an output increase of 5%. The plant could be PWR, BWR or PHWR. The minimum unit size was 600MW, and the minimum plant size was 800MW.

The accepted bidder had to meet several criteria, such as five years of experience with this type of power plant, licensed to operate in the country, previous experience of constructing and commissioning at least two nuclear plants, designation of a reference plant similar to Akkuyu and designs must not have had a previous accident.

Turnkey basis for the bid and bidder responsibilities for the Turkish facility

The bid was to be for a nuclear power plant on a turnkey basis. This was to comprise a nuclear and turbine island, fuel storage system (with 20 years spent fuel capacity), coolant water intake and outlet structures and GIS Substation of 154kV and 380kV. In addition, the successful bidder had to supply two years fuel (during the warranty period), with an option to supply fuel for a total of seven years.

The bidder would supply spare parts and supervise the plant for the two-year warranty period with an option for an additional three years thereafter. The bidder would train the plant staff and construct the ancillary facilities.

Bids were submitted by three consortia, namely Atomic Energy of Canada, in partnership with Turkish firms Guris and Gama Bayinder; Westinghouse-Mitsubishi, in partnership with Turkish firms MNG and Enka; and NPI (Fromatone and Siemens), in partnership with Turkish firms Simko, Garanti Koza, STFA and Telefon.

Concerns over the Turkish nuclear power plant facility

Largely because of nuclear’s high ‘hidden’ costs and waste disposal problems, environmental groups tend to oppose all nuclear projects. In the case of Turkey, the area is also prone to earthquakes, with a 6.2 Richter-scale earthquake having hit Adana, 180km from the plant site.

While the plant is being designed to withstand earthquakes of up to 6.5 on the Richter scale, the possibility of a stronger quake has caused concerns.

Another reason for resistance in western countries is the possibility of nuclear weapons. Civil power plants can produce plutonium for military uses. The volatility of internal Turkish politics, along with the country’s chequered history with some of its neighbours, has made this another matter for concern.

Mersin residents were also displeased with the government’s decision to go ahead with the Akkuyu NPP project. In April 2011, an anti-nuclear human chain was formed in the western quarters of the city to protest the decision.

Power purchase agreement guarantee for Turkey’s Akkuyu nuclear power plant

Turkish Electricity Trade and Contract Corporation (TETAS) guaranteed the purchase of 70% power generated from the first two units and 30% from the third and fourth units over a 15-year power purchase agreement. Electricity will be purchased at a price of 12.35¢/kWh and the remaining power will be sold in the open market by the producer.