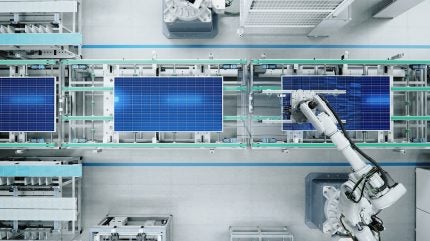

China’s Ministry of Industry and Information Technology has finalised new investment guidelines for solar photovoltaic (PV) manufacturing projects, as reported by Reuters.

The move aims to curb overcapacity in the sector, a persistent issue that has led to a significant drop in prices.

The guidelines, released on Wednesday 20 November 2024, stipulate that companies must maintain a minimum capital ratio of 30% for solar PV projects, an increase from the previous 20% for certain PV projects, with the 30% ratio previously reserved for polysilicon manufacturing.

The ministry’s guidelines, while not mandatory for project approvals, set out expectations on efficiency and energy consumption and encouraged local governments to allocate manufacturing projects judiciously.

The guidelines are part of China’s strategy to promote upgrading and structural adjustments within the PV industry.

This development comes on the heels of a reduction in export tax rebates for solar components, which is likely to cause slight price increases for international buyers as manufacturers pass on the costs.

Oversupply challenges could persist for up to two years despite the measures, according to solar panel manufacturer Longi Green Energy Technology.

Longi Green posted a net loss of 5.24bn yuan ($739m) in H1 2024 against a net income of 9.2bn yuan a year previously.

The loss fell within the range anticipated by the world’s leading producer of solar wafers in July 2024, with Longi attributing it to a “mismatch” between supply and demand, which caused a sharp decline in prices for its key products.