GlobalData’s latest report, ‘Mexico Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of Mexico and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

Since the change in government in 2018, the growth in Mexico’s renewable power sector has been slower, growing from 10.2GW to 17.8GW, compared to the growth the sector saw between 2013 and 2018 when constitutional reforms allowed the renewable sector to take on a larger role, allowing the industry to grow from 3.5GW to 10.2GW.

The country’s present government is looking for ways to restore renewable energy’s growth trajectory and passed a bill in March 2021 to assist with this. The government has stated that this is to minimise corruption and induce healthy competition between the state and private companies. However, the amendment has led the Federal Electricity Commission (Comisión Federal de Electricidad, CFE) to take control of the power sector.

According to the amendment, the CFE owns at least 54% of the power market and prioritises its own power generation and not the lowest cost power. The CFE generates power from nuclear, hydro, natural gas and oil. Most of the green power produced in the country is by the private sector, which means that with the current reform it would be dispatched last, despite being cheaper. This will eventually make the sector less attractive to private players and will gradually lead to increased electricity bills for end-consumers.

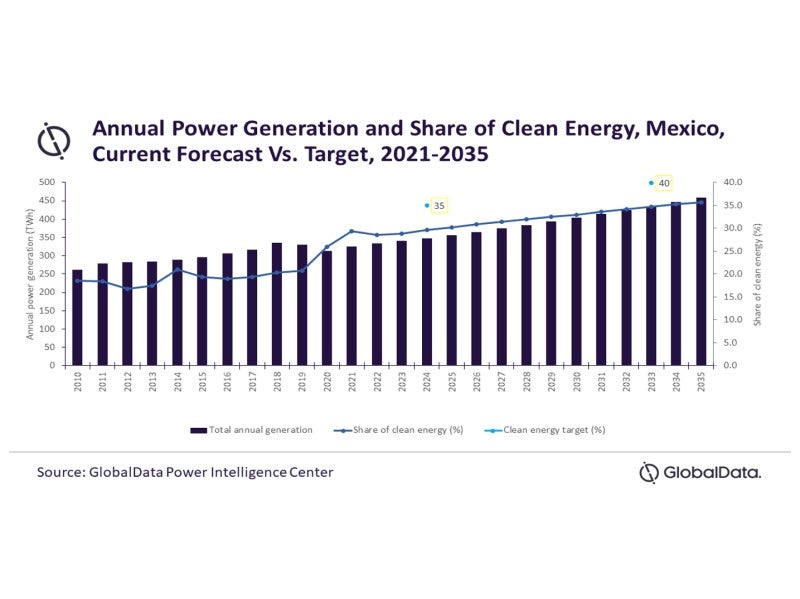

Under the Energy Transition Law, Mexico aims to achieve 35% of its electricity generation from clean energy sources by 2024, 39.9% by 2033, and 50% by 2050. Despite this, the targets do not seem achievable, especially with the government still favouring traditional technologies of electricity generation. Even with the inclusion of large hydro and nuclear power generation in its clean energy targets, Mexico is still not on track to meet its goal.

Despite having a strong presence since the 2000s, the Mexican renewable power market has witnessed slow growth due to administrative barriers. Electricity generation is dominated by thermal power technology, accounting for a share of 70.7% of total generation in 2021. The country’s first renewable power auction was conducted in 2016, and between 2016 and 2018, three rounds of auctions were conducted, awarding nearly 7.7GW of renewable power capacity. The fourth auction, scheduled to be held in 2018, was cancelled, with the government stating that the auctions were only delayed, however, they still have not been rescheduled.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMexico has massive potential for harnessing power from wind. The states of Oaxaca, Yucatan and Tamaulipas have registered wind speeds greater than 8m/s. Additionally, as most of the areas in Mexico receive an average insolation of 4.5kWh/m² daily, solar photovoltaics (PV) also has huge development potential. The government should look at exploiting this potential and expedite stalled renewable auctions. Ways this could be achieved include providing incentives to encourage private participation even at the small-scale, framing favourable policies, and creating a competitive market, encouraging private participation.

Mexico’s GDP (at constant prices) increased from $1,057.8bn in 2010 to $1,269.9bn in 2021, at a CAGR of 1.7%. The GDP (at constant prices) of the country declined sharply from $1,309.9bn in 2019 to $1,201.0bn in 2020 because of the Covid-19 pandemic. The Mexican Government implemented national lockdowns to curb the spread of Covid-19, which resulted in reduced demand. The GDP rose 5.7% in 2021 from 2020 and is expected to cross pre-pandemic levels by 2023. During 2021-2030, the GDP of the country is expected to reach $1,517.8bn.

Related Company Profiles

C.F.E. s.r.l.