Business optimism improved in June 2022 compared to May 2022, even amid concerns over rising costs and slowing demand, revealed an analysis of an ongoing poll by Verdict.

Verdict has been conducting the poll to study the trends in business optimism during COVID-19 as reflected by the views of companies on their future growth prospects amid the pandemic.

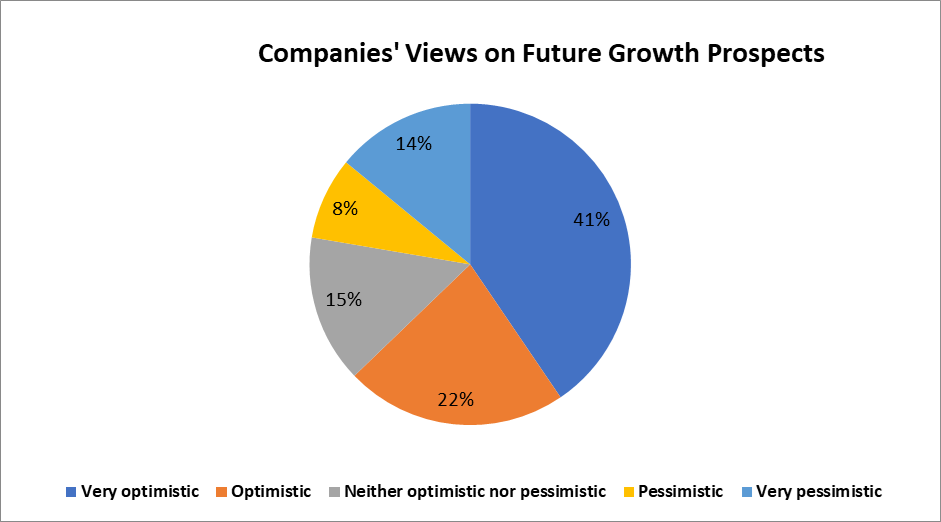

Analysis of the poll responses recorded in June 2022 shows that optimism regarding future growth prospects increased by five percentage points to 63% from 58% in May 2022.

The respondents who were optimistic decreased by two percentage points to 22% in June, while those very optimistic increased to 41% from 34% in May.

The respondents who were pessimistic decreased by two percentage points to 8% in June, whereas those who were very pessimistic decreased by two percentage points to 14%.

The percentage of respondents who were neutral (neither optimistic nor pessimistic) decreased by one percentage point to 15% from 16% in May.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe analysis is based on 363 responses received from the readers of Verdict network sites between 01 June and 30 June 2022.

Business confidence remains equivalent to long-term average in the UK

Business confidence in the UK remained similar to the long-term average of 28% in June, although the month-on-month confidence levels declined by ten percentage points, according to the Lloyds Bank Business Barometer. High inflation, increasing costs and slowing demand were some of the concerns faced by businesses. The East of England reported the highest increase in business confidence from 14% to 31%.

The ONS Business Insights and Conditions Survey for the two weeks ending 26 June 2022 further indicated that 17.6% of respondents in the UK believed that their business performance will improve over the next 12 months. Additionally, up to 50% of the respondents expected business performance to remain the same, while 13.7% expected it to decrease.

French and Italian businesses report improved confidence in June

The National Institute of Statistics and Economic Studies (INSEE) further indicated a rise in business confidence in France from 106.3 in May 2022 to 107.6 in June 2022. New orders, improved production expectations and an expected increase in the size of their workforce in the coming months contributed to the improved sentiment.

Business climate improved markedly in the manufacturing sector in France to 108 in June from 106 in May, while that in the construction sector to 115 in June from 114 in May. Building contractors remained far more positive about their past activity than they were in May although they were less optimistic about the projected activity in the next three months.

Similarly, Italy reported a rise in confidence from 110.6 in May to 113.6 in June, according to the Istat Economic Sentiment Indicator (IESI) index. The confidence improved particularly in manufacturing from 109.4 in May to 110 in June. Favourable calculations on the order books, better expectations from production, and an estimated rise in inventories led to the increase in business confidence.

Confidence index in construction also improved from 158.7 in May to 159.7 and from 103.8 to 109.1 in the market services sector. In the retail trade sector, confidence index increased from 105.8 in May to 107.2 in June.

Businesses remain optimistic in the US and Canada

The latest MetLife & US Chamber of Commerce Small Business Index reached its pandemic-era high with a second quarter score of 66.8%, compared to the last quarter score of 64.1 in 2022. Small businesses cited inflation to be their biggest challenge, followed by supply chain disruptions and the impact of COVID-19. The Business Council of Alberta’s Business Expectations Survey revealed that optimism remained high about Alberta’s economic outlook. The survey found that 78% of the respondents reported an improvement in forward-looking indicators, while 65% expect sales to increase over the next 12 months. Labour and financial constraints, however, are expected to impact business activity in the next 12 months.