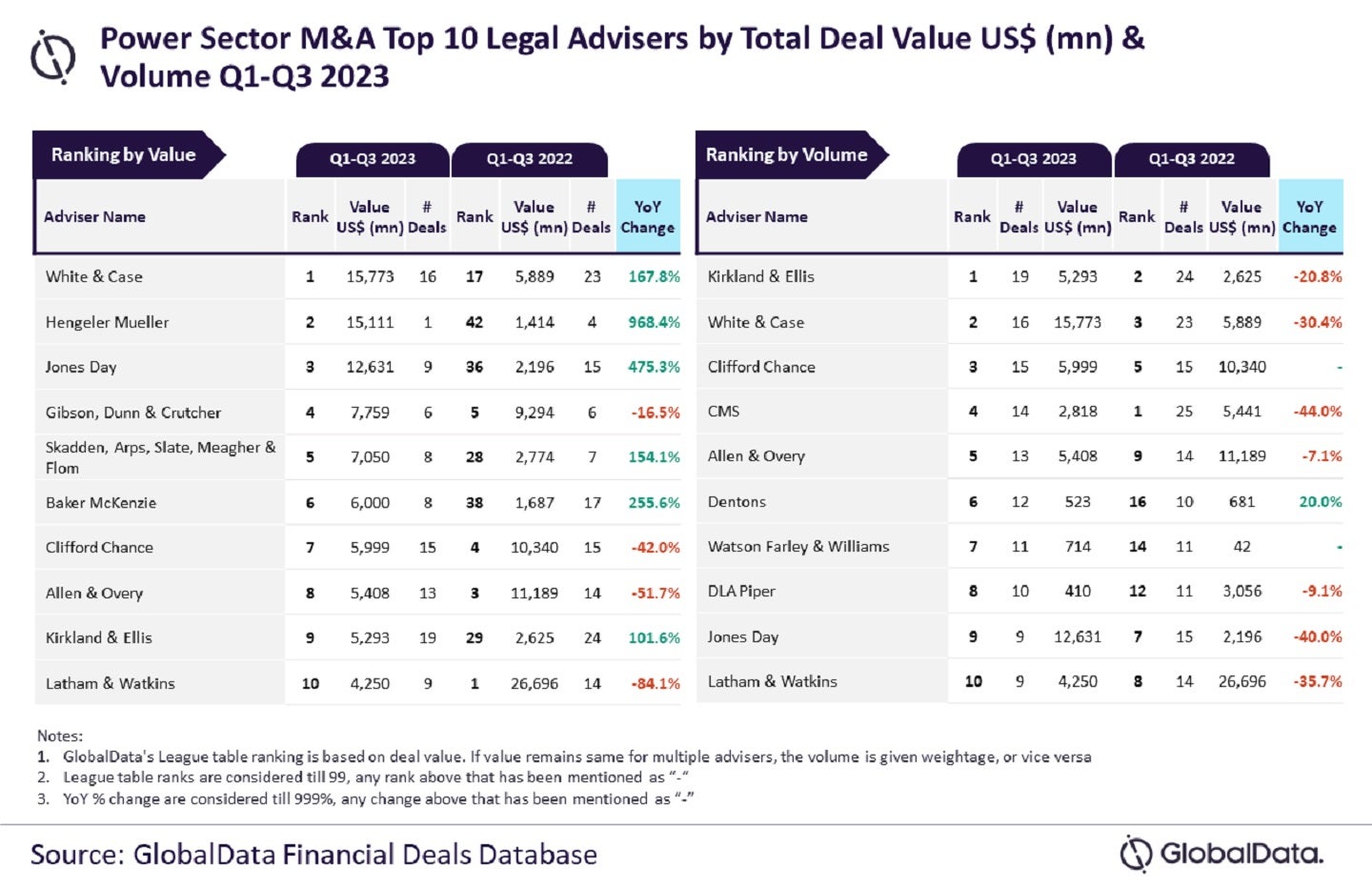

GlobalData’s latest league table reveals that White & Case and Kirkland & Ellis were the top legal advisers for power sector mergers and acquisitions (M&A) from the first to the third quarters (Q1–Q3) of 2023 in terms of value and volume, respectively.

According to the data and analytics company’s Financial Deals Database, White & Case advised on deals worth $15.8bn to occupy the top spot by value.

Hengeler Mueller advised on deals, valued at $15.1bn, to take second spot.

Jones Day was ranked third by value, after advising on deals worth $12.6bn.

Gibson, Dunn & Crutcher, which advised on $7.8bn worth of deals, was placed fourth in the list, while Skadden, Arps, Slate, Meagher & Flom was ranked fifth with deals worth $7.1bn.

In terms of volume, Kirkland & Ellis advised on 19 deals to take the leading position.

White & Case came second by volume after advising on 16 deals, while Clifford Chance occupied the third position by advising on 15 deals.

CMS was fourth with 14 deals, and Allen & Overy fifth with 13.

GlobalData lead analyst Aurojyoti Bose stated: “Due to the involvement in the $15bn deal to acquire Toshiba by TBJH, the total value of deals advised by White & Case as well as its ranking by value took a major jump in Q1 to Q3 2023 compared with Q1 to Q3 2022. However, it faced close competition for the top spot by value from Hengeler Mueller.

“Apart from leading by value, White & Case also occupied the second position by volume during Q1–Q3 2023. Similarly, Kirkland & Ellis, which led by volume, also occupied the ninth position by value.”

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory company websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.