GlobalData’s latest report, ‘Saudi Arabia Power Market Size and Trends by Installed Capacity, Generation, Transmission, Distribution and Technology, Regulations, Key Players and Forecast, 2022-2035’, discusses the power market structure of Saudi Arabia and provides historical and forecast numbers for capacity, generation, and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

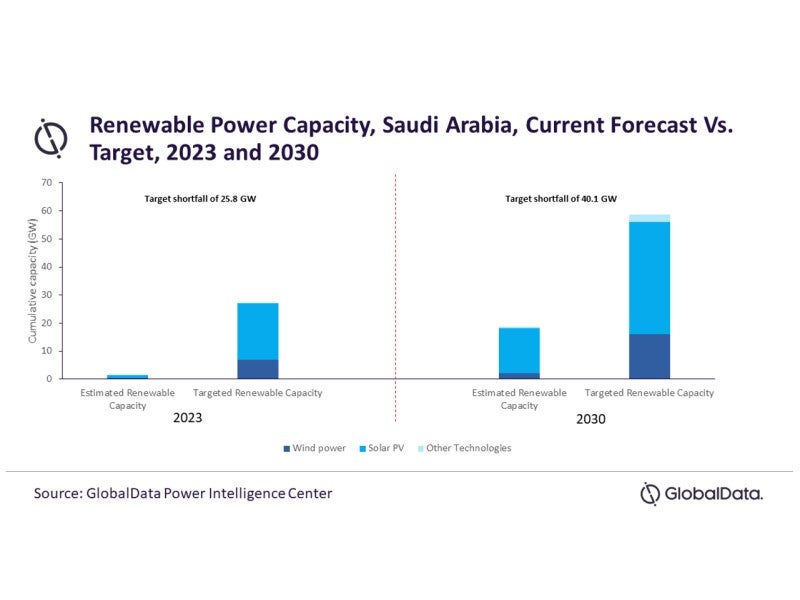

Under the Saudi Arabia Vision 2030, the country revised its renewables target to achieve 27.3GW of renewable power capacity by 2023 and 58.7GW by 2030. However, at its current rate of renewables development, the country is not even close to the 2023 target and even the 2030 targets look out of reach. Saudi Arabia’s current renewable capacity additions see the country adding an average of 0.1GW a year between 2010-2021, which will eventually lead to a shortfall of 25.8GW to its 2023 target.

The power sector in Saudi Arabia is facing numerous challenges when it comes to renewable power. Its issues range from low transparency to a lack of skilled human resources, an overarching bureaucracy, a high dependence on desalinated water, and low energy efficiency. Enforcement of contracts is also a concern. Further, the country is known to be a difficult location in which to start a business, it has low levels of international trade and there isn’t a robust insolvency resolution system in place.

There is a lack of continuity regarding policy making and administrative direction, which is a major concern for the development of renewable power. For instance, the King Abdullah City for Atomic and Renewable Energy (KA-CARE), which was moderately vested with powers, was stripped off its nodal status after the change in government.

Not only does the government need to ensure that the current plans are implemented in a timely manner, but the development of renewable power capacity additions need to be fast tracked if they are to have a chance at meeting the 2030 target. The country should look at enabling strong policies and provide incentives for the growth of small-scale renewable power in the country.

Further, the institutions and policies that support the development of renewable power are changed too often, and the processes and permits for renewable power plants should be eased. The country could look to extend international partnerships for technology transfer to ensure efficient and reliable renewable power network.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGDP increased from $528.2bn in 2010 to $692.3 bn in 2021 at a CAGR of 2.5 % (constant rates). The Saudi Arabian economy is largely dependent on oil exports. Service sector dominates the GDP of the country. The government has recently increased its focus toward the development of industries. However, industrialisation has been progressing slowly, due to a lack of transparency in governance, cumbersome bureaucracy, a shortage of skilled human resources and political instability in neighboring countries, which have created an uncertain investment climate.

Related Company Profiles

KeyPlayers Inc