Governments love nuclear, mostly. Grid planners love the reliability, low cost of generation, and prestige of nuclear generation. However, the construction cost, long lead-up time, and security implications have deterred governments from investing in new generations of nuclear. Because of these factors, governments have looked toward small modular reactors (SMRs) for a new wave of investment.

The first SMRs have now received their licenses, but the vast majority of reactors remain at the early planning stage. Engineers have promised that SMRs will allow nuclear construction in otherwise unfavourable areas, even allowing reactors to “pop-up” for (relatively) short periods of time. As manufacturers seek locations for their first SMRs, this claim is being put to the test.

Site requirements for small modular nuclear reactors

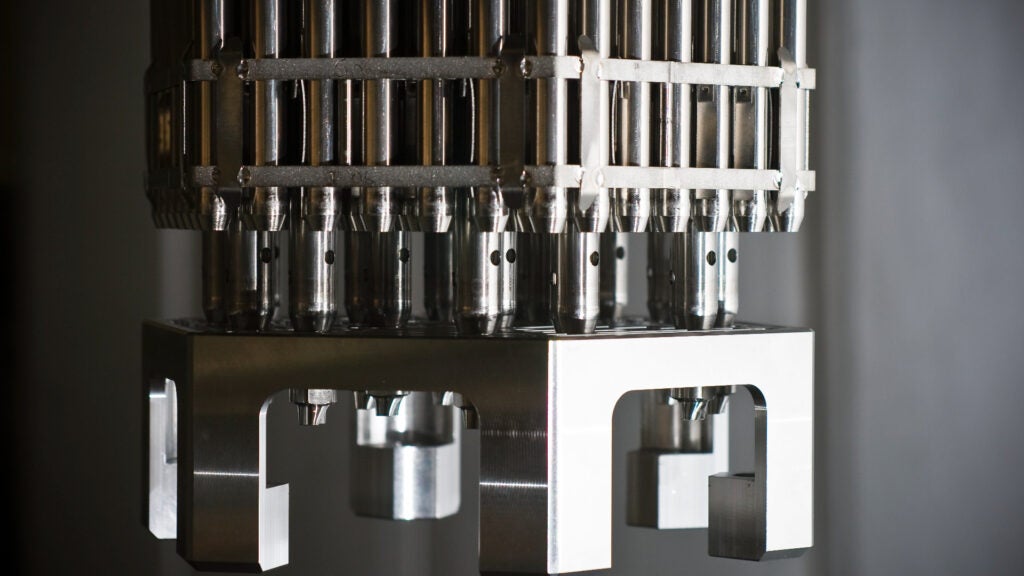

The International Atomic Energy Agency (IAEA) requires high building standards of nuclear developers. The prefabricated nature of SMRs modules allows manufacturers to adhere to the standards while maintaining the efficiency and speed of a production line, lowering the variability and associated costs of nuclear construction.

However, SMRs still have many of the same requirements as conventional reactors. Any nuclear development requires secure infrastructure connections for transport of radioactive material. Nuclear power plants also require a supply of water, often from nearby rivers and seas. This water cools the reactor, turning into steam to drive the turbines.

As a result, despite the promises of SMR development, the first reactors are mostly planned for existing nuclear sites. According to the IAEA, the four SMRs currently under construction lie in Argentina, China, and Russia. Argentina’s CAREM reactor will generate 25MW adjacent to the Atucha I Nuclear Power Plant. China will generate 125MW on the site of the Changjiang nuclear plant using its Linglong One reactor design.

Russia’s two reactors have similarly small capacities, with each generating less than 75MW. However, the country has embraced the promise of more mobile and versatile nuclear power, with its reactors powering the Ust-Kuyga gold mine and the Akademik Lomonosov power ship.

While SMRs can only promise a small portion of the power provided by conventional nuclear, these four reactors sit far behind the promise of the coming wave of globalised SMR development.

France leads in nuclear, but small modular reactors remain difficult

French energy company EDF likely has more experience with nuclear generation than any other company. Many expect EDF to take the lead in SMR development, but most of its SMR developments have come as a result of joint ventures.

In 2019, an IAEA conference saw the first plans for the Nuward SMR project, which would generate 340MW from two reactors. EDF developed the design alongside the French Alternative Energies and Atomic Energy Commission, French naval engineers NavalGroup, and nuclear developer TechnicAtome, with EDF turbine engineering subsidiary Framatome later joining the project.

In February 2022, the French Government announced that the Nuward SMR design will form part of its France 2030 plan, giving it access to $1.1bn (€1bn) of public funding. The government hopes to see an SMR prototype by 2030, helping the country towards its goal of 25GW of new nuclear generation by 2050.

