Oceania’s energy transition has gotten off to a slow start, with Australia and New Zealand accounting for the lion’s share of developments in energy transition in the region. However, Australia’s 2024-2025 federal budget suggests that the region is overall trending in the right direction. Government funding schemes and new initiatives, such as Australia’s National Interest Framework (2024), will be vital in transitioning to a net-zero environment.

All 14 of Oceania’s nations have set 2050 as the year to achieve net zero – in line with the Paris Agreement. Its renewable power capacity share has increased, growing at a CAGR of 12% from 2015 to 2024, however, fossil fuels still account for over half its power generation share showing that Oceania is still overly reliant on the latter.

The breakdown of its generation and capacity

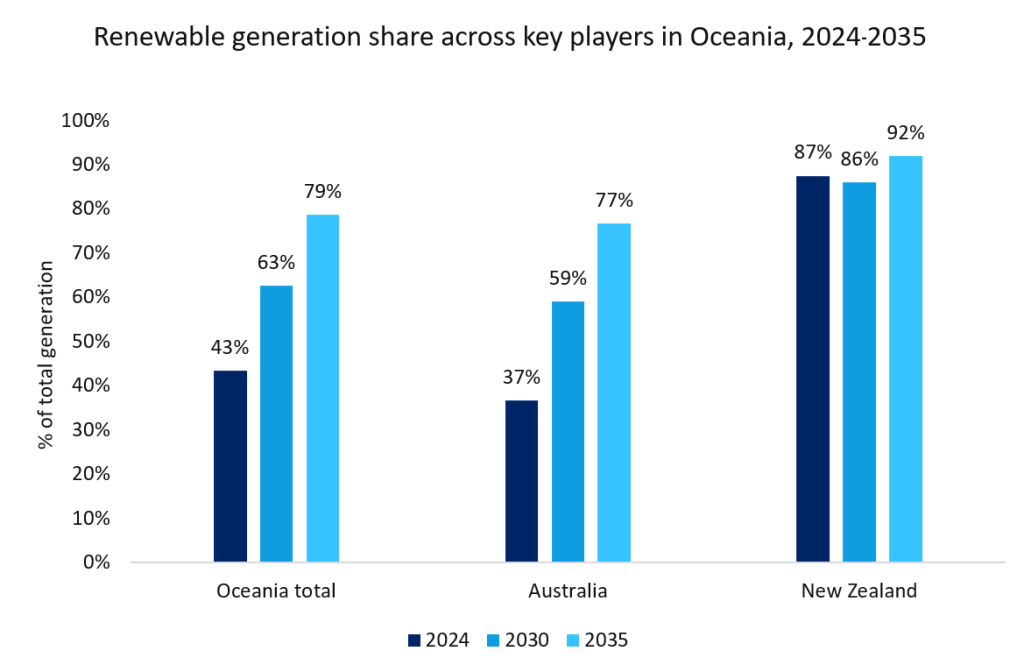

For Oceania, it is clear it can generate its power chiefly from renewables due to its abundant solar resources, as well as its coastal wind potential. However, the data shows that most of the power in the region is still generated from fossil fuels. Renewable technologies make up 59% of the power capacity share while only contributing 43% to the generation share, however, there are signs that Oceania aims to shift this dynamic over the next decade. Through government initiatives such as A Future Made in Australia (2024), public investment is being pumped into renewables such as solar with the A$1bn Solar SunShot programme as a part of the National Interest Framework. It identifies sectors such as solar or wind, which it recognises as having a regional competitive advantage, and invests in projects on the basis that they contribute towards a net zero roadmap while also enhancing economic resilience and security. This is reflected in GlobalData’s generation database, where the combined share of wind and solar within Oceania’s power mix is expected to increase from 26% to 66% between 2024 and 2035.

As the region’s top emitter, Australia’s renewable generation share is only 37% in 2024 while New Zealand’s is 87%. New Zealand’s electricity has been primarily generated from hydropower, however, the extent to which means that the country is not fully capitalising on its solar and wind potential and the falling project costs of these technologies. Projects such as the Lake Onslow pumped hydro scheme, which would have improved New Zealand’s energy storage capacity, have been scrapped by the government. This is owing to hydro being a capital-intensive technology caused by the scale of typical projects and uncertainty over the direction of New Zealand’s upcoming energy transition strategy. Despite this, it is still forecast to reach 92% renewable power generation by 2035, something which Australia must try to emulate.

Australia remains the fifth largest producer, the second largest exporter and has the third largest reserves of coal globally. Despite its efforts to diversify its power mix and reduce domestic coal usage, decommissioning almost 16GW of coal power between 2024 and 2035, coal continues to play a key role in Australia. There are doubts as to whether the pace at which fossil fuels are being phased out is sufficient and whether enough is being done to offset emissions from existing thermal-based generation assets to enable Australia to reach its 2050 targets.

Oceania needs to leverage its vast wealth of resources

Australia is the major market for energy storage in Oceania. In 2024, its capacity amounted to just over 6GW representing only 2% of the global energy storage capacity. This capacity is set to grow at a CAGR of 28% between 2024 and 2030, which is greater than the global growth rate of storage capacity which is 16%. Battery energy storage will be the storage type that sees the largest growth with a CAGR of 38% between 2024 and 2030. Developing a more secure energy storage capacity is key to reducing the impact of the intermittent nature of renewable energies such as solar and wind and addressing energy security concerns.

Batteries will also be key in the transport sector. Transport emissions account for 17% of New Zealand’s total emissions and 21% of Australia’s emissions. Due to the scale of emissions from the sector, both governments have stressed the importance of electrifying the transport industry by expanding its electric vehicle fleet and improving existing EV charging infrastructure by introducing the National Electric Vehicle Strategy (Australia, 2023) and Charging our Future (New Zealand, 2023) to ensure that the progress is smooth. According to GlobalData’s Automotive database, this is evidenced in Australia with BEV being forecasted to make up 47% of all light vehicle sales and EV charging sites expected to grow from a total of 1,325 sites in 2024 to almost 2,350, both in 2028.

With the solution to decarbonising transport being focused on electrification, the development of renewable energies, primarily solar and wind, and supportive energy storage technologies remains imperative to a fully electrified transport system which is integrated into a green energy network.

Yet for a sector that contributes such a significant proportion of emissions, the BEV sales share does not seem sufficient if Oceania is serious about reducing emissions. More needs to be done to incentivise the purchase of EVs over ICEs, whether that be through more exemptions or further improvement of infrastructure.

Summary

In summary, Oceania is introducing legislation and investment that is paving the way for its energy transition, in a bid to tap into its vast renewable potential. With fossil fuels still accounting for over 50% of its power generation share, the reliance the Australian economy still has on coal, and the increasing precedence placed on electrifying sectors, Oceania needs to increase the momentum of progress within the renewable energy industry. The expansion of its solar and wind capabilities supported by the deployment of scalable, modular energy storage systems, is key in the feasibility for industries to completely electrify their processes. This will only be more feasible through continued legislative and fiscal support from governments to incentivise private investment at scale.