In the same month, EDF bought US company GE Steam Power, which has a nuclear turbine unit in France. While EDF did not mention SMRs in its statement accompanying the purchase, the purchase brings more of the technologies for nuclear energy into the EDF group, allowing it to better develop self-contained units.

Under the deal, GE retains its nuclear services business that operates more than 100GW of nuclear plants across the Americas. It also did not sell the GE Hitachi Nuclear Energy (GE HNE) joint venture, which currently has several SMRs in early development.

Small modular nuclear reactors from the Americas

In December 2021, GE HNE announced an agreement with Ontario Power Generation to install Canada’s first SMR. GE HNE already works at the Darlington Nuclear Generation Station, refurbishing the four existing, conventional reactors there. Under its December deal, the new BWRX-300 reactor would operate as the fifth unit of the Darlington Nuclear Generation Station from 2028.

Construction of the new SMR will take two to three years, a fraction of the nine years required by the existing plant’s Unit 2. This design has an operational lifespan of 60 years, far exceeding Unit 2’s original 25-year license. GE HNE says that the SMR has approximately “10% the size and complexity” of conventional nuclear, also reducing project risk. However, the 300MW capacity of the BWRX-300 compares poorly to the 878MW capacity of any of the existing units.

The SMR would also make use of much the existing nuclear infrastructure at the site, minimising costs and construction time. On a greenfield site without these advantages, the benefits of SMRs will compete with the fact that there is no modular approach to nuclear infrastructure.

The original plant does not display the best of nuclear construction, with costs coming in at more than four times the original budget. Modular construction promises to keep costs down, though cost estimates for this reactor remain undisclosed. Developers will aim for an installation cost of $2,250/kW, after initial cost-efficiency savings, implying a total cost of $675m. This gives the design a capacity cost approximately double that of modern solar, but with a more manageable supply of power.

In the same month as the Canada deal, GE HNE announced a similar agreement to develop 10 new reactors in Poland, at currently undecided locations. Poland’s Synthos Green Energy would operate these SMRs, intended to help the country transition away from coal power. Canadian engineering firm BWXT Canada would manufacture components, with construction beginning in 2025, with commissioning due in 2028.

“Too late and too expensive”?

US engineering firm Nuscale also plans to develop SMRs in Poland, under a contract with mining company KGHM. This would involve deployment of a 924MW VOYGR SMR, the most powerful SMR around. It also plans to build a similar plant in Idaho, US, starting operations in 2029. However, this has attracted critique from the Institute for Energy Economics and Financial Analysis think tank.

In a report from February 2022, the institute said that the Nuscale design was “too late and too expensive” compared to modern renewables. Nuscale claims its SMR to have a generating cost of $58/MWh, with a construction cost of $3,000/kW. The think tanks claims that these costs would be “highly uneconomical” compared with renewables, although does not compare the relative uptimes of the power sources. Instead, the think tank claims that the SMR will likely not reach its expected 95% capacity factor leading to a misplaced investment.

US SMR manufacturers hope to export their designs to Europe, with GE HNE saying it also had SMR deployment agreements “in place” with companies in the US, Estonia, and the Czech Republic. In these markets, GE will face competition from another household name.

International engineering leaders compete for modular nuclear development

In the UK, engineering company Rolls Royce have started assessing sites for potential reactors. Just like EDF, the company has received public funding for its SMR project, which aims to compete with modern renewables.

Rolls Royce has less experience in the nuclear sector, focussing on aerospace engineering. However, executives hope the company’s experience with turbine engineering and prefabricated manufacturing will give it an advantage with SMRs. The company claims that these reactors will not need prototyping because of their similarity to existing reactors.

Rolls Royce’s SMR would generate 470MW at an initial marketed cost of $3bn (£2.2bn) per unit. The company expects prices to fall to $2.45bn (£1.8bn). This would give the units a development cost of $6,382/kW. Assuming full use throughout the day, the company expects operations to cost $68/MWh (£50/MWh).

In a statement, the company said it has memoranda of understanding in place with Estonia. Turkey, and the Czech Republic. In the UK, the Nuclear Decommissioning Authority has sought government permission to start negotiations with Rolls Royce over which sites could host the UK’s first SMRs.

The sites in the running include Dungeness, Kent, on the country’s south-east coat, Moorside, Cumbria, on the north-west coast of England, and Wylfa, Anglesey, off the north-west coast of Wales. The company has said it aims to build its first SMR “in the early 2030s”, completing “up to 10 by 2035”.

Ultimately, all multinational SMR development relies on an expectation of less demanding planning restrictions for SMRs compared to conventional nuclear. With so few SMRs currently at planning stage, and with many of those expected to be built at existing nuclear sites, few opportunities to test this claim have yet arisen. All multinational developers have factored in significant manufacturing savings as production continues, but if planning laws do not match the pace of SMR development, SMR development could remain a solely national effort